US DOLLAR OUTLOOK: USD PRICE ACTION PROBES TWO-YEAR LOWS AS VIX ‘FEAR-GAUGE’ FLOPS

- USD price action flirting with fresh two-year lows as US Dollar nosedives

- DXY Index staring off the edge of a cliff amid sustained US Dollar weakness

- The US Dollar could remain under pressure with the VIX ‘fear-gauge’ imploding

The US Dollar is trading on its back foot again as USD price action plunges lower against key FX peers. News that president-elect Joe Biden will formally begin the transition process helped propel a risk-on move, which likely piggybacked on the market’s upbeat reaction to word that former Federal Reserve Chair Janet Yellen will be tapped for Treasury Secretary.

Also, worse-than-expected consumer confidence data released shortly after the New York opening bell this morning could have contributed to an unwind of the positive response by USD price action to a solid US PMI report yesterday. US Dollar weakness across the board correspondingly drove the US Dollar Index back down to two-year lows.

Recommended by Rich Dvorak

Introduction to Forex News Trading

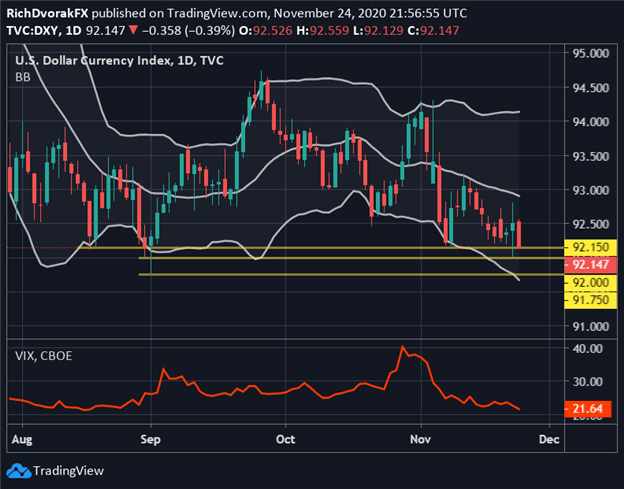

DXY – US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (30 JUL TO 24 NOV 2020)

Chart by @RichDvorakFX created using TradingView

On a less pessimistic note, however, the US Dollar Index still hovers slightly above the psychologically-significant 92.00-price level highlighted by its 31 August and 23 November intraday swing lows. The DXY also trades a touch above the 01 September intraday low, which might serve as another potential demand zone for US Dollar bulls if sellers try to make a deeper push. The lower Bollinger Band could also provide an area of buoyancy, whereas the downward-sloping 20-day simple moving average might keep a lid on any rebound attempts.

Recommended by Rich Dvorak

Forex for Beginners

That said, USD price action might remain under pressure while the S&P 500-derived VIX Index, or fear-gauge, bleeds lower. This is seeing that a lower VIX suggests improving risk appetite and waning demand for safe-haven currencies such as the US Dollar. On the other hand, if the VIX Index can defend its current level here around the 22-handle, which is its lowest level since August, US Dollar bulls might continue to hold the critical support zone as well.

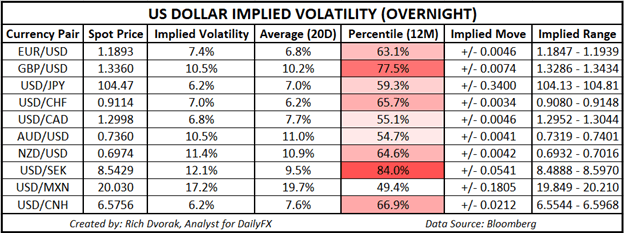

USD PRICE OUTLOOK – US DOLLAR IMPLIED VOLATILITY TRADING RANGES (OVERNIGHT)

Learn More – What is Implied Volatility & Why Should Traders Care?

EUR/USD, GBP/USD, and USD/JPY will be in focus during Wednesday’s trading session considering the three major currency pairs comprise 57.6%, 11.9% and 13.6 of the DXY Index respectively. As such, the broader US Dollar will likely take direction from its primary counterparts. Though not included in the US Dollar Index, NZD/USD price action might be another notable FX pair to keep on the radar considering it is expected to be the most active major judging by its overnight implied volatility reading of 11.4%.

Keep Reading – USD/CAD Price Outlook: Canadian Dollar Climbs with Crude Oil

— Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight

|

|

Leave a Reply

You must be logged in to post a comment.