EUR/USD Rate Talking Points

EUR/USD pulls back from a fresh monthly high (1.1470) even though European leaders reach a deal for a COVID-19 recovery fund, but the Relative Strength Index (RSI) may show the bullish momentum gathering pace as the indicator approaches overbought territory.

EUR/USD Pulls Back from July High as EU Splits COVID-19 Recovery Fund

EUR/USD struggles to retain the advance from earlier this week as the European Union (EU) plans to split the EUR 750B recovery fund, with EUR390B allocated for grants, while EUR 360B in low interest loans will be available for member states.

However, the bearish reaction in EUR/USD may end up being short lived as a bull flag formation appears to be unfolding in July, with the continuation pattern materializing as the RSI extends the bullish trend from earlier this year.

Looking ahead, it remains to be seen if the efforts by fiscal authorities will alter the course for monetary policy as the European Central Bank (ECB) “remains fully committed to doing everything necessary within its mandate to support all citizens of the euro area.”

Recent remarks from ECB officials suggest the Governing Council will carry out a wait-and-see approach after expanding the Pandemic Emergency Purchase Programme (PEPP) by EUR600 billion in June as board member Yves Merschreveals that a European recovery fund “would reduce the burden on monetary policy and the need for further easing of the policy stance.”

In turn, the ECB may stick to the sidelines as “euro area activity is expected to rebound in the third quarter,” and the Governing Council may rely on its current tools to support the monetary union as the central bank shows little intent of pushing the main refinance rate, the benchmark for borrowing costs, into negative territory.

With that said, the ECB may merely buy time at the next meeting on September 10, and the reluctance to implement lower Euro Area interest rates may keep EUR/USD afloat as the European recovery fund undermines the scope for additional monetary support.

Recommended by David Song

Forex for Beginners

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

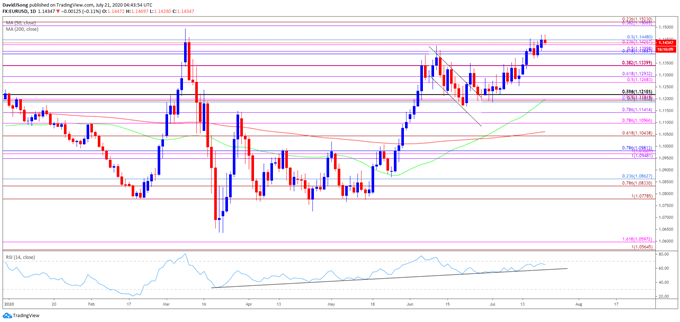

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, EUR/USD failed to test the March high (1.1495) in June amid the lack of momentum to break/close above the Fibonacci overlap around 1.1430 (23.6% expansion) to 1.1450 (50% retracement), with the Relative Strength Index (RSI) pulling back from overbought territory during the same period after triggering an extreme reading for the second time in 2020.

- Nevertheless, a ‘golden cross’ materializing towards the end of June as the 50-Day SMA (1.1198) crossed above the 200-Day SMA (1.1062), with the RSI managing to hold trendline support to retain the bullish trend from earlier this year.

- Will keep a close eye on the RSI as it approaches overbought territory, with another break above 70 likely to be accompanied by a further advance in EUR/USD like the behavior seen in June.

- A bull flag formation appears to be unfolding amid failed attempt to close below the 1.1190 (38.2% retracement) to 1.1220 (78.6% expansion) region in July, with the continuation pattern bringing the 2020 high (1.1495) on the radar as EUR/USD takes out the June high (1.1423).

- Need a closing price above the Fibonacci overlap around 1.1430 (23.6% expansion) to 1.1450 (50% retracement) to open up the March high (1.1495), which largely aligns with the 1.1510 (38.2% expansion) to 1.1520 (23.6% retracement) region.

Recommended by David Song

Traits of Successful Traders

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

|

|

Leave a Reply

You must be logged in to post a comment.