GOLD & CRUDE OIL TALKING POINTS:

- Gold prices drop with stocks as the US Dollar gains on haven demand

- Crude oil prices flirt with bearish reversal as US-China tensions swell

- Stock index futures signal risk-off bias likely to carry into the week-end

Gold prices fell alongside stocks as escalating US-China tensions soured market sentiment. The risk-off backdrop drove haven demand for the US Dollar, which undermined the appeal of anti-fiat alternatives epitomized by the yellow metal, driving it downward. Crude oil prices likewise fell as the defensive backdrop swept up the range of cycle-sensitive assets.

The US was reported to be readying a federal contract ban on companies using Huawei technology, and also brought Magnitsky Act charges against several Chinese officials over alleged human rights abuses in Xinjiang province targeting the Uighur community. Reports of swelling Covid-19 cases in the US probably compounded negativity.

The downbeat mood extended from Wall Street into Asia-Pacific trade and more of the same looks likely ahead. Stock index futures tracking top European and US benchmarks are pointing sharply lower, suggesting liquidation will carry through into the week-end. A sparse offering on the economic data docket offers few roadblocks to derail established momentum.

Recommended by Ilya Spivak

Get Your Free Gold Forecast

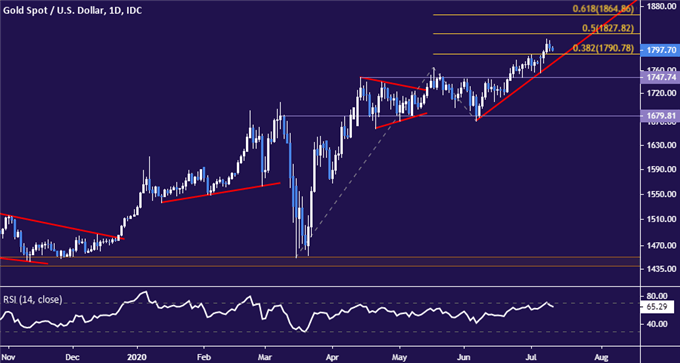

GOLD TECHNICAL ANALYSIS

Gold prices pulled back to digest gains after breaking resistance marked by the 38.2% expansionat 1789.78, but the dominant uptrend remains intact for now. Confirming a larger bearish reversal probably requires a daily close below 1747.74. Near-term resistance is at 1827.82, the 50%Fib, with a break above that exposing the 61.8% level at 1864.86 thereafter.

Gold price chart created using TradingView

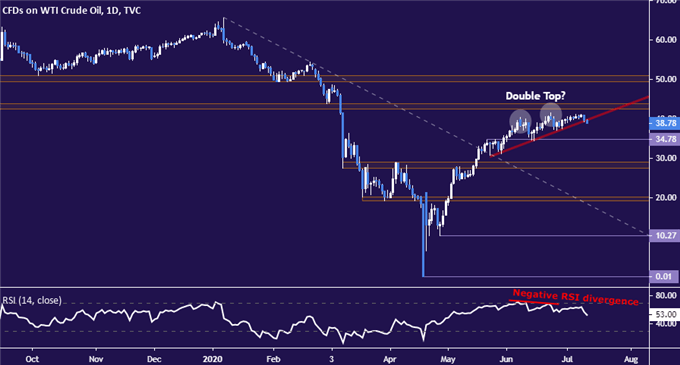

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are flirting with a break of trend line support guiding them higher since late May. Confirmation on a daily closing basis is likely to target the 34.78 inflection level next, followed by the 27.40-29.11 area. Alternatively, a push above resistance in the 42.40-43.88 area looks like it may set the stage for a challenge of the 50/bbl figure.

Crude oil price chart created using TradingView

Recommended by Ilya Spivak

Get Your Free Oil Forecast

COMMODITY TRADING RESOURCES

— Written by Ilya Spivak, Head APAC Strategist for DailyFX

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

|

|

Leave a Reply

You must be logged in to post a comment.