Fundamental Forecast for the US Dollar: Neutral

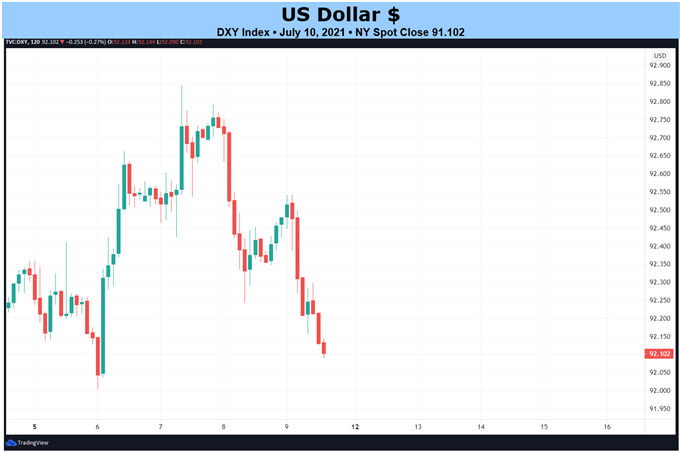

- The US Dollar (via the DXY Index) has dropped back as the calendar moved into mid-July on the back of declining Fed rate hike expectations and collapsing US Treasury yields.

- And even though another hot inflation report is anticipated, markets are actually becoming less convinced that the Fed will hike interest rates anytime soon; action will be constrained to tapering off asset purchases.

- According to the IG Client Sentiment Index, the US Dollar has a mixed bias heading through the middle of July.

US Dollar Back Down

The US Dollar (via the DXY Index) has dropped back as the calendar moved into mid-July on the back of declining Fed rate hike expectations and collapsing US Treasury yields. But with a potent catalyst due over the coming days – the June US inflation (CPI) report on Tuesday – a shift in the recent narrative may be around the corner.

While hot inflation readings should theoretically spill into higher US Treasury yields, the fact that the Federal Reserve continues to resolutely insist that inflation is “largely transitory” may prevent significant topside move in yields. Accordingly, there is asymmetric risk for the US Dollar: a hot inflation report may not do anything to push yields higher; a softer inflation reading could justify another leg lower in yields.

US Economic Calendar Loaded with Risk

The move into the middle of the month brings forth a meaningful docket of event risk based out of the US. Several high rated economic releases coupled with Fed Chair Jerome Powell’s semi-annual Congressional testimony make for a potentially

- On Tuesday, July 13, the June US inflation report (CPI) will be released, with elevated inflation rates expected to persist. Also on Tuesday, the US federal government’s monthly budget statement for June is set for publication.

- On Wednesday, July 14, a separate June US inflation report (PPI) will be released, looking at input costs for businesses (e.g. ‘at the factory gate’). Fed Chair Powell will head to Capitol Hill for day 1 of 2 of his Congressional testimony, reflecting on the contents of the July Monetary Policy Report that was released on July 9. Later in the day, the Fed’s Beige Book will be released.

- On Thursday, July 15, the weekly jobless claims data is due ahead of the July Philadelphia Fed manufacturing index. Later, June US industrial production figures will be released. Finally, Fed Chair Powell will return to Capitol Hill for day 2 of 2 of his Congressional testimony.

- On Friday, July 16, the June US retail sales report was released before the preliminary July US Michigan consumer sentiment report, including 5-year inflation expectations. At the end of the day, the US Treasury’s foreign bond investment report and overall net capital flows data for May will be released.

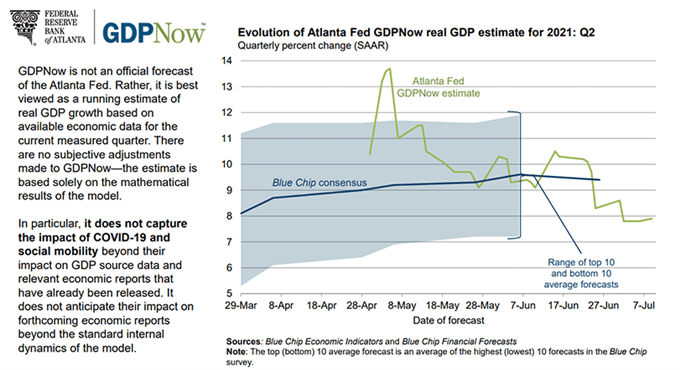

Atlanta Fed GDPNow 2Q’21 Growth Estimate (July 9, 2021) (Chart 1)

Based on the data received thus far about 2Q’21, the Atlanta Fed GDPNow growth forecast has been downgraded again. After the past week’s data, “the nowcast of second-quarter real gross private domestic investment growth increased from [4.7%] to [5.1%] percent.”

The next update to the 2Q’21 Atlanta Fed GDPNow growth forecast is due on Friday, July 16.

For full US economic data forecasts, view the DailyFX economic calendar.

