Euro (EUR/USD) Price, News, and Analysis:

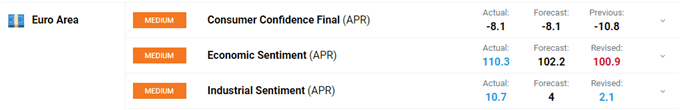

- Eurozone economic and industrial sentiment beat expectations in April.

- EUR/USD mired around 1.2120 as US and EU Q1 GDP prints near.

The latest Eurozone consumer and business confidence indicators surprised to the upside today suggesting renewed optimism within the block, despite the ongoing partial lockdowns. The vaccination plan is picking up pace and April’s data hint that Eurozone growth may be stronger than previously anticipated.

EUR/USD traders will not have to wait for too long to see the latest growth pictures in both the Eurozone and the US with the first look at Q1 GDP out shortly. The US number is released at 12:30 GMT today and is expected to show a sharp pick-up, possibly beating current market expectations of 6.1% QoQ. US data has been strong of late, a situation acknowledge by Fed chair Jerome Powell at the latest FOMC meeting yesterday. Mr. Powell upgraded his economic outlook of indicators of economic activity and employment having ‘turned up recently’ at the last meeting to ‘strengthened’ yesterday and this may suggest that today’s number will beat to the upside.

On Friday, Germany and the Euro Area will release their Q1 GDP data and this is forecast to show further weakness. German QoQ GDP is forecast to contract by 1.5% in Q1 compared to +0.3% in Q4 2020, while the Euro Area is forecast to contract by 0.8% compared to -0.7% in the prior quarter. German GDP is released at 08:00 GMT and the Euro Area’s number at 09:00 GMT.

For all market-moving economic data and events, see the DailyFX Calendar.

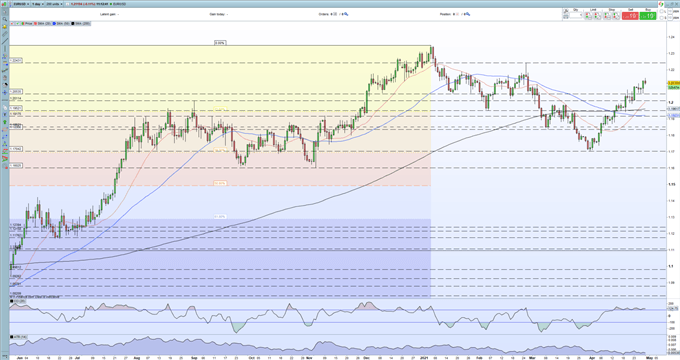

EUR/USD will remain rangebound before today’s number and possibly tomorrow’s releases and will also be impacted by end-of-month flows which are forecast to be negative for the US dollar and positive for the Euro which may spark volatility going into the weekend. The daily EUR/USD chart remains in a strong short-term uptrend, although the CCI indicator suggests this move may be currently overdone. The 23.6% Fibonacci retracement and the 200-day simple moving average meet around the 1.1950 area providing reasonable support, while any further upside will have to take out the February 25 multi-month high with conviction if the rally is to continue.

EUR/USD Daily Price Chart (June 2020 – April 29, 2021)

IG Retail trader datashow 33.07% of traders are net-long with the ratio of traders short to long at 2.02 to 1.We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

What is your view on EUR/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

|

|

Leave a Reply

You must be logged in to post a comment.