Main Thesis

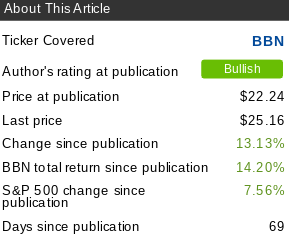

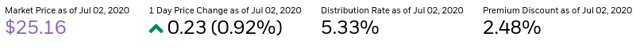

The purpose of this article is to evaluate the BlackRock Taxable Municipal Bond Trust (BBN) as an investment option at its current market price. This is a fund I own and have recommended on many occasions, and has served me quite well. Although I continue to believe it could represent a good long-term buy for many retail investors, my current outlook has cooled somewhat. The primary reasons are driven by macro factors, such as challenging debt environments for municipalities and state governments.

With most states still not fully open yet in the U.S., revenues will continue to come under pressure on both general obligation and revenue muni bonds. Further, the amount of taxable muni supply in the market today far exceeds levels we have seen in the past. Issuance has been soaring this year, and that could pressure the underlying prices of the fund. Finally, when I last covered BBN, the fund had a discounted price, which I typically look for when starting positions in CEFs. Today, the fund now has a 2% premium, which should make investors cautious.

Background

First, a little background on BBN. The fund is managed by BlackRock (BLK), and its objective is to “seek high current income, with a secondary objective of capital appreciation,” primarily through exposure to taxable municipal bonds. Currently, BBN trades at $25.16/share and yields 5.33% annually, paying monthly distributions. I most recently covered BBN back in April, when I saw a lot of value at the current price. In hindsight, this was a good call, with BBN registering a very strong return since publication:

Source: Seeking Alpha

Given the size of this return compared to the broader market, I wanted to take another look at BBN to see if I should change my outlook. After review, I believe a more cautious stance is now warranted, and I will explain below.

Rising Supply Raises A Warning Sign

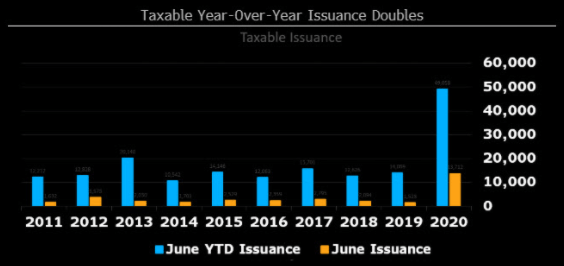

To begin, I want to touch on one of the primary reasons why I think BBN’s return will slow down a bit in the short term. This point has less to do with BBN in isolation, and more to do with a general trend in the taxable muni market as a whole. Specifically, this is rising supply. So far, investor demand for this debt has been strong, so rising supply has not had much of a negative impact on total return. And municipalities have been more than willing to increase their issuance, as they struggle with both a health crisis and rising debt loads. However, there is no guarantee investor appetite will remain robust going forward, so we have to consider how this sharp increase in issuance could impact returns in the second half of the year.

To see why this is an area I am focusing on, let us put current issuance figures in perspective. As 2020 has progressed, year-to-date issuance far exceeds the levels we saw in the previous decade, as shown in the graphic below:

Source: Bloomberg

My takeaway here is simple – if supply keeps rising at this rate, the underlying value of these assets is going to come under pressure. As supply rises, prices will often fall (all other things being equal). Right now, prices are continuing to rise as the economy recovers and investor demand remains extremely high for these assets. In fairness, these trends could both continue, and the market could continue to absorb a further rise in supply. However, I believe some caution is warranted here, primarily because new issuance is dramatically higher than it has been in the past. As a result, I would be very selective on when I buy into BBN, or taxable munis as a whole.

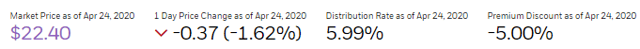

Fund Now Sports A Premium Price

My next point looks at BBN with regard to the fund’s current valuation. In my prior review, I viewed the valuation quite positive, as BBN’s market price offered investors a 5% discount to NAV. Given my generally bullish outlook on taxable munis as a whole, picking up BBN at a discounted price seemed quite appealing. Fast forward to today, and this attribute has changed. While BBN is not wildly expensive right now, its strong performance has pushed the cost to own the fund up quite considerably. To illustrate, consider the two charts below, which show BBN’s discounted price at the time of my last review, compared to its current price, as shown below, respectively:

Source: BlackRock

As you can see, BBN’s value proposition is not nearly as attractive as it once was. While I must emphasize I would not rule out buying BBN on this metric alone, since a 2% premium is not crazy, we have to keep in mind this fund typically trades at par, or at a discount. Therefore, for patient investors, I imagine waiting for a better entry point to present itself makes sense. Personally, this is the approach I am taking for now.

Global Demand Could Remain High

Now that I have covered a few reasons justifying why I am lowering my forward outlook, I want to reiterate that I am not “bearish” on this fund. While I am concerned about the rising price and valuation, I don’t see a tremendous amount of downside either. Therefore, for investors who don’t want to sit on cash waiting for a better opportunity to develop, there is absolutely a case to be made for buying or holding here.

