Crude Oil, Copper, Vaccination Milestones, Texas Winter Storm, Commodities Briefing – Talking Points:

- Crude oil rallied with stocks, Texas winter storm created supply woes

- Copper aiming for 2012 peak on high demand as US Dollar weakens

- China reportedly mulling rare earth export curbs to US defense sector

- WTI, copper uptrends remain, but distance to key trendlines a risk

Recommended by Daniel Dubrovsky

What are the top trading opportunities this year?

Growth-linked crude oil prices and copper futures aimed higher over the past 24 hours as market mood remained optimistic. This is as equities were closed for trading in China and in the United States amid the Lunar New Year and Presidents’ Day holidays respectively. In Europe, the Euro Stoxx 50 and FTSE 100 climbed as equities tracking futures on Wall Street followed.

Broadly speaking, weakness in the anti-risk US Dollar certainly helped propel both crude oil and copper prices upward. Vaccine rollout milestones in the US and UK likely contributed to ongoing bets of economic recovery from the coronavirus pandemic. You can see this dynamic being priced in longer-dated Treasury yields. The 10-year rate soared at market open.

Further bolstering crude oil prices has been the extreme cold weather in the state of Texas. This has resulted in near-term supply concerns as power outages put millions in the dark. Meanwhile, a pickup in demand for the red metal is pressuring tight inventories. China, the largest consumer and producer of copper, saw stockpiles for the metal shrink to the lowest for this time of year in over a decade, according to Bloomberg.

Towards the end of Tuesday’s APAC session, reports crossed the wires that China is mulling rare earth exports to U.S. defense contractors, according to the Financial Times. Attention now turns to the United States’ response. Market mood did sour, with volatility likely amplified given lower levels of liquidity. Both crude oil and copper pulled back slightly.

Still, futures tracking Wall Street remain in the green before European hours. A ‘risk-on’ tone may continue benefiting WTI and copper prices as the US Dollar is pressured. Eurozone GDP data and German sentiment are on tap. Fed speak from members Esther George and Robert Kaplan are also due. They are expected to talk about the economy and outlook. Check out the DailyFX Economic Calendar for more key events.

Recommended by Daniel Dubrovsky

What does it take to trade around data?

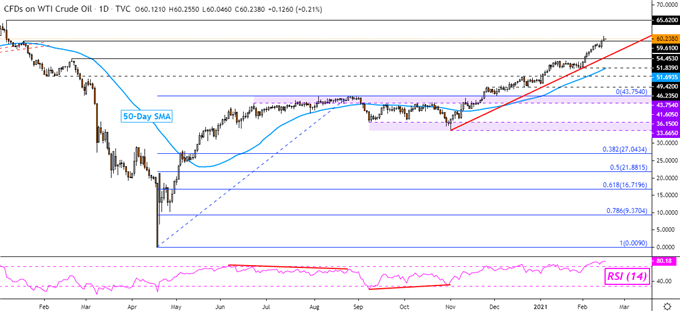

Crude Oil Technical Analysis

WTI crude oil prices have confirmed a break above the January 2020 high, exposing the peak from last year at 65.62. Momentum seems to be favoring the current trend as RSI follows prices to the upside. Still, maintaining the focus to the upside has been rising support from November – see chart below. This does leave WTI with some room to fall in the short-run before facing the trendline.

WTI Crude Oil Daily Chart

Chart Created Using TradingView

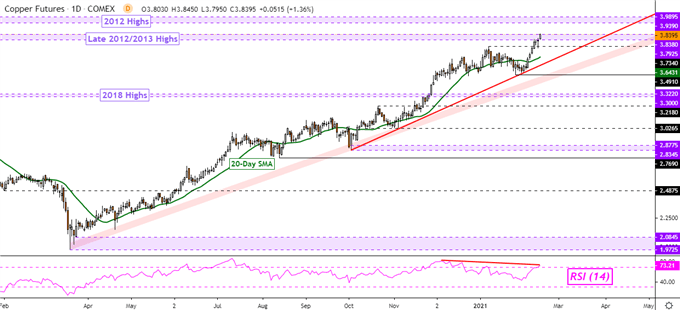

Copper Technical Analysis

Copper futures extended gains, climbing towards peaks seen in 2012. However, getting there entails pushing through late-2012/2013 highs. This makes for a key zone of resistance between 3.7925 and 3.8380. Meanwhile, negative RSI divergence does warn that upside momentum is fading. This can at times precede a turn lower. Much like WTI, there is some room to fall before the red metal faces key rising support – see chart below.

Copper Futures Daily Chart

Chart Created Using TradingView

–— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

|

|

Leave a Reply

You must be logged in to post a comment.