Bitcoin Outlook: Bearish

US Inflation Smashes Estimates, Bitcoin Bears Step In

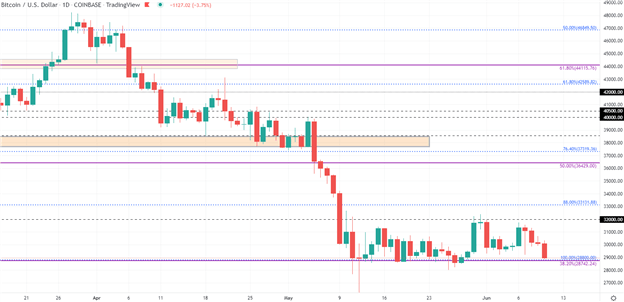

Throughout the week, the release of high impact economic data has exacerbated fears of rising inflation, weighing on stocks and cryptos alike. With Bitcoin prices currently trading within a well-defined range, the key psychological level of $30,000 continues to provide a firm level of support and resistance for price action, holding both bulls and bears at bay.

As the war in Ukraine rages on, rising food and energy costs continue to support higher prices, placing additional pressure on policy makers to implement more aggressive monetary tightening measures in an effort to drive inflation lower.

Visit the DailyFX Educational Center to discover how to trade the impact of politics on global markets

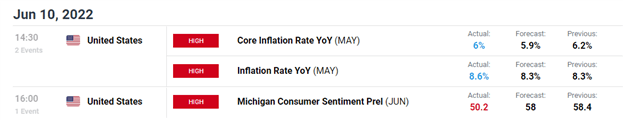

After ECB (European Central Bank) president Christine Lagarde confirmed the Governing Council’s intention to raise the key interest rate in July, US inflation rose to a four-decade high in May while a bleak Michigan Sentiment report provided a gloomy outlook for the prospects of economic growth.

DailyFX Economic Calendar

With investors pricing in a negative growth outlook and a higher probability for the Federal Reserve to increase rates more aggressively than initially anticipated, Bitcoin bears were able to gain traction before finding support at around the $29,000 mark.

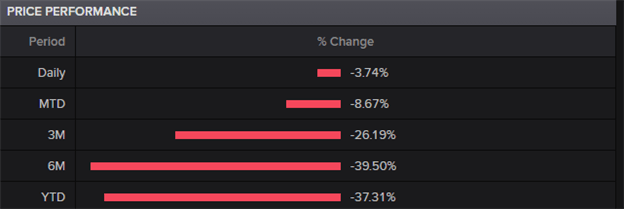

At the time of writing, Bitcoin has fallen by 37% (YTD) as the speculative asset remains vulnerable to the geopolitical backdrop.

Source: Refinitiv

Although fundamentals remain the prominent driver for price action, major technical levels may act as an additional catalyst for both the immediate and longer-term move.

Chart prepared by Tammy Da Costa using TradingView

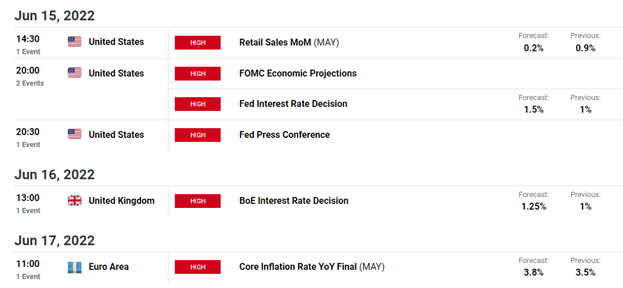

Over the next week, major risk events include the FOMC Economic Projections as well as the Fed and BoE interest rate decision which will likely drive digital assets if a faster pace of tightening and more aggressive rate hikes are announced (cryptocurrency is negatively impacted by higher rates as investors favor higher-yield assets)

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

|

|

Leave a Reply

You must be logged in to post a comment.