1Q Forecasts: Vaccines Mean Hope Springs Eternal: Long MXN/JPY, Long Copper (XCU/USD), Long RUT & NDX

There’s a gorilla in the room. My Top Trade Opportunities coming into 2020 were long crude oil and long CAD/JPY because, “Global Recession? Take the Under.” Now that the laugh is out of the way, in my defense, no one had “coronavirus pandemic” on their bingo card going into 2020.

With that said, my Top Trading Opportunity of 2021 might as well be called: “Global Recession? Take the Under (Take Two)”, as it were. This time is different (always fatal words, but I insist!).

The coronavirus vaccines are being deployed in developed Western economies, marking the beginning of the end of the pandemic. Economic activity is coming back to life. Airports are getting busier, and ports and shipping lanes are becoming more active.

In this low interest rate world with pent up aggregate demand and significant slack in the world’s major economies, there is ample room for growth. If growth is the story of 2021, the underperformers of early-2020 should do well.

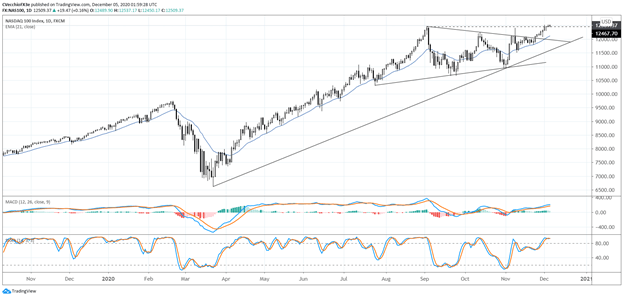

US NASDAQ (NDX) Daily Chart (Dec 2019 to Dec 2020)

Chart prepared by Christopher Vecchio, created with TradingView

In the equity space, this means companies with less-robust balance sheets and economic performances that may have disappointed during mid-2020. I like those that have high betas relative to the US S&P 500; small cap and mid cap stocks should outperform large caps ex-tech (to this end, the Russell 2000 offer more potential than the S&P 500). But the Nasdaq 100 still looks like it wants higher; the symmetrical triangle breakout in early-December 2020 appears to be just getting started.

Copper (XCU/USD) Weekly Chart (Dec 2010 to Dec 2020)

Chart prepared by Christopher Vecchio, created with TradingView

In the metals space, copper and silver appear poised to outperform gold, which typically trails during periods with high liquidity and high growth (I like mixed exposure of long copper and short gold, or long silver and short gold, which potentially curtail upside potential but add diversification to portfolio composition).

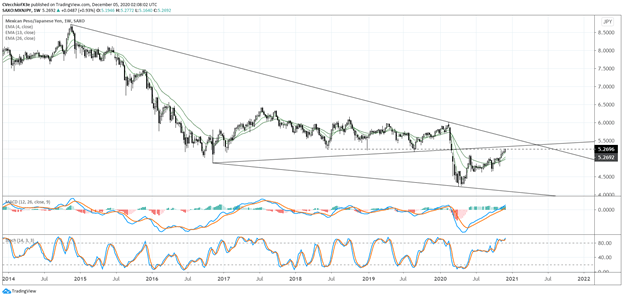

MXN/JPY Daily Chart (Aug 2011 to Dec 2020)

Chart prepared by Christopher Vecchio, created with TradingView

In FX markets, EM FX should continue to outpace developed FX, with pairs like MXN/JPY and ZAR/JPY outpacing pairs like GBP/CHF or USD/JPY. The Mexican Peso is of particular interest, given the country’s exposure to the silver trade as the world’s top exporter of silver, as well as its reliance on the US economy: 30% of Mexican GDP can be attributed to trade activity with the US.

Elsewhere in FX, It would not surprise me if EUR/USD rates jump to 1.3000 in the first half of 2020, especially if USD/CNH continues to fall (the PBOC is leveraging the Euro to sink the US Dollar from my point of view, a strategy in line with China’s issuance of USD-denominated debt; a weaker US Dollar makes the debt cheaper to service, and in effect works towards China’s goal to ultimately displace the US Dollar as the world’s reserve currency). Lastly, I do think that both GBP/USD and USD/JPY rates end up the year not too far from where they start – choppy, sideways price action appears likely for the foreseeable future.

Recommended by Christopher Vecchio, CFA

Get Your Free Top Trading Opportunities Forecast

|

|

Leave a Reply

You must be logged in to post a comment.