The market gyration in March this year offers a good opportunity to stress test various instruments such as ETFs and mutual funds. In this article, we take a closer look at how bond ETFs behaved.

Broad-based stock index ETFs

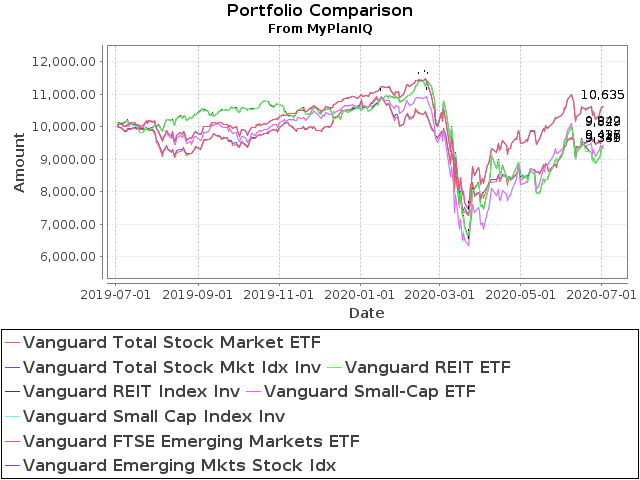

The good news is that most broad-based stock index ETFs did withstand the volatile period in March and had no large discrepancies compared with their mutual fund counterparts. For example, the following chart shows each broad-based index ETF matched its mutual fund counterpart pretty well, even in the lows of March this year:

ETFs vs. Mutual Funds (as of 7/2/2020):

| Ticker/Portfolio Name | YTDReturn** | 1Yr AR | 3Yr AR |

|---|---|---|---|

| (VTI) Vanguard Total Stock Market ETF | -2.5% | 6.4% | 10.4% |

| (VTSMX) Vanguard Total Stock Mkt Idx Inv | -2.5% | 6.4% | 10.4% |

| (VNQ) Vanguard REIT ETF | -12.2% | -6.6% | 3.2% |

| (VGSIX) Vanguard REIT Index Inv | -12.3% | -6.6% | 3.0% |

| (VB) Vanguard Small-Cap ETF | -11.4% | -5.7% | 4.1% |

| (NAESX) Vanguard Small-Cap Index Inv | -11.4% | -5.8% | 3.9% |

| (VWO) Vanguard FTSE Emerging Markets ETF | -7.0% | -1.6% | 3.0% |

| (VEIEX) Vanguard Emerging Mkts Stock Idx | -7.1% | -1.7% | 2.9% |

Notice that in the above, even a narrower sector REITs ETF (VNQ) still matched its mutual fund counterpart VGSIX well.

In general, mutual funds are priced using the end of day prices and their NAVs (Net Asset Values) are decided by their underlying holdings’ closing prices. Their NAVs are more stable than ETFs’ prices as these are traded continuously in an exchange during market hours.

Because of ample liquidities among stocks (especially from reasonably sized small caps up), stock ETFs didn’t exhibit large discrepancies against their mutual fund counterparts.

During the last three serious market routs (2000 internet bubble, 2008 financial bubble, and the recent COVID scare), other than some brief intro-day glitch, broad-based index stock ETFs have matched well.

Bond ETFs

Unfortunately, the same can’t be said to bond ETFs. Let’s look at the following charts:

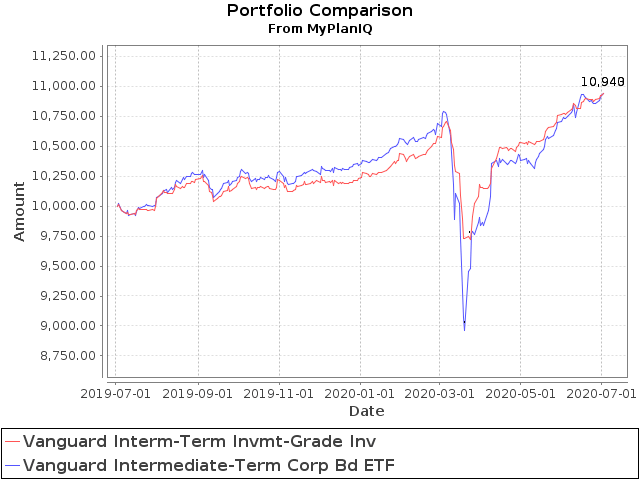

The first is to compare investment-grade corporate bonds ETF (VCIT) with its mutual fund counterpart (VFICX):

VCIT’s 17% of drawdown during March is way worse than VFICX’s 9.2% drawdown. Though it recovered back somewhat in April mostly because of the Federal Reserve’s unprecedented intervention in bond markets, this is something beyond most bond and conservative investors’ risk comfort zone.