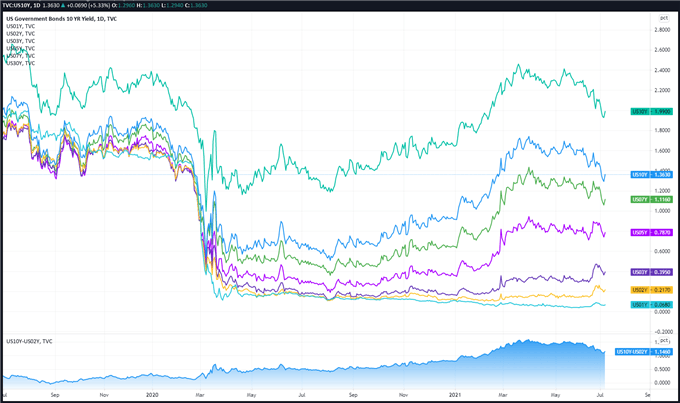

US Treasury Yield Curve (1-year to 30-years) (July 2019 to July 2021) (Chart 2)

Historically speaking, the combination of falling US Treasury yields coupled with dampened Fed rate hike odds has produced a difficult trading environment for the US Dollar.

Fed Very Much in the Spotlight

The June US inflation report brings acute focus to the Federal Reserve’s narrative that price pressures are “largely transitory.” And even though another hot inflation report is anticipated, markets are actually becoming less convinced that the Fed will hike interest rates anytime soon; action will be constrained to tapering off asset purchases.

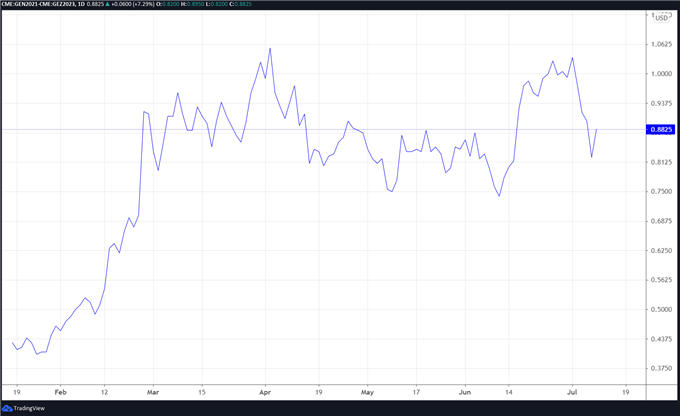

We can measure whether a Fed rate hike is being priced-in using Eurodollar contracts by examining the difference in borrowing costs for commercial banks over a specific time horizon in the future. Chart 1 below showcases the difference in borrowing costs – the spread – for the July 2021 and December 2023 contracts, in order to gauge where interest rates are headed in the interim period between July 2021 and December 2023.

EURODOLLAR FUTURES CONTRACT SPREAD (JULY 2021-DECEMBER 2023): DAILY RATE CHART (March 18 to July 9, 2021) (CHART 3)

At their July following the June US nonfarm payrolls report, there were 107-bps worth of rate hikes discounted by December 2023; now, there are just over 88-bps priced-in. Markets are taking a less hawkish view of the FOMC, plain and simple. In effect, nearly 80% of a 25-bps rate has been wiped off the table.

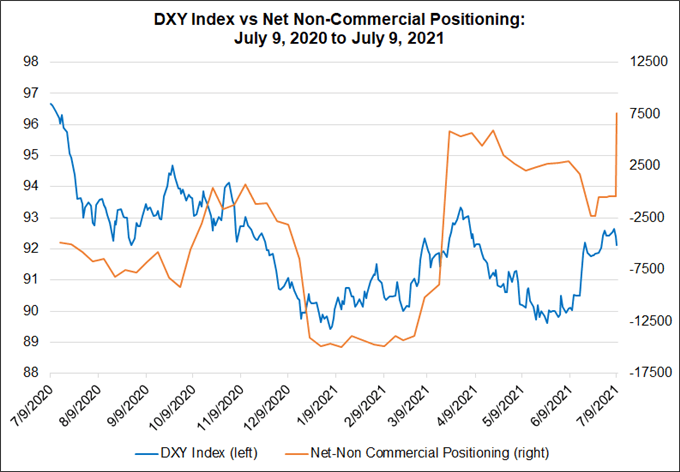

CFTC COT US Dollar Futures Positioning (July 2020 to July 2021) (Chart 4)

Finally, looking at positioning, according to the CFTC’s COT for the week ended July 6, speculators flipped from net-short to net-long, accumulatinga net-long US Dollar position of 7,564 contracts. While US Dollar positioning has been hovering around fairly neutral levels for the past three months, the recent shift in positioning now has the futures market the most net-long over the past 52-weeks.

— Written by Christopher Vecchio, CFA, Senior Currency Strategist

|

|

Leave a Reply

You must be logged in to post a comment.