GBP/USD – Prices, Charts, and Analysis

- Bank of England to hike by 25 basis votes, but who voted for what?

- When will passive quantitative tightening turn active?

The Bank of England (BoE) will next week hike interest rates by a further 25 basis points to 1% and may give details about when, and under what conditions, they will start actively selling UK gilts from their balance sheet. While a 50 basis point hike is not fully priced out at next Thursday’s meeting, it seems highly unlikely, especially with UK sentiment and consumer spending sliding lower. The BoE has been highly vocal about where it sees inflation in 2022, their latest thoughts centered around 8%, a level that does demand a much tighter monetary policy to be enacted to prevent soaring price pressures from becoming entrenched in 2023. The play-off between stamping down on inflation and keeping UK growth robust is a tricky one and needs to be handled carefully by the BoE. The Bank of England governor Andrew Bailey admitted as such recently saying the central bank was walking a tight line between tackling inflation and avoiding recession with the jobs market now key.

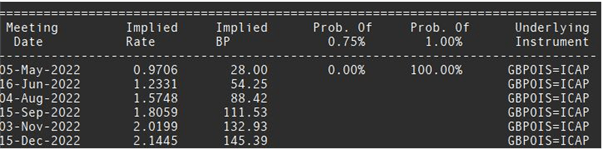

It will also be worth noting how the MPC vote on rates next week to get an inkling of whether or not market expectations that UK rates will be over 2% by the end of the year are realistic or not.

At the last meeting one voting member, Jon Cunliffe, voted for no change in rates leaving the count 8-1 and he may be joined by another MPC member, Silvana Tenreyro, who has in the past warned of the trade-off of tightening rates too quickly. A 7-2 split would also suggest that the market’s assumption that rates are going to be continually hiked this year is too aggressive. This would undermine Sterling further.

Sterling may get a boost at next week’s meeting if the Bank of England give greater clarity about how they will proceed to reduce their GBP875 billion of UK government bond holdings further. In February the BoE announced that they would stop reinvesting maturing gilts (passive tightening) to keep their holdings constant at GBP875 billion, and if the central bank announces what conditions are required for them to start selling their holdings (active tightening) then markets will start to prop up Sterling as they see tighter monetary conditions in the future.

For all market-moving economic data and events, refer to the DailyFX calendar

The British Pound has had a torrid few weeks, especially against a rampant US dollar, and recently traded back at lows last seen in June 2020. This is an accumulation of negative news in the UK including the path of rate hikes, fears that growth is stalling, and increased political risk, and unless these worries are tempered, then Sterling will struggle to move higher.

GBP/USD Weekly Price Chart – April 29, 2022

Retail trader data show that 80.99% of traders are net-long with the ratio of traders long to short at 4.26 to 1. The number of traders net-long is 2.19% lower than yesterday and 9.17% higher from last week, while the number of traders net-short is 7.23% higher than yesterday and 6.97% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

|

|

Leave a Reply

You must be logged in to post a comment.