This article was co-produced with Dividend Sensei and edited by Brad Thomas.

Let me be clear right from the get-go.

I would never recommend putting half of my net worth in a single asset class. Ever. As much as I love REITs, it would be downright foolish to put all of my hard-earned capital into them alone. Or anything else, for that matter.

I know this from personal experience.

Back when I was younger, I took on enhanced risk as a real estate developer. By the time I was 25, I’d built up a substantial net worth. And it seemed to me that the real estate gravy train would never come to an end.

But it did. Worse yet, it went right off the tracks.

That’s why I’m more focused on principal preservation these days. Losses can teach us a lot of things we otherwise would never learn, prompting us to become more intelligent investors. As Benjamin Graham explained:

“Adversity is bitter, but its uses may be sweet. Our loss was great, but in the end, we could count great compensations.”

Sure enough, over the past few months, I’ve been uncovering some real gems outside the REIT sector. In doing so, my research serves multiple purposes, helping me to:

- Develop a retirement strategy of my own

- Helps readers (like you)

- Help my mother with her retirement strategy

It’s a win-win-win situation.

This Is Intense!

We’ve been warning for weeks about the most irrational bubble in U.S. history.

What happens when you combine:

- The second-highest valuations

- The worst economic, corporate, and labor market fundamentals in 75 years?

The answer is high risk for investors who don’t know what they’re doing.

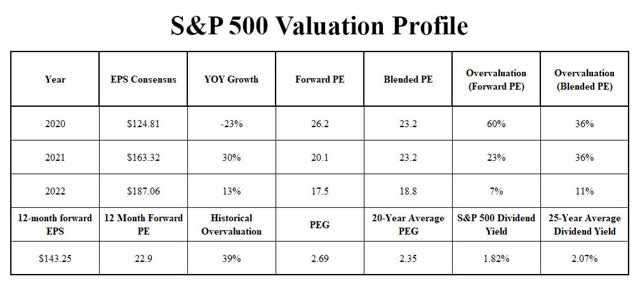

(Source: Dividend Kings S&P 500 Valuation & Total Return Potential Tool)

Now, remember that valuations cannot be used to time the market. In this case, they’re only telling us that stocks have priced in a lot of future growth, thereby lowering probability-weighted expected returns.

It takes six years before fundamentals and valuations really start to explain most total returns.

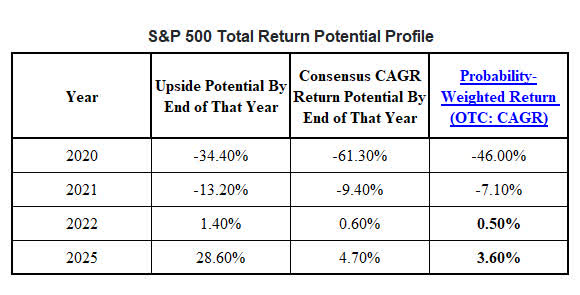

(Source: Dividend Kings S&P 500 Valuation and Total Return Potential Tool)

(Source: Dividend Kings S&P 500 Valuation and Total Return Potential Tool)

Stocks can remain irrational for many years though. That’s why bubbles occur in the first place.

However, such activity also can create immense opportunities for long-term income investors to lock in safe, high-yield, exceptional future returns. And that’s precisely what we’re seeing today in British American Tobacco (BTI).

