USD/JPY Analysis

Recommended by Richard Snow

Get Your Free JPY Forecast

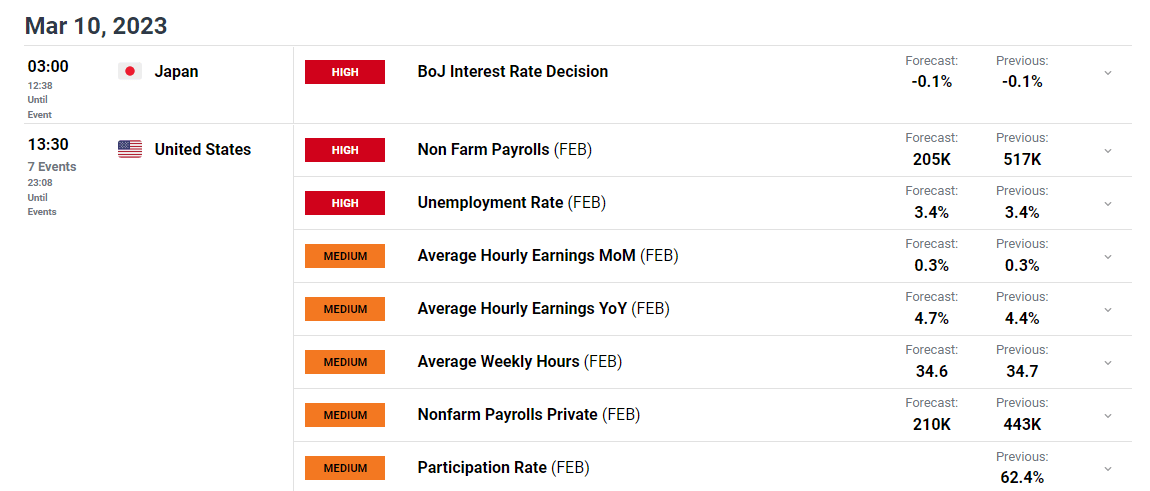

Final BoJ Meeting for Outgoing Kuroda, NFP and Average Hourly Earnings

Haruhiko Kuroda will preside over his final Bank of Japan policy meeting tomorrow after the Japan’s lower house approved the nomination of Kazuo Ueda. Ueda is expected to be approved by the upper house tomorrow and will chair his first policy meeting at the end of April.

After initially hawkish comments, Ueda has been seen to backtrack on indications that the status quo will be changed soon after his appointment. He has however mentioned that a change in policy will need to be assessed as Japan looks to climb down form year of pro-growth, ultra-loose monetary policy.

The eventual policy change will not be easy at a time when just yesterday, GDP data for Q4 of 2022 revealed that Japan narrowly avoided a recession in the second half of 2022. Annualized GDP for October to December showed a miniscule 0.1% growth for the fourth quarter. Due to lower growth currently being experienced, talk of stepping away from accommodative policy is probably best to be avoided despite inflation continuing to rise.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Crucial Friday Data to Guide USD/JPY Direction

Jerome Powell mentioned that the FOMC will be scrutinizing upcoming inflation data ahead of the committees policy meeting on the 22nd of March. Non-farm payroll data, average hourly earnings and next week’s CPI figures are all crucial in that regard. Continuing inflationary pressures are likely to support the dollar and US yields at the expense of the yen via the USD/JPY pairing.

Customize and filter live economic data via our DailyFX economic calendar

USD/JPY has recovered a sizeable portion of its losses which amassed during the more hawkish rhetoric surrounding the potential BoJ replacement and comments of policy review by other prominent voices from academics to those close to the BoJ. Since Ueda has stepped back from his initial comments, USD/JPY reversed course and continued higher once again, most recently aided by Powell’s admission that the FOMC may be forced to hike at a faster pace later this month if the totality of the inflation data deems it necessary.

