Euro, EUR/USD, EUR/JPY, European Central Bank, PEPP – Talking Points:

- Equity markets gained ground during APAC trade as the sell-off in global bond markets slowed.

- The ECB’s weekly bond-purchase figures will be keenly eyed by regional investors.

- EUR/USD perched constructively above key support.

- EUR/JPY rates eyeing a break above key downtrend resistance.

Asia-Pacific Recap

Equity markets rebounded robustly during Asia-Pacific trade as the sell-off in global bond markets slowed. Australia’s ASX 200 surged 1.74% higher, on the back of the RBA doubling its purchases of longer-term government bonds, while Japan’s Nikkei 225 soared 2.41%. China’s CSI 300 climbed 1.49% and Hong Kong’s Hang Seng Index rose 1.43%.

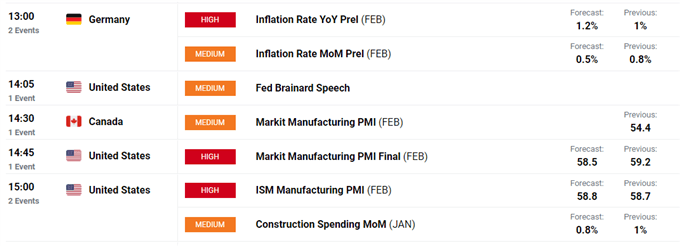

In FX markets, the cyclically-sensitive AUD, NZD, CAD and NOK largely outperformed, while the haven-associated USD, CHF and JPY slid lower. Gold and silver prices jumped over 1.2% as yields on US 10-year Treasuries slid back to 1.4%. Looking ahead, German inflation data for February headlines the economic docket alongside US manufacturing PMI figures.

ECB Weekly Bond Purchases in Focus

The Euro plunged lower against the US Dollar at the end of last week, and may continue to lose ground, if the European Central Bank follows through on suggestions that it will act aggressively to counter an unwanted rise in bond yields.

Governing Council member, and head of open market operations, Isabel Schnabel stated that “a rise in real long-term rates at the early stages of the recovery, even if reflecting improved growth prospects, may withdraw vital policy support too early and too abruptly given the still fragile state of the economy”, adding that “policy will then have to step up its level of support”.

This reinforced comments from Chief Economist Philip Lane, who warned that the central bank will lean on the flexibility of its Pandemic Emergency Purchase Program to limit any unwanted tightening of financial conditions.

Italian-German 10-year yield spread daily chart created using Tradingview

Indeed, the notable widening of the risk-gauging spread between Italian and German 10-year bonds could provide the impetus for the ECB to act sooner rather than later.

With that in mind, traders will intently scrutinize the central bank’s latest bond-buying figures, with a marked increase in purchases probably weighing on the Euro and signifying that the ECB could look to do more in the short-term.

However, if the rate of purchases remains stable, that may pave the way for the trading bloc’s currency to gain ground against the haven-associated USD and JPY.

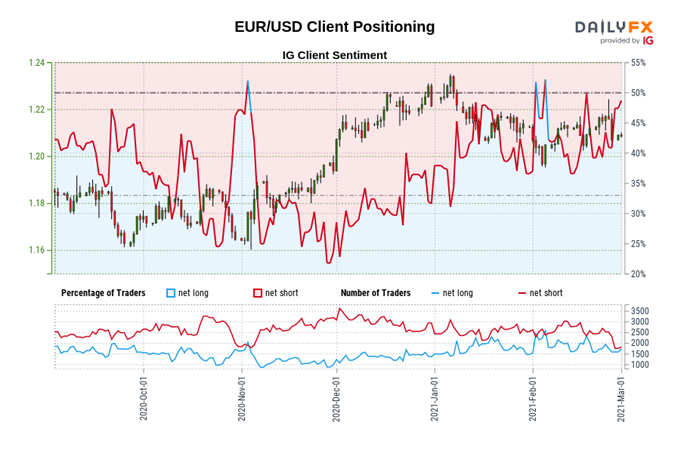

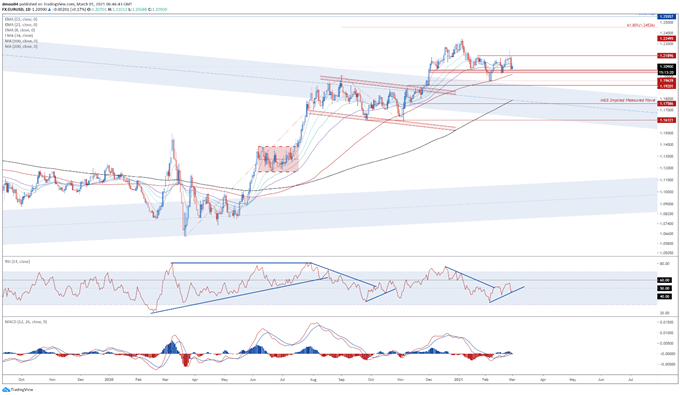

EUR/USD Daily Chart – Range Support Stifling Selling Pressure

EUR/USD daily chart created using Tradingview

EUR/USD rates are perched constructively above range support at 1.2035 – 1.2055, after failing to gain a firm foothold above 1.2200.