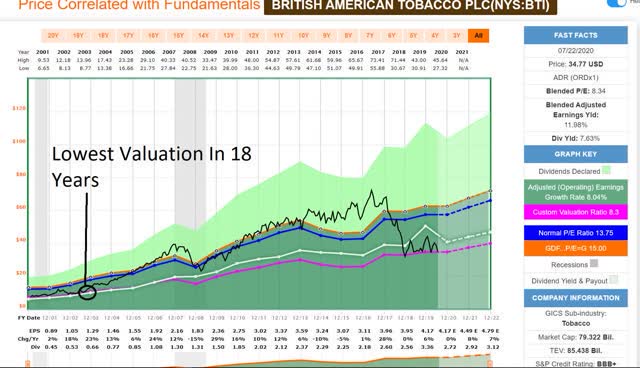

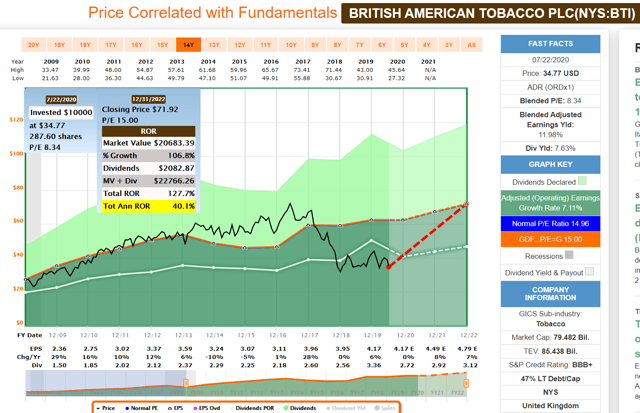

Right now, the company is trading in year four of a bear market, resulting in its lowest valuation in 18 years.

(Source: F.A.S.T Graphs, FactSet Research)

(Source: F.A.S.T Graphs, FactSet Research)

BTI has spent as much as six years overvalued and six years undervalued at a time. It’s currently been undervalued for three years, which means that – if historical trends hold – it should return to fair value within three years.

In other words, BTI, a proven incredible income and wealth compounder, is poised for massive total returns in the coming years.

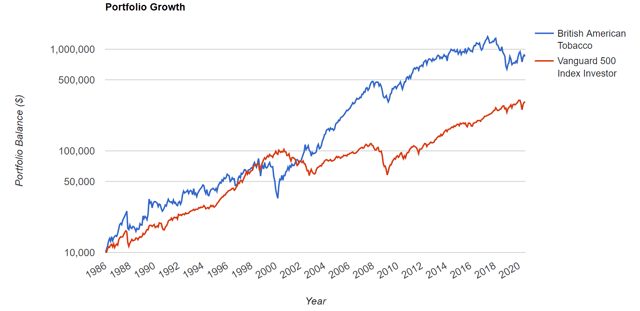

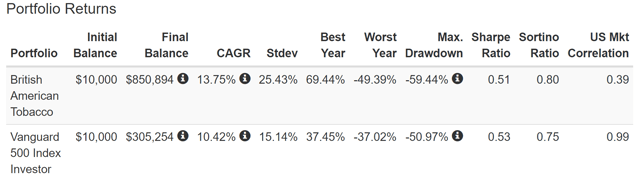

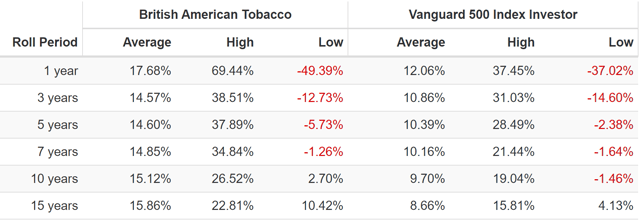

BTI Total Returns Since 1986

(Source: Portfolio Visualizer)

BTI’s yield in 1986 was 2.3%, and its 2019 yield on cost was 455%. So, there’s no question it’s a quality company.

It’s outperformed the market by 32% over 34 years, resulting in an 85-fold increase in investor wealth.

A 7.5% Yield Retirees Can Likely Depend On

The cost of such returns is, admittedly, high volatility. That and the occasional multi-year bear market.

But there are four very good reasons why we’re bullish about BTI anyway, starting with the safe income it generates.

