US Dollar (DXY) Price and Chart Analysis

- Is the US rate hiking sequence coming to an end?

- Fed chair Powell highlights tighter credit conditions.

Recommended by Nick Cawley

Trading Forex News: The Strategy

A look at the latest Fed Fund rate probabilities currently suggests that the Federal Reserve has raised interest rates for the last time in its battle against above-target inflation. While these probabilities constantly change, and inflation remains uncomfortably high and sticky, chair Powell said that the FOMC had discussed leaving interest rates unchanged yesterday due to the recent banking crisis. In his statement, chair Powell said,

‘In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.’

While chair Powell continued to highlight that monetary policy would be centered on achieving the Fed’s 2% inflation target, he also noted that

‘tighter credit conditions for households and businesses, which would, in turn, affect economic outcomes. It is too soon to determine the extent of these effects and therefore too soon to tell how monetary policy should respond. As a result, we no longer state that we anticipate that ongoing rate increases will be appropriate to quell inflation; instead, we now anticipate that some additional policy firming may be appropriate.’

It is this slight change of language, which still leaves the Fed with plenty of wiggle room if needed, that has helped to weaken the US dollar with traders now considering that US interest rates are at, or are extremely close to, their cycle peak.

For all market-moving data releases and economic events see the real-time DailyFX Calendar.

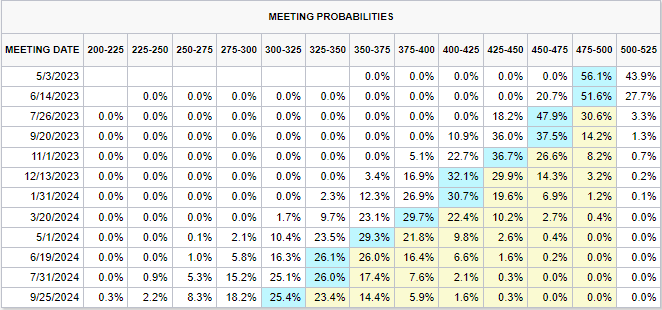

US Treasury yields fell after the FOMC decision with the rate-sensitive US 2-year trading back below 4%.

US 2-Year US Treasury Yield – One-Hour Chart

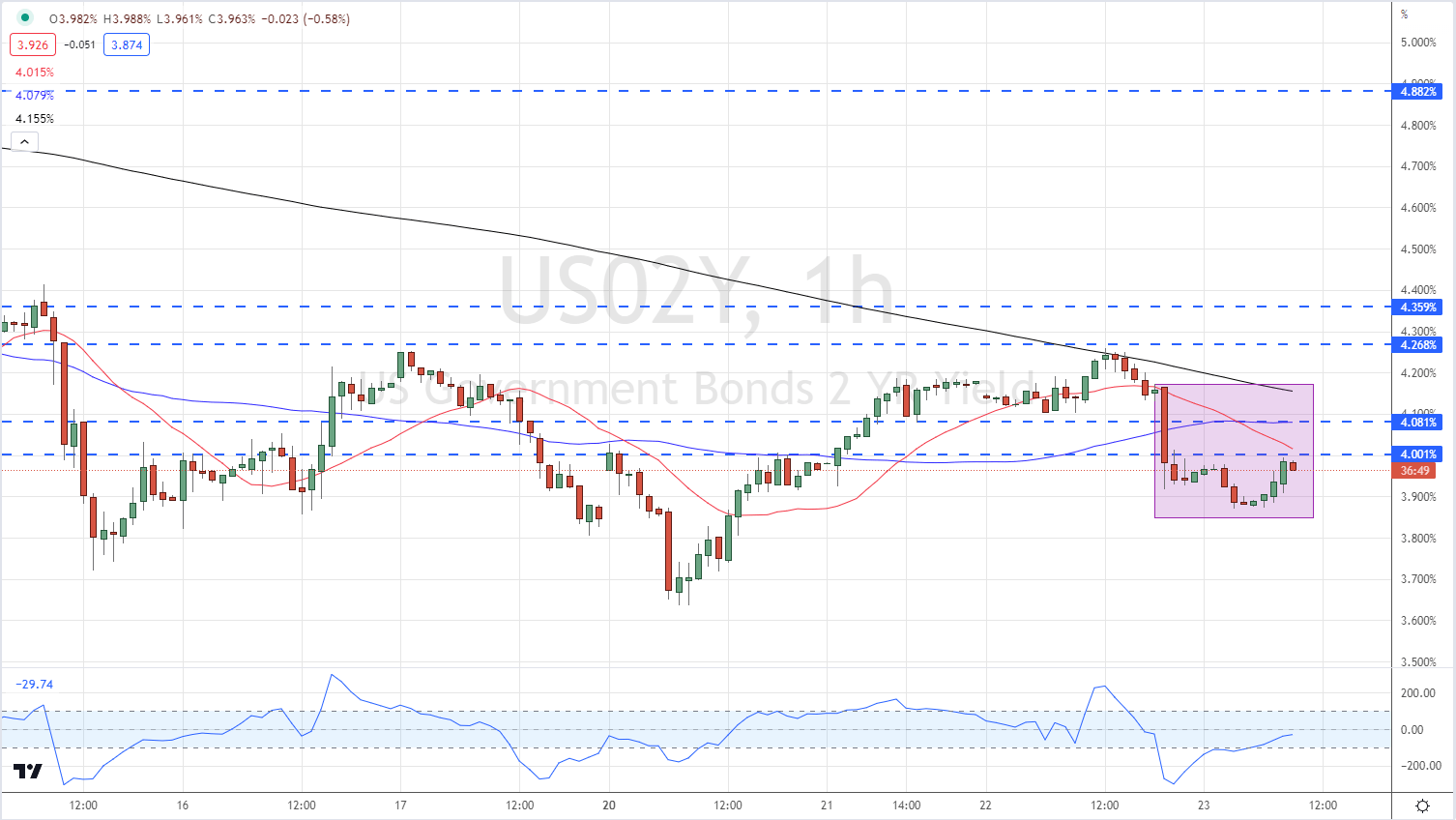

The US dollar index is back below 103 and is testing levels last seen nearly two months ago. The greenback is trying to recoup some of Wednesday’s post-FOMC losses but the chart still looks heavy and pointing lower. Later today we have the latest US jobless claims (12:30 GMT) that will give an update on the strength of the jobs market. The Bank of England will reveal its latest monetary policy half an hour earlier at midday and any hawkish twist or rhetoric from the UK central bank will also weigh on the US dollar index.

US Dollar Index (DXY) March 23, 2023

Charts via TradingView

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

|

|

Leave a Reply

You must be logged in to post a comment.