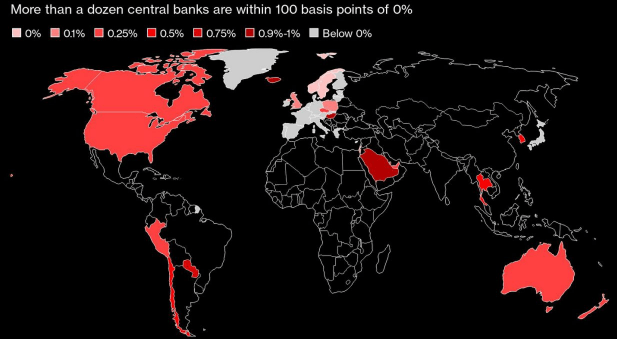

During my last few reviews, I highlighted rising foreign demand for U.S. debt as a key tailwind for BBN. Foreign investors, many of whom face negative interest rates in their home countries, have been drawn to U.S. treasuries, corporate bonds, and munis. While many U.S.-based investors may prefer tax-exempt munis, foreign investors who are not subject to U.S. taxes often find taxable munis preferable. The result has been an influx of foreign cash in to the sector, which helps explain the almost 15% gain since late April.

I bring this up because not much has changed in the interest rate environment to alter this thesis. Governments, mostly in Europe and Asia, have kept interest rates stubbornly low, as shown in the graph below:

Source: Yahoo Finance

My takeaway here is that foreign demand is likely going to remain high in the second half of the year, so maintaining exposure to this sector could absolutely make sense. Further, as I will discuss in the following paragraph, there are reasons to suspect foreign interest in taxable munis will rise at the expense of U.S. corporate bonds of similar credit quality.

Credit Risk Similar To Corporates, But Yield Is Higher

As I alluded to above, I see a fundamental reason why foreign investors may favor taxable munis going forward, aside from the tailwind of artificially low interest rates. Clearly, for U.S. or foreign investors, there are many fixed-income options. Therefore, while lower interest rates can be a source of positive momentum for BBN, that does not mean investors are going to necessarily choose it over alternative investments. A similar asset class, in terms of credit quality and duration, are U.S. investment grade corporate bonds. Similar to taxable muni bonds, both sectors enjoy a historically low level of defaults and yields that exceed what U.S. treasuries offer. However, it is worth pointing out that taxable munis are offering distinctively higher yields at the moment, increasing their relative attractiveness.

To illustrate, consider BBN’s current yield against one of the most popular corporate bond ETFs, the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), as shown below:

| Fund | Yield |

| BBN | 5.33% |

| LQD | 2.97% |

Source: Seeking Alpha

As you can see, the income stream from BBN is noticeably higher. Considering both are taxable yields for U.S. investors, there is a strong argument that we will see increased demand domestically as well.

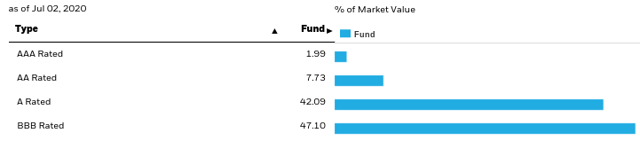

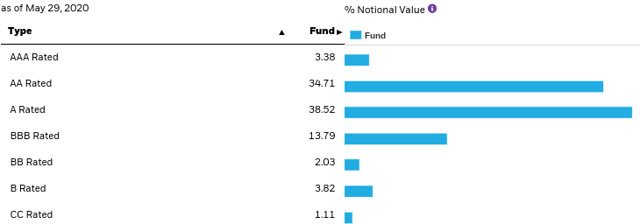

Of course, we have to also consider the credit quality of the funds, as a higher yield does not always indicate a stronger total return potential. Yields and credit quality typically move in opposite directions, so investors may be concerned the risk level with BBN is higher than LQD, and thus not worth the trade-off. However, when we consider the make-up of the respective funds, we see the majority of each is investment grade, with BBN actually holding a higher proportion of bonds further up the credit ladder, as shown below (LQD’s credit make-up is listed first, followed by BBN):

As displayed in the charts above, both passive ETFs hold almost exclusively investment grade debt. While LQD is designed to hold investment grade corporate bonds, BBN has more flexibility, so it does hold some non-investment grade and non-rated munis. However, I believe this is balanced out by the fact it holds over 1/3 of its debt in the AA and AAA-rated categories.

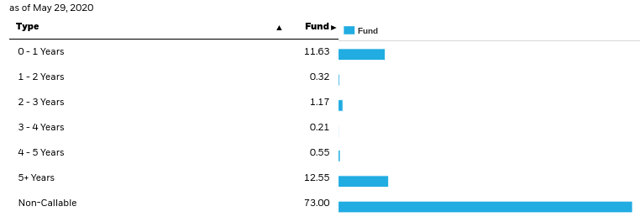

Another factor to consider when evaluating the higher yield is its sustainability. While credit risk is not a major factor with investment grade bonds, call risk is. As interest rates decline, it becomes more likely that bonds will be called/retired before maturity and reissued at prevailing (lower) interest rates. Fortunately, the risk to BBN on this front is not substantial. The reason being over 70% of the bonds in the portfolio are non-callable, as shown below:

Source: BlackRock

Ultimately, this is a very desirable attribute in a low, and especially declining, interest rate environment. While treasuries, corporate bonds, and mortgage bonds are facing a lot of refinancing risk, BBN’s yield appears sustainable.

Bottom Line

BBN has been a strong performer short term, but I believe investors should downplay their short-erm expectations from here. While I think the taxable muni sector has some important tailwinds supporting it, the rising supply of news bonds and fiscal challenges facing local governments tells me adding to positions now may not be prudent. When I couple this reality with the fund’s premium price, a neutral outlook makes sense. Therefore, I believe investors should be very selective with new entry points in BBN at this time.

Disclosure: I am/we are long LQD, BBN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

|

|

Leave a Reply

You must be logged in to post a comment.