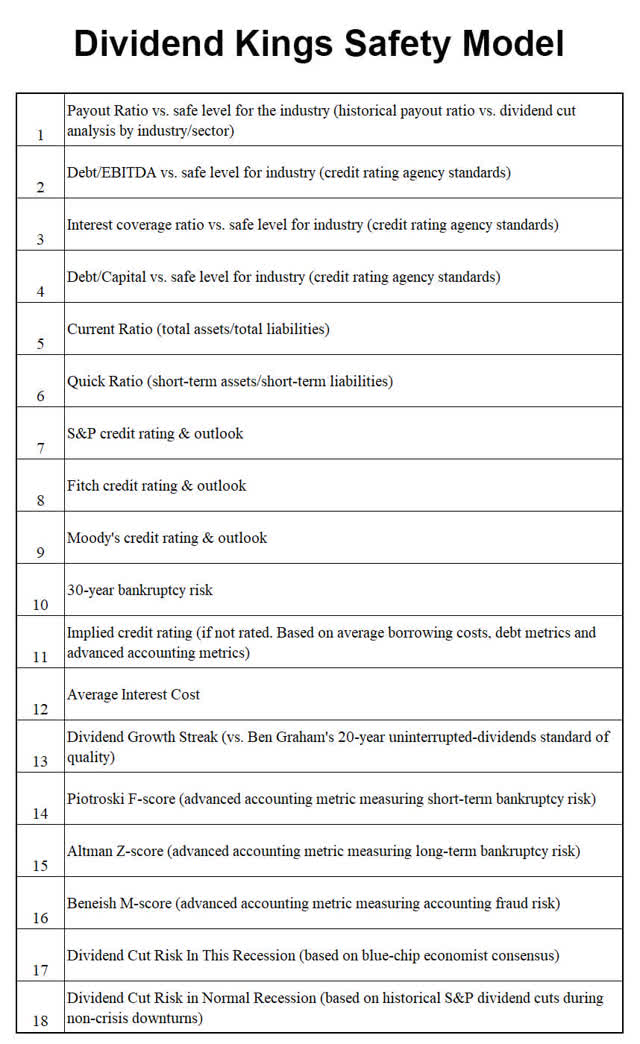

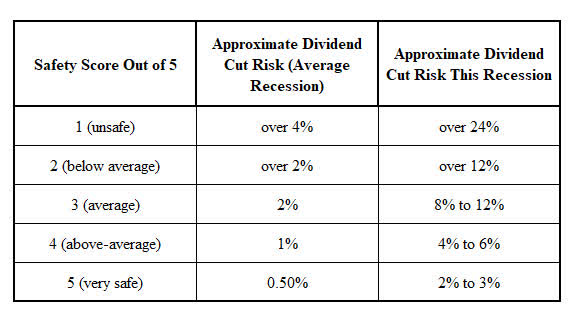

We have no interest in yield traps with dangerous dividends, especially during the worst recession in 75 years. That’s why Dividend Kings uses the following 18-metric safety model:

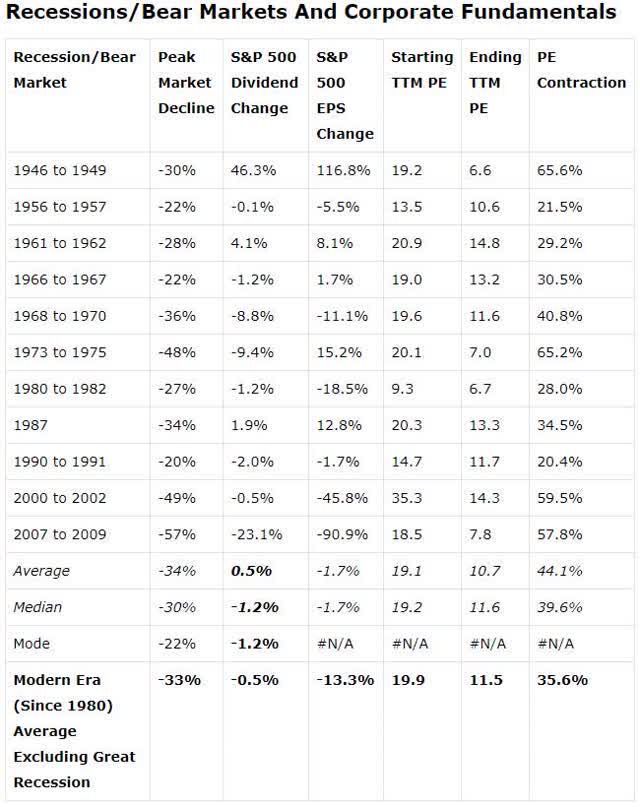

Scores are determined by benchmarking the S&P 500’s average historical recessionary dividend cut – which, by definition, represents an average-quality company.