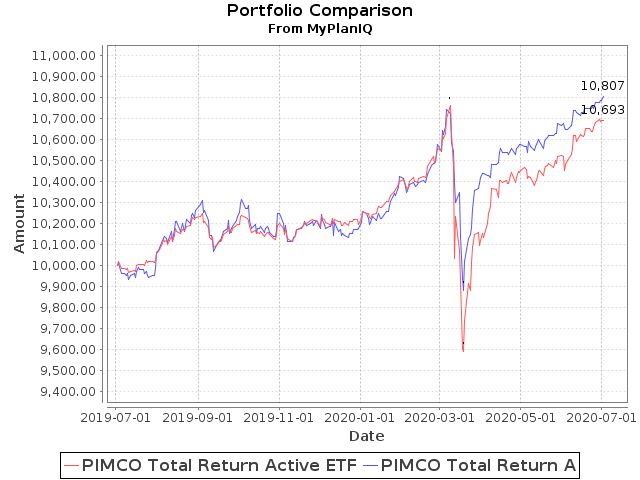

The next chart compares PIMCO’s total return bond ETF (BOND) with PIMCO’s total return bond fund (PTTAX):

We see a similar larger drop of ETF BOND than mutual fund PTTAX. The maximum drawdown 11% vs. 8% is narrower but still very noticeable. Up till now, the ETF hasn’t caught up with the mutual fund.

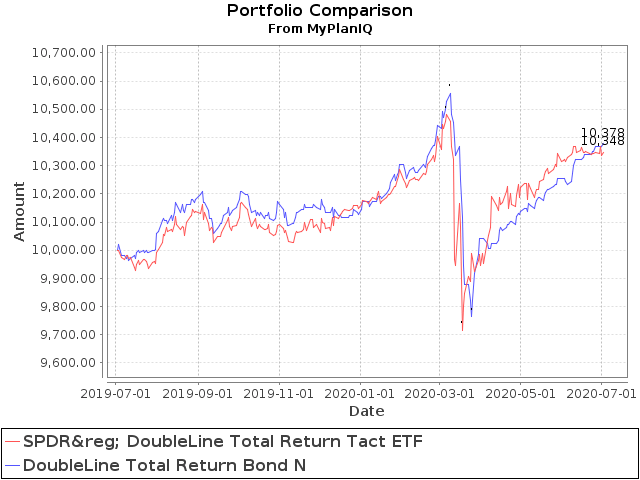

The next one is between DoubleLine’s total return bond ETF (TOTL) and its mutual fund (DLTNX):

This time, the discrepancy narrowed considerably: 7.3% vs. 7.5% in terms of maximum drawdown in March. However, we attributed such narrower discrepancy to the more stable underlying holdings the DoubleLine funds had in March: DoubleLine funds held large amount of mortgage-backed securities that held up relatively well during the downturn, compared with corporate bonds held by BOND or VCIT.

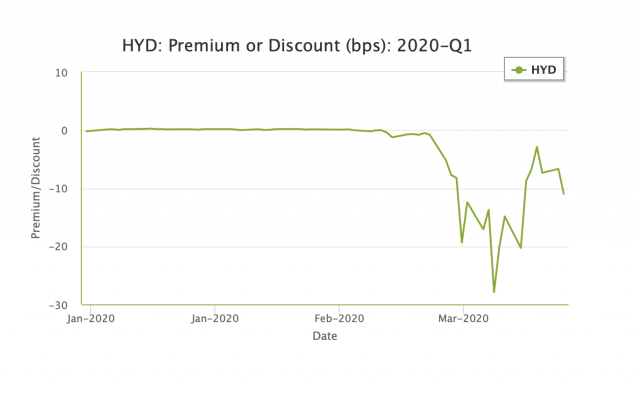

Finally, let’s take a look at Van Eck Muni High Yield Bond ETF’s (HYD) discount history (i.e. compared with its NAVs):

Source: Van Eck

So HYD’s price was discounted as much as 28% in March this year!

