US STOCKS OUTLOOK:

- The S&P 500 and Nasdaq 100 post modest losses on Thursday after a positive performance at the cash open

- Cautious traders appear to be taking profits on fears that the recent rally had gotten ahead of fundamentals

- Economic data on the inflation and growth front will be key for stocks going forward

Most Read: US Stocks Break 2022 Downtrends – Setups for Nasdaq 100 & S&P 500

After a vigorous rally on Wednesday, sparked by an encouraging inflation report, stocks were subdued on Thursday, unable to follow through on the topside. Although the major equity benchmarks posted strong gains in early morning trading, Wall Street later erased its advance, with cautious traders beginning to take profits on fears that the recent upswing had gotten ahead of fundamentals.

When it was all said and done, the S&P 500 edged down 0.07% to 4,207, undermined by a sharp pullback in the consumer discretionary sector. Meanwhile, the Nasdaq 100, after briefly exiting bear market territory, reversed course, falling 0.65% to 13,291 on the day, weighed down by an unexpected spike in U.S. Treasury yields.

With sentiment on the mend, today’s weak performance may just be a temporary breather in the recovery process; after all, financial assets never follow a straight line regardless of the type of trend. That said, there may still be some upside after a pause and consolidation, provided the economy continues to evolve favorably and avoids major downturn.

To better navigate turbulent market conditions commonplace in 2022, it is important to keep an eye on macro releases going forward, especially those related to consumer prices. While July’s CPI and PPI numbers moderated more than forecast, the fight against inflation is by no means over; on the contrary, the battle has just begun. For this reason, incoming data will be key in setting the trading bias on Wall Street.

At the moment, the emerging narrative is that the Fed could slow the pace of interest rate hikes at future FOMC meetings and possibly pivot to a dovish stance in 2023. This theory could be reinforced if inflationary pressures begin to cool more rapidly in the coming months. It is too early to say, but the stars seem to be aligning for that scenario.

On the growth front, U.S. GDP contracted in the second quarter after a similar slump in the first three months of the year, but the country may not yet be in recession by the NBER’s official criteria, which take into account the strength of the labor market. For now, there are no signs of widespread layoffs, an indication that the economy is holding its own in a context of tighter monetary policy. If the outlook does not get materially worse hereon out, a soft landing could still be achieved, creating the right environment for the S&P 500 and Nasdaq 100 to extend their rebound.

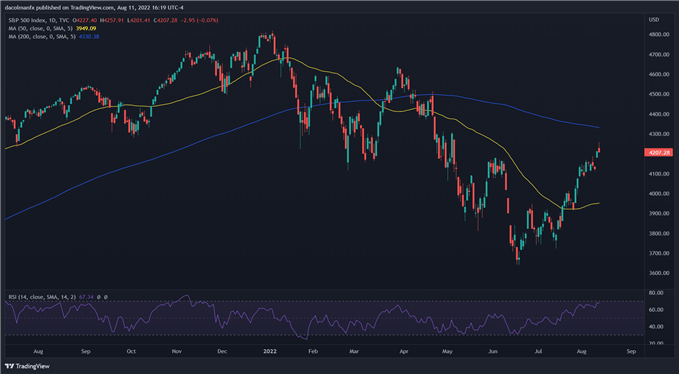

DAILY S&P 500 CHART

S&P 500 Chart Prepared Using TradingView

|

|

Leave a Reply

You must be logged in to post a comment.