(Source: Moon Capital Management, NBER, Multipl.com)

(Source: Moon Capital Management, NBER, Multipl.com)

We then calibrate dividend-cut risk in this recession by looking at the consensus GDP decline range from blue-chip economists. By this, we mean the 16 most accurate (out of 44 tracked by MarketWatch).

BTI scores a 4/5 above-average. So, there’s about a 5% probability of a dividend cut in this recession. Here’s why:

- 2020 consensus payout ratio: 65% vs. 85% safe for this industry

- Debt/Capital: 47% vs. 60% safe

- Debt/EBITDA: 3.8 vs. 3 or less safe

- Interest coverage ratio: 4.9 vs. 8+ safe

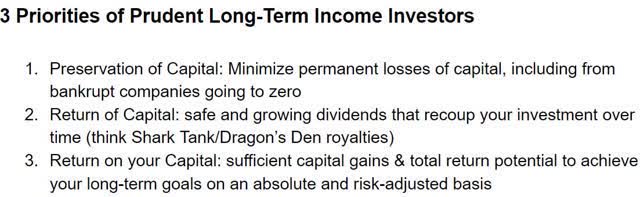

- S&P credit rating: BBB+ stable outlook = 5% 30-year bankruptcy risk

- Fitch credit rating: BBB stable outlook = 7.5% 30-year bankruptcy risk

- Moody’s credit rating: Baa2 (BBB equivalent) stable outlook = 7.5% 30-year bankruptcy risk

- Dividend growth streak: Two years (changed to quarterly payments in 2018 from semi-annual)

- F-score: 7/9 vs. 4+ safe, 7+ very safe = very low short-term bankruptcy risk

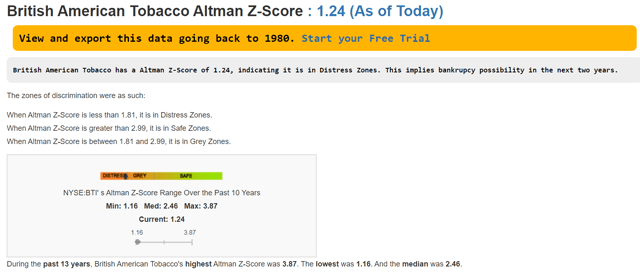

- Z-score: 1.24 vs. 3+ very safe = distressed

- M-score: – 2.49 vs. -2.22 or less safe = low accounting fraud risk

- Safety score: 4/5 above-average safety

- Dividend cut risk in this recession: 4%-6%

- Dividend cut risk in a normal recessional: 1%

Debt is the primary concern for BTI. That makes sense since it bought the rest of Reynolds American in 2017 in a $49 billion, mostly debt-funded deal.

On the one hand, that made it the largest tobacco giant on earth. On the other, it caused its debt ratios to weaken significantly.

Then, there’s its low Z-score, an advanced accounting metric that scans quarterly and annual reports for key asset ratios to estimate long-term bankruptcy risk.

(Source: Gurufocus)

Fortunately, BTI’s 13-year median is 2.46, a much safer level. Plus, the company has been aggressively deleveraging for the past few years.