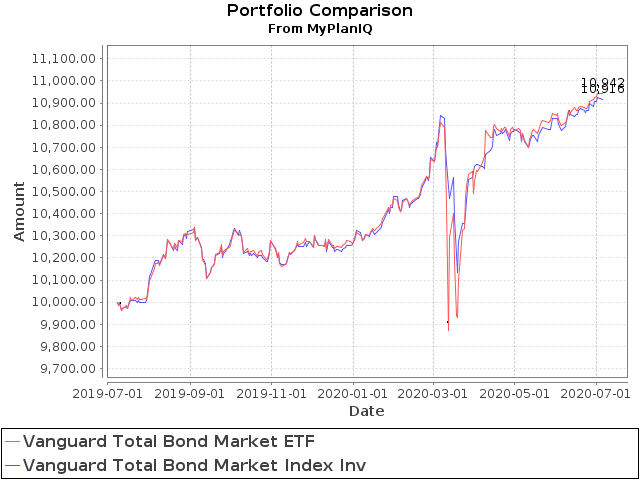

On the other hand, broad-based bond index ETFs like BND or AGG have smaller drawdown spread (8.7% vs. 6.5%) compared with their mutual fund counterparts:

In bond markets, Treasury bonds are the most liquid and thus Treasury bond ETFs have the least price discount/premium against their NAVs. A broad-based bond index ETF such as BND has a sizable weight in Treasury bonds, thus it also tends to have a smaller price/NAV discount. Investment-grade corporate bonds, on the other hand, are less liquid than Treasuries while high yield bonds are the least liquid and thus tend to have the largest price/NAV discounts in a volatile market.

To summarize, the above data show that

- Broad-based stock index ETFs can be a very good alternative to their mutual fund counterparts in terms of volatility. In addition, they are low cost, available in all brokerages, and are flexible to trade. In our opinion, investors can safely use them in place of mutual funds.

- Bond ETFs, unfortunately, are really not up to the task to replace their mutual fund counterparts. This issue is more inherent and fundamental – the underlying bonds just don’t have enough liquidity for market makers and operators to quickly arbitrage away or suppress the large discounts (or premiums). We have watched this space for a long time. At the moment, we believe investors should still choose bond mutual funds if this is possible.

The implication of the above observations on our asset allocation portfolios is that one probably should use a mix of stock ETFs and bond mutual funds in a portfolio. One issue that arises from this is that ETF trades are settled 2 days later (T+2) while mutual funds are settled one day later (T+1). If one wants to sell ETFs and buy a bond mutual fund, it has to wait one more day before the ETF sell is settled, instead of just simply using mutual fund exchange feature to issue buy and sell orders in the same time. Similarly selling a mutual fund and buying a stock ETF also need to wait till the next day for the fund to settle. Note in a margin account, one can issue an ETF buy order the same day after placing a mutual fund sell order that will be carried out at the end of that day. Since stock trades are more sensitive to timing, in both cases (sell stock ETFs and buy bond mutual funds or sell mutual funds and buy stock ETFs) in a margin account, stock ETF trades can be carried out timely while bond mutual fund trades are delayed (which is less sensitive to timing).

This issue can be alleviated if one carefully segregates stock investments from bond investments, either in two accounts physically or in two conceptual parts in a single account. In the stock portion (or portfolio), it uses bond ETFs when it’s necessary (i.e. if TAA or AAC calls for switching from stocks to bonds). The only time when the two portions need to cross over is when the portfolio needs to rebalance among stocks and bonds. In general, we don’t recommend frequent stock and bond rebalances. One should rebalance only when there is a significant out-balance of the two portions. On average, once a year or so. Such a rebalance does not need to be in a hurry and can be carried out in more than one day.

Disclosure: I am/we are long VCIT, VTI, BND. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

|

|

Leave a Reply

You must be logged in to post a comment.