BoC Decides to Leave Rates Unchanged

* Update 15:28 GMT

Bank of Canada decides against raising the overnight target rate. Remains at 0.25%

For live economic data bookmark our customizable economic calendar

the Bank expects Canada’s economy to grow by 4% in 2022 and about 3½ % in 2023. Admits the economic slack has been absorbed however continues its reinvestment phase, maintaining its overall holdings of Gov bonds roughly constant.

“In Canada, GDP growth in the second half of 2021 now looks to have been even stronger than expected. The economy entered 2022 with considerable momentum, and a broad set of measures are now indicating that economic slack is absorbed” – Bank of Canada

The Bank foresees diminishing supply shortages resulting in inflation dropping to around 3% from 48% currently, by year end.

The Bank of Canada has emerged as one of the most hawkish of the major central banks, at least as far as market expectations are concerned – see below.

Markets Predictions: Implied probabilities derived form rate markets suggested 5 hikes for 2022 just prior to the decision and around 80% probability of a 25 bps hike after today’s meeting.

Analyst Predictions: seven out of thirty one economists polled by Reuters favored a hike which highlights the divergence in thinking between ‘professionals’ and the general market.

Hotter Inflation, Stronger Labor Market & the Economy

Canadian inflation sits at 4.8% (CPI), above the 1-2% target, however this is some way off US CPI which stands at 7%. Later we hear from the FOMC regarding its interest rate decision so keep an eye on the economic calendar and our live coverage of the event. The jobs market has recovered well and currently sits 240k above pre-pandemic levels.

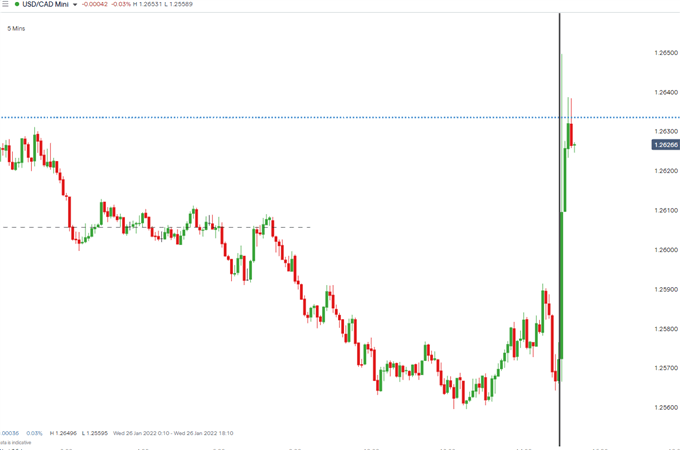

Immediate Response in USD/CAD

*The 5 minute USD/CAD chart revelas an immediate spike in US/CAD which was to be expected gven that a rate hike was largely priced in. The move reached 82 pips higher and currently trades around 60 pips higher than before the release, so still elevated somewhat.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

|

|

Leave a Reply

You must be logged in to post a comment.