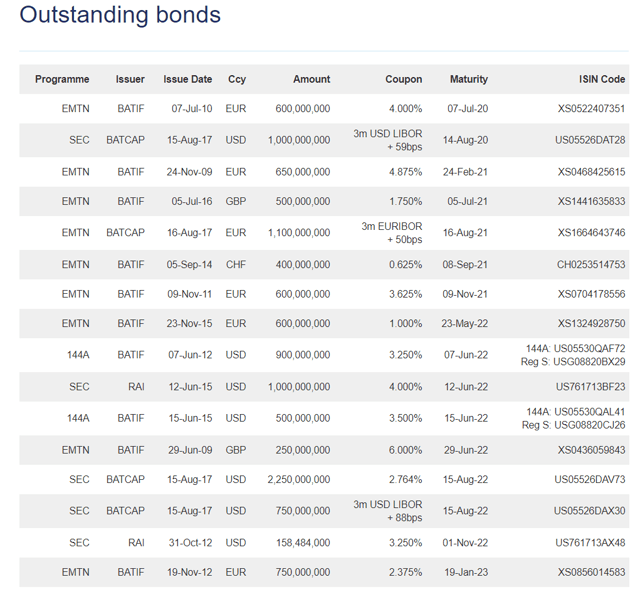

(Source: bond investor presentation)

(Source: bond investor presentation)

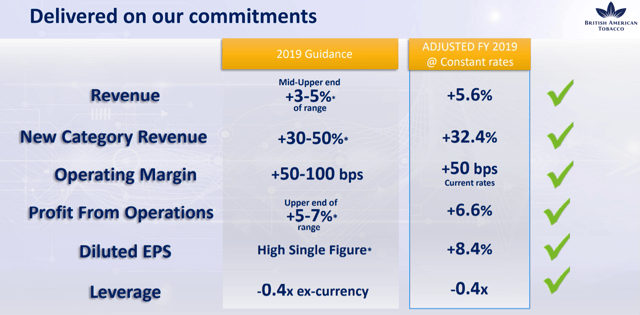

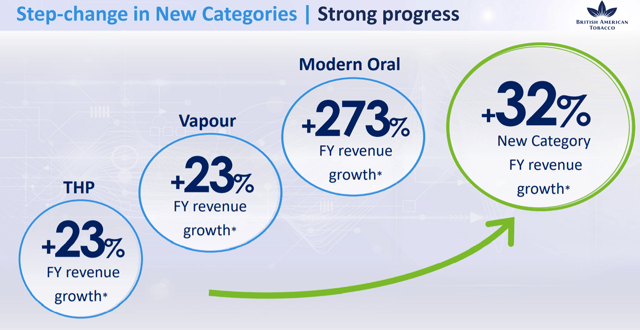

For instance, it deleveraged by 0.4 turns in 2019. That was while delivering on its growth and margins guidance with 32% reduced-risk product sales growth.

BTI Finance Director Tadeu Marroco told analysts on the Q4 conference call in February (emphasis added):

“The leverage on the balance sheet continues to be a priority. With current FX rates representing a headwind, we expect to drive adjusted net debt to adjusted EBITDA down to around 3.2x at current rates by the end of the year and then to below 3x by the end (of) 2021…

“We expect operating cash conversion to be in excess of 90% and remain committed to a 65% dividend payout ratio…

“Strong free cash flow after dividends of £1.9 billion exceeded our guidance of £1.5 billion. This underscores our ability to sustainably grow the dividend, maintain a 65% dividend payout ratio and simultaneously reduce our leverage by 0.4 times at constant rates.“

Sub 3.0 leverage would make BTI’s debt safe, at least in terms of net leverage.

The company converted 97% of earnings per share into free cash flow in Q1. And it expects to maintain a steady conversion ratio over 90% over time.

The payout ratio policy is 65%, and analysts expect it to stay there in 2020, 2021, and 2022. That factors in 7% expected dividend hikes next year and the next.

Source: BTI

As you can see above, $9.8 billion in bonds are maturing by the end of 2022 – the year health experts expect this pandemic to end. That represents 18% of BTI’s $53 billion in long-term debt.

Meanwhile, its stable BBB/BBB+ credit ratings allow it to borrow for up to 40 years at 4% interest rates. And its average interest cost is 4.2%, which is currently about 1% below its returns on invested capital.

