EUR/USD Price, Chart, and Analysis

- ECB rate hike and anti-fragmentation tool details are expected.

- Italian political instability and Nord Stream re-opening fears.

The European Central Bank (ECB) will this week begin hiking interest rates in an effort to stem rampant inflation and will give the market further details of its anti-fragmentation facility in an effort to quell any bond market flare-ups. The ECB is behind most other central banks in tightening monetary, a situation that is visible in the weakness of the common currency in the FX market.

The ECB is expected to raise interest rates by 25 basis points on Thursday, the first hike since April 2011, trimming the deposit rate from -0.50% to -0.25%. The deposit rate has been in negative territory since June 2014. While next week’s hike has been well signaled by the central bank, financial markets want more and currently price in around 35bps of rate hikes. With Euro Zone annual inflation currently at 8.6%, a larger-than-expected hike may be needed.

The ECB will also give more details on their anti-fragmentation facility, a tool that will be used to keep Euro Zone bond yields from rising too quickly. This facility is expected to be unlimited – in an effort to warn off bond vigilantes – and will have a flexible framework to allow the central bank to step in and buy bonds when it deems it necessary. Italian bond yields have been rising sharply over the last months – widening their yield spread with comparable German Bunds – and the ECB will want to keep Italian borrowing costs under control in an effort to spur economic growth. This new facility may look to sterilize interventions by selling lower-yielding/high-quality bonds from Germany and Austria for example to buy bonds from countries with high debt levels, for example Italy.

And Italy is in the headlines for a different reason at the moment after Prime Minister Mario Draghi offered his resignation to the President on Thursday. Italian President Sergio Mattarella rejected his PM’s resignation and asked him to continue discussions in the Senate. PM Draghi tendered his resignation after the 5-Star Party, his largest coalition partner, withdrew their support over a new cost of living aid package. If PM Draghi goes, Italian bond yields will rise on heightened political uncertainty, at the very time that the ECB is looking to dampen higher borrowing costs.

The energy crisis in Europe could intensify next week if Russia refuses to re-open the Nord Stream 1 gas pipeline that it closed on Monday for one week of maintenance. Nord Stream 1 is the main gas pipeline between Russia and Germany and any delay in re-opening will intensify the energy crisis hitting Europe at the moment.

For all market-moving economic releases and events, see the DailyFX Calendar

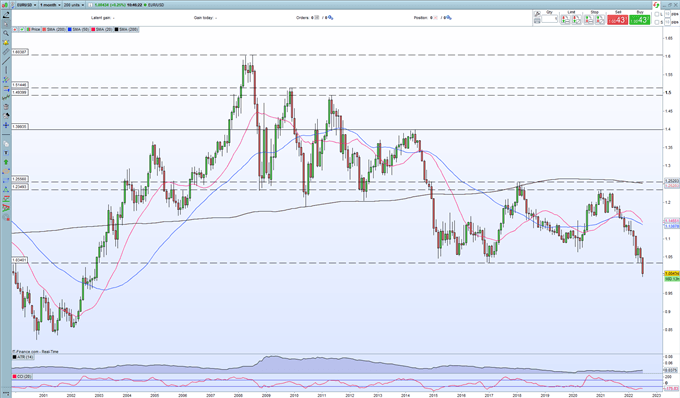

This week saw EUR/USD finally trade at parity after it broke an important support level earlier in the month. The sell-off in the pair has been constant and with little in the way of technical support, EUR/USD may fall back, and stay below 1.000 in the coming days and weeks.

EUR/USD Monthly Price Chart July 15, 2022

Retail trader data show71.46% of traders are net-long with the ratio of traders long to short at 2.50 to 1. The number of traders net-long is 6.38% lower than yesterday and 2.89% higher from last week, while the number of traders net-short is 14.48% higher than yesterday and 25.37% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

|

|

Leave a Reply

You must be logged in to post a comment.