Dow Jones & Nasdaq 100 Forecast:

Dow Jones, Nasdaq 100 Forecasts for the Week Ahead

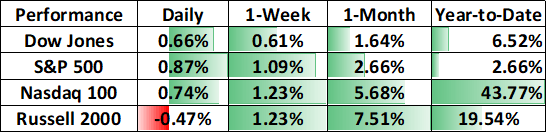

US equities pushed higher during the quiet holiday period with each of the Dow Jones, Nasdaq 100 and S&P 500 clocking new all-time highs to start the week. In a return to form, the Nasdaq 100 continues to outpace the Dow Jones which has effectively put an end to the industrial rotation trade that the market witnessed in November. Suffice it to say, the technology sector has returned to its perch atop the list of high-flying sectors in the US stock market as the Nasdaq 100 looks to close out the year with a gain of more than 40%.

Source: Bloomberg

That being said, there are some themes still unfolding in the market. Reports of strong spending during the holiday season have helped to bolster retail stocks – further aided by the prospect of a $2,000 stimulus check offered to many Americans. Together, retail giants like Amazon, Walmart and Target could be shorter-term beneficiaries of the activity, and expected activity, in the retail world.

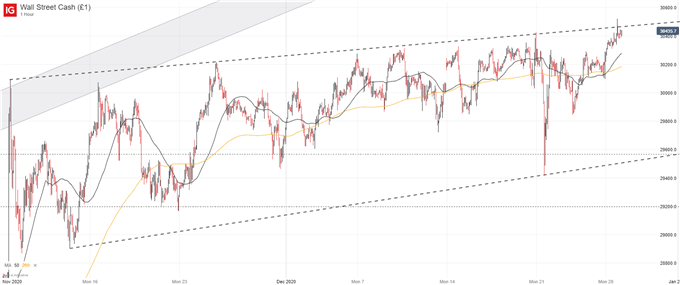

Dow Jones Price Chart: 1 – Hour Time Frame (November 2020 – December 2020)

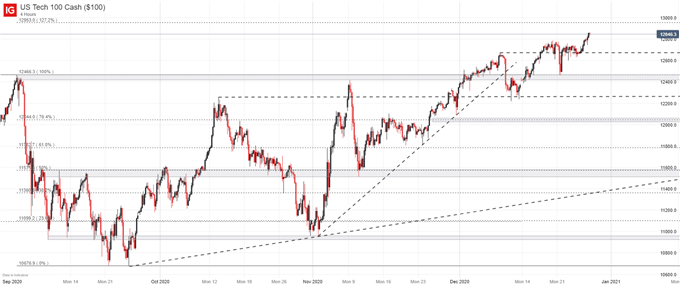

In the shorter term, the Dow Jones and Nasdaq 100 will look to continue their push higher amid the ongoing holiday season. Lower volume and tighter liquidity could give rise to increased volatility until the market fully reawakens in the New Year. Until then, there are few scheduled events that might erode the fundamental backdrop. As a result, there is little to suggest the indices will suddenly reverse lower, particularly without major resistance overhead.

Recommended by Peter Hanks

Get Your Free Equities Forecast

Nasdaq 100 Price Chart: 1 – Hour Time Frame (September 2020 – December 2020)

Should shorter-term pullbacks occur, nearby support is readily available for both the Industrial Average and the tech-heavy Nasdaq derived from prior swing-highs. Further still, client sentiment data reveals retail traders remain net-short the US indices which suggests they could continue to climb since we typically take a contrarian view to crowd sentiment.

| Change in | Longs | Shorts | OI |

| Daily | 8% | 7% | 7% |

| Weekly | 16% | 0% | 4% |

–Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

|

|

Leave a Reply

You must be logged in to post a comment.