USD/MXN Fundamental Forecast: Neutral

EMERGING MARKETS OUTSHINE SAFE-HAVENS

Investor’s growing demand for riskier assets has sent emerging market currencies soaring since the height of the coronavirus pandemic back in March. USD/MXN has enjoyed an influx of sellers in November, its second consecutive month of declines, and further US Dollar weakness – as is expected given the Dollar Basket (DXY) reached a two-year low this week – would mean that the Mexican Peso would have its longest uninterrupted run against the Dollar since the aftermath of the 2008 crisis.

But domestic Central Banks are unlikely to want their currencies to outrun the Dollar too far in the long-run, given the impact it can have on their local economies, meaning that currency manipulation could start to be a threat. This can be both in terms of monetary policy that acts as a depreciation of the local currency and also capital and investment controls to deter an influx of foreign capital into emerging markets.

MSCI Emerging Markets Index (Dec 2018 – Dec 2020)

Source: Refinitiv

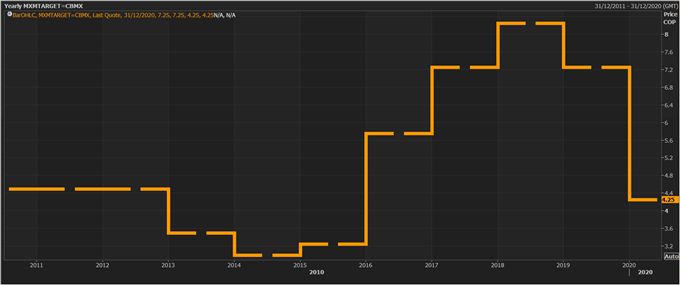

MEXICAN PESO AS A CARRY TRADE

Way before the pandemic erupted, the Mexican Peso was enjoying healthy gains as it was seen as a profitable carry trade currency given its high interest rate. Fast-forward almost a year later, and USD/MXN is nearing the levels seen at the end of 2019 as risk-on sentiment has helped correct the massive surge in the currency pair when investors were seeking protection at all cost back in March. But the Mexican Peso still enjoys a healthy rate differential with the US, so it is likely that investors will seek positive returns on bonds in Emerging Countries like Mexico.

Mexico interest rate change

Source: Refinitiv

Recommended by Daniela Sabin Hathorn

Top Trading Lessons

So looking ahead, there is still further room for the Mexican Peso to appreciate against the US Dollar, but investors should be wondering whether at some point Banxico is going to take action to stop an overly appreciated domestic currency. It is also true that a stronger Peso makes it cheaper to repay dollar-denominated debt, which may be a reason why Emerging Markets ride it out a little longer.

The underlying health of the economy is also an important factor, given that hiking rates seems to be far of the table at this point given the expected weakness in economic recovery. So ultimately, fundamental factors for the Mexican Peso are not as strong as they would have been a few weeks back and we could expect to see some caution creep into the markets towards the end of the year.

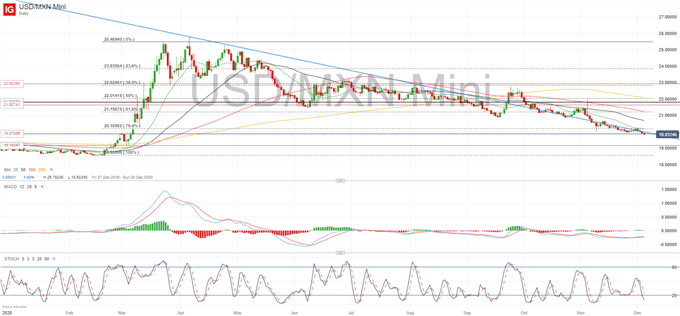

USD/MXN Daily chart

From a technical standpoint, bearish exhaustion also seems to be creeping into USD/MXN given it has been hovering just above the horizontal support line at 19.87 for almost two weeks now. The chart remains bearish but oversold conditions are clearly in place, so a possible short-term recovery towards the 76.4% Fibonacci at 20.18 cannot be ignored. If we get a sustained break below the horizontal resistance, the next area of interest could be 19.14, which has previously acted as support.

Recommended by Daniela Sabin Hathorn

Building Confidence in Trading

— Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin

|

|

Leave a Reply

You must be logged in to post a comment.