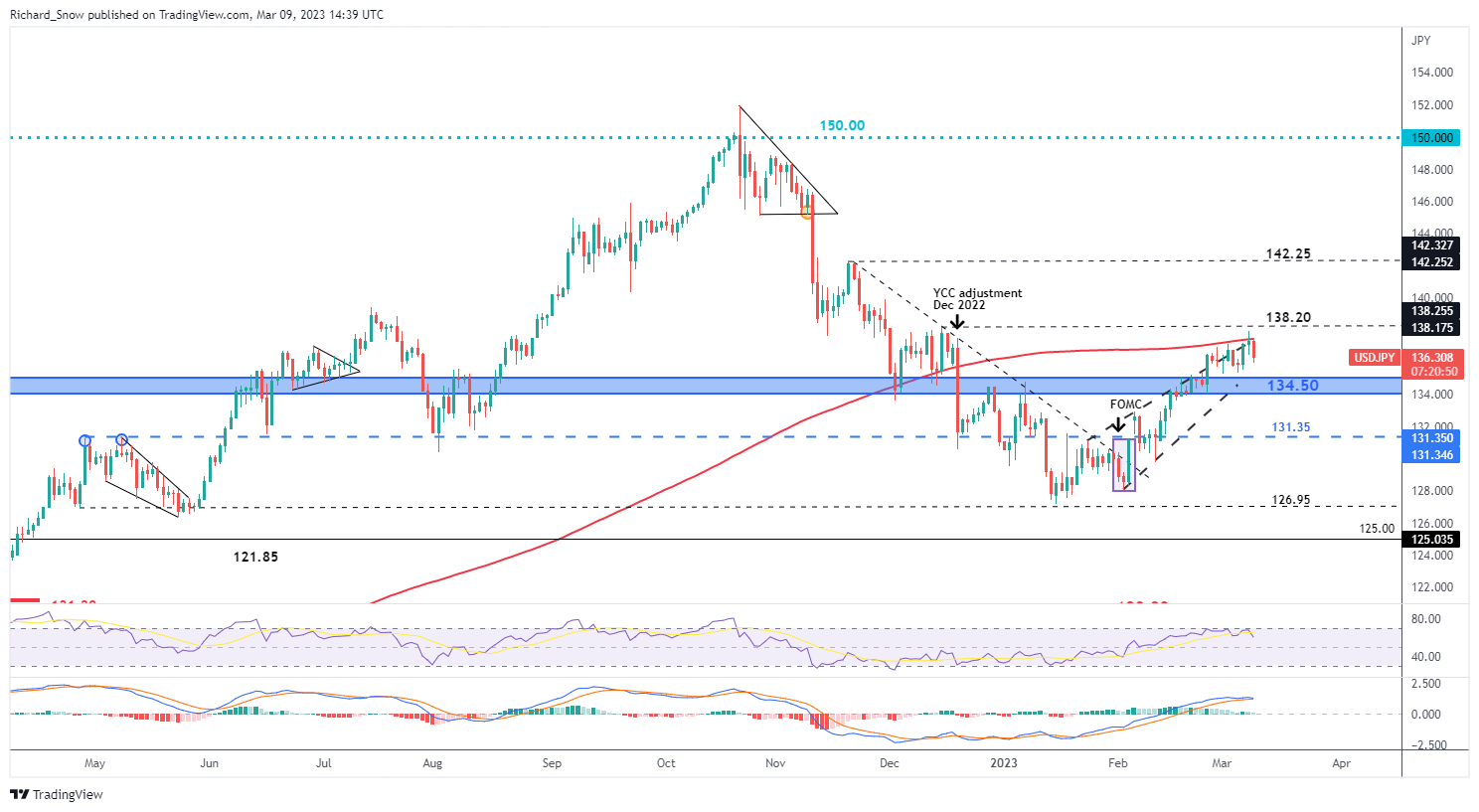

138.20 – which coincides with the late 2022 high as the Bank tweaked its yield curve control – and 142.25 appear as levels of resistance. The zone of support at 134.50 reveals the most immediate level to watch to the downside, followed by 131.35.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

|

|

Leave a Reply

You must be logged in to post a comment.