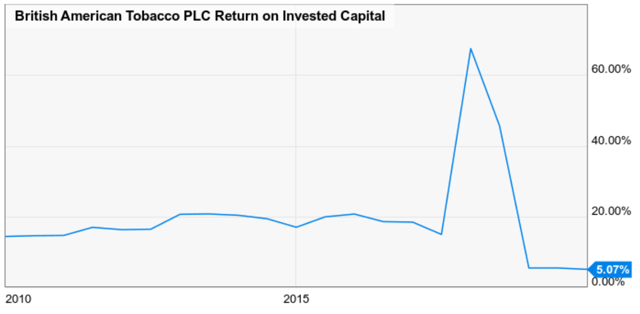

(Source: YCharts)

But buybacks are suspended until management gets the net leverage ratio to a safe 2.9 or better by year’s end. Once it resumes, EPS, FCF, and dividend growth should benefit to keep BTI’s valuation low.

The S&P Weighs In On British American Tobacco

What do the credit rating agencies say about BTI? Well, S&P last reviewed it on April 27, after the pandemic had started. It reiterated the company’s BBB+ status it had first assigned in 2017, adding that, with Reynolds:

“BAT will strengthen its presence in the attractive U.S. market, which will represent over 40% of the combined group’s revenues and earnings.

“The U.S. market is highly profitable, with an efficient supply chain, benefiting from a relatively low excise duty on cigarettes. This translates into fairly high wholesale selling prices in the low retail selling price environment.

“Nevertheless, despite the significant pricing power and low price elasticity in the U.S., we continue to believe that emerging markets will remain growth drivers over the medium term, mainly because of their increasing middle-income populations.”

It also likes BTI’s research and development capabilities now, and its “leadership position in the vapor segment.” These should allow it “to manage declining demand I developed markets more smoothly.” Which is good considering how 40% of its sales and earnings are now generated in the U.S.

Here’s a bit more of its larger evaluation (emphasis added):

“The stable outlook reflects our view that BAT will be able to sustain strong cash flow generation, following the successful integration of Reynolds in the third quarter of 2017. We would expect BAT’s credit metrics will be compatible with the ‘BBB+’ rating over the next two to three years, including adjusted debt to EBITDA in the range of 3x-4x…”

If BTI achieves its sub-3 leverage ratio and returns to about 8x interest coverage, S&P says it can regain its A- credit rating.

The Fitch (and Moody’s) Take On The Situation

For its part, Fitch last reviewed British American Tobacco on May 19, writing (emphasis added):

“In our view, BAT’s business risk profile has benefited from the full integration of RAI in 2018, leading to greater scale and control in the North American markets, including a diversified and strong product and marketing platform for next-generation products (NGP), supporting BAT’s ambitious growth targets in this product category…

“The ratings reflect BAT’s position as the largest international tobacco company, with a 26.9% market share of the global market excluding China. BAT’s operations are supported by the diversity of its portfolio of brands and of the countries it operates in.

“Post-merger BAT now combines a strong concentration in the profitable US market with steady cash flow from Western Europe and Australia and we estimate between 20% and 25% of profits from high-growth emerging markets.”

BTI overtook PM as the world’s largest tobacco company when it bought Reynolds, with its 27% market share. That excludes China, of course, where government monopolies control the market.

And Moody’s rates BTI Baa2, the equivalent of BBB, with a stable outlook, which we discuss in the risk section.

But the bottom line is that BTI’s dividend remains safe due to management’s proven ability to balance shareholder returns with steady and aggressive deleveraging.

A Lucrative Business Model With Strong Long-Term Growth Prospects

(Source: Investor presentation)

As a tobacco company, some investors have environmental, social, and governance (ESG) concerns. Which is understandable.