With price tracking firmly above the 100-MA (1.2019), and the RSI eyeing a push above 50, the path of least resistance seems higher.

A daily close back above the 8-EMA (1.2115) would probably intensify buying pressure and clear a path to challenge the February high (1.2243). Clearing that brings the yearly high (1.2349) into the crosshairs.

Alternatively, piercing psychological support at 1.2000 could pave the way for sellers to retest the February low (1.1952).

The IG Client Sentiment Report shows 48.96% of traders are net-long with the ratio of traders short to long at 1.04 to 1. The number of traders net-long is 14.88% higher than yesterday and 0.72% higher from last week, while the number of traders net-short is 7.78% higher than yesterday and 22.98% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

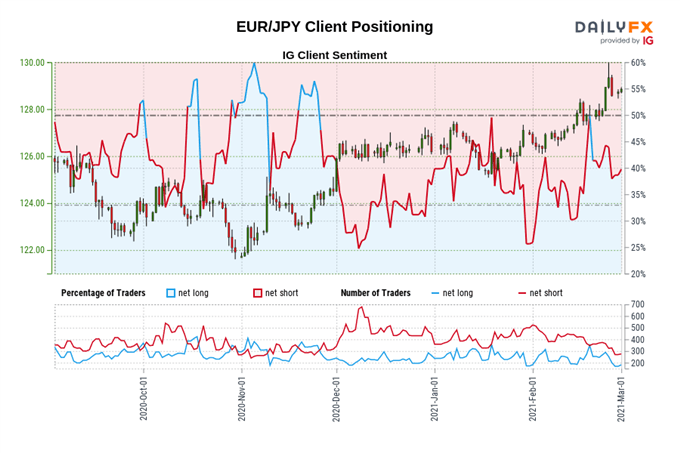

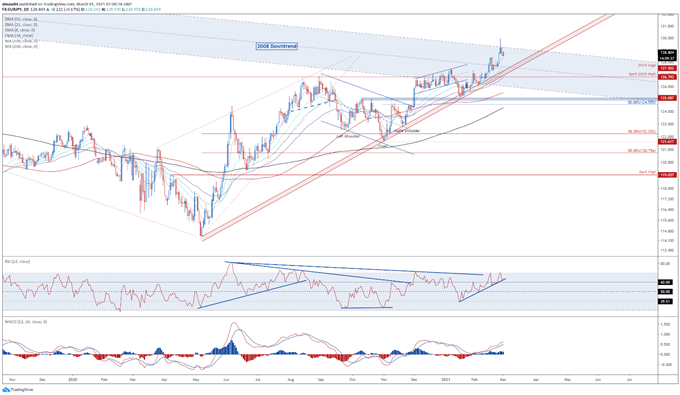

EUR/JPY Daily Chart – Attempting to Breach 2008 Downtrend

EUR/JPY daily chart created using Tradingview

EUR/JPY rates appear to be gearing up to break long-term trend support extending from the 2008 highs, as prices hover above the psychologically pivotal 128.00 mark.

With the RSI tracking its yearly uptrend, and the MACD climbing to its highest levels since early December, further gains appear in the offing.

A daily close above resistance at 129.00 would probably signal the resumption of the primary uptrend and bring the 130 mark into play.

However, sliding back below the 8-EMA (128.36) could propel the exchange rate back towards the 2019 high (127.50) and uptrend extending from the March 2020 nadir.

The IG Client Sentiment Report shows 43.09% of traders are net-long with the ratio of traders short to long at 1.32 to 1. The number of traders net-long is 24.71% higher than yesterday and 19.08% lower from last week, while the number of traders net-short is 3.70% higher than yesterday and 27.46% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/JPY prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/JPY price trend may soon reverse lower despite the fact traders remain net-short.

— Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss

Recommended by Daniel Moss

Top Trading Lessons

|

|

Leave a Reply

You must be logged in to post a comment.