GBP/USD Price, Chart, and Analysis

- UK PM may raise national Insurance contributions for 25 million taxpayers.

- Traders cut back on long GBP/USD exposure.

Keep up to date with all market-moving data releases and events by using the DailyFX Calendar

The short-term direction of GBP/USD will be decided later today when the August US Jobs Report is released with market expectations of between 725k and 750k new jobs being created. Today’s jobs report (NFP) is the last look at the US labor market ahead of the September 21-22 FOMC meeting. Last week’s speech by Fed chair Jerome Powell, and weaker than expected US data over the last few days, has seen the market pare back expectations of a taper timetable being announced at the September meeting, pushing the US dollar back down to a one-month low. With the US on holiday on Monday – Labor Day – any divergence from market expectations may have an outsized effect on the greenback across a range of USD pairs post-release.

Sterling has had little domestic news or data to help turn the dial of late, though this is likely to change next week when UK PM Boris Johnson is said to be announcing a hike in UK National Insurance to help pay for reforms of the social care program. The announcement is likely to affect 25 million UK taxpayers and would break the Conservative pledge in the 2019 General Election that there would be no increase in National Insurance. If this hike comes into play, PM Johnson will have to carefully navigate tricky waters as breaking any tax pledge would undermine public confidence in the PM.

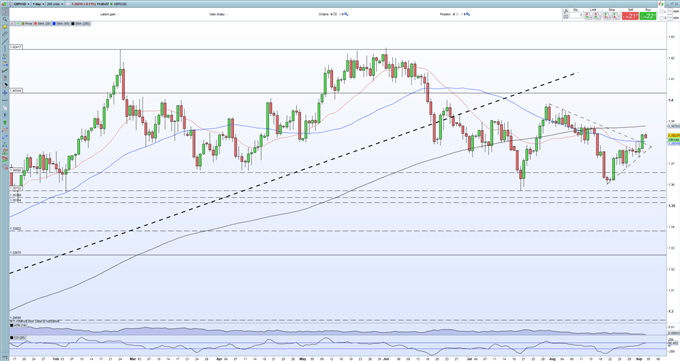

GBP/USD remains above 1.3825 on US dollar weakness and today’s release will set the short-term course for the pair. The daily chart does show a bullish breakout from a short-term pennant formation, pushing the pair to a two-week high. Volatility in GBP/USD is at or near multi-week lows (ATR), while the pair are now nearing overbought territory (CCI), giving an unclear outlook in the short term.

IG client sentiment data (shown below) shows traders are now fairly evenly balanced in GBP/USD after cutting back net-long positions and increasing net-short exposure over a one-day and one-week timeframe.

GBP/USD Daily Price Chart September 3, 2021

Retail trader data show shows 51.11% of traders are net-long with the ratio of traders long to short at 1.05 to 1. The number of traders net-long is 11.00% lower than yesterday and 23.47% lower from last week, while the number of traders net-short is 13.58% higher than yesterday and 29.20% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse higher despite the fact traders remain net-long.

{{SENTIMENT|GBP/USD}}

What is your view on GBP/USD– bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

|

|

Leave a Reply

You must be logged in to post a comment.