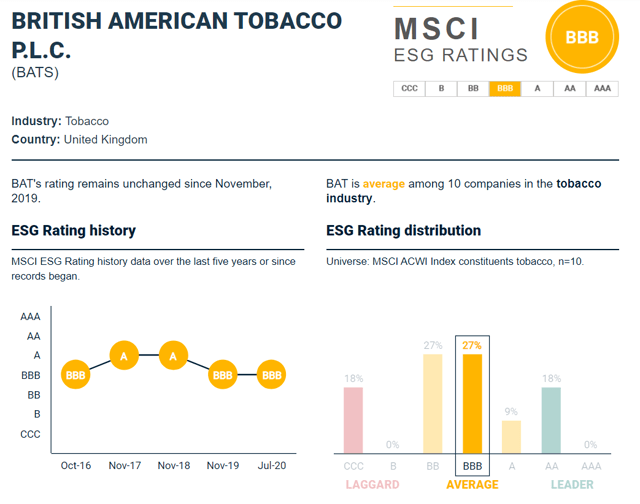

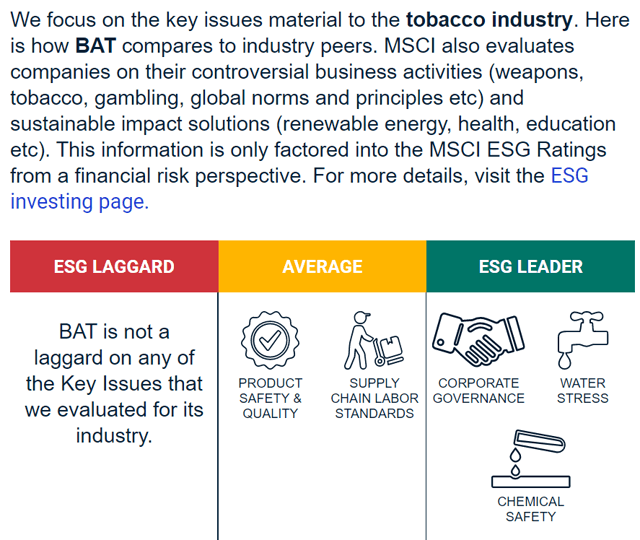

But BTI has actually done a good job in terms of ESG initiatives over the years. MSCI, the global indexing giant, gives it an average assessment in this regard relative to nine of its largest peers.

(Source: MSCI)

According to MSCI, BTI has room for improvement (all companies do). Yet it has no major deficiencies in its business practices. And it’s an industry leader in corporate governance, water efficiency, and chemical safety.

(Source: investor presentation)

Plus, S&P (which owns Dow Jones), ISS, and other ESG-rating organizations have recognized BTI for its good execution on sustainable business practices.

As far as its core business right now – cigarettes – the company benefits from a wide moat, courtesy of its strong premium brands.

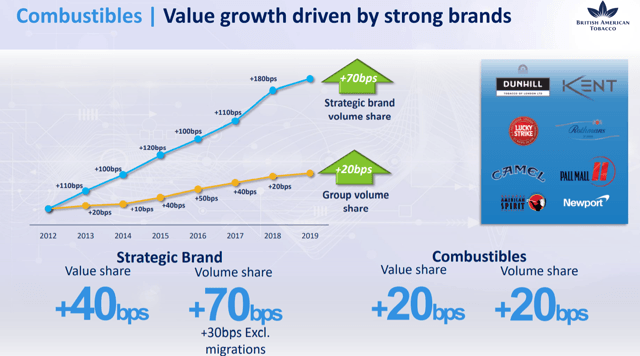

(Source: Bond investor presentation)

BTI has gained market share steadily since 2012, mostly at the expense of weaker rivals like Imperial Brands (OTCQX:IMBBY) and Japan Tobacco (OTCPK:JAPAF).

(Source: Bond investor presentation)

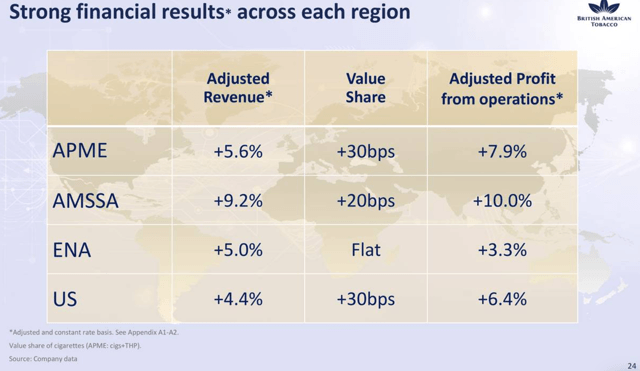

In all of its regions, its market share was stable or improved slightly. Meanwhile, revenue rose 4.4%-9.2%, driving 3.3%-10% growth in operating profits.

(Source: investor presentation)

In 2019, the company gained 0.3% in market share in the U.S. to now command 36.8% market share. As such, it’s second only to Altria (MO).

(Source: investor presentation)

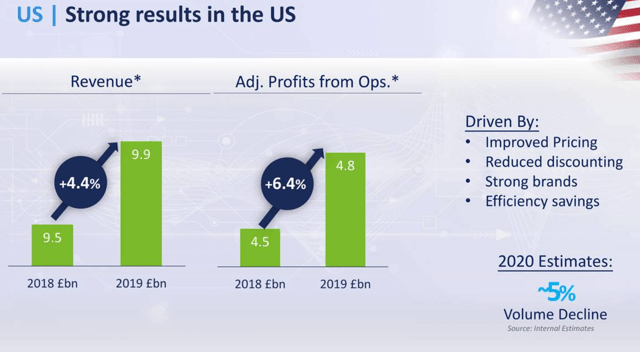

U.S. sales were up 4.4% last year, with 6.4% growth in operating profits. Though those are expected to fall 5% in 2020, pricing increases and cost-cutting should generate stable revenue and profitability.

(Source: investor presentation)

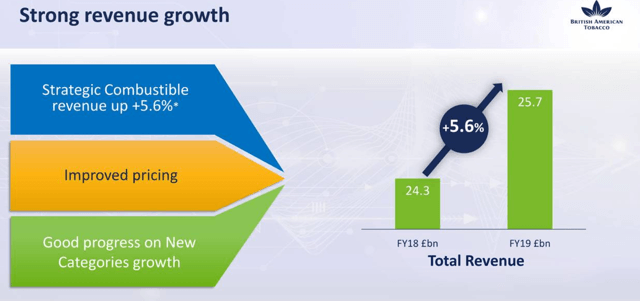

Overall, last year, cigarette revenue was up 5.6% in constant currency terms courtesy of BTI’s continued strategy of steadily raising prices faster than volume declines.

(Source: investor presentation)

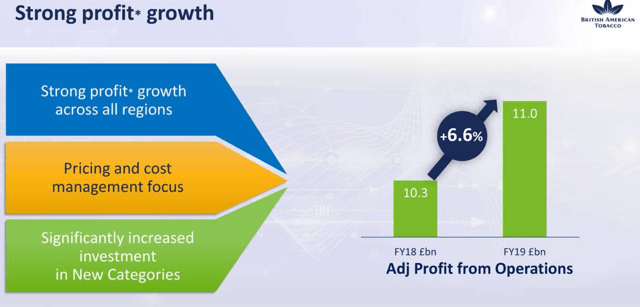

Last year, operating profits rose by 6.6%, as it executed on its synergistic cost savings plan for Reynolds. And its long-term plan is to shift from a tobacco company to a nicotine company.

(Source: Bond investor presentation)

By 2023, BTI expects to generate $6.4 billion in RRP (next-gen products) sales, representing approximately 25% of its revenue.

(Source: investor presentation)

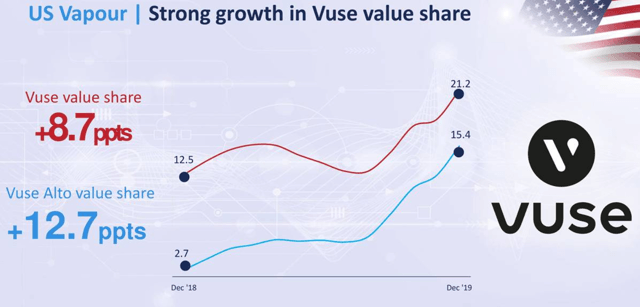

BTI’s Vuse vaping brand had a rapidly-growing market share at the end of last year – coming in at 21.2%.

(Source: investor presentation)

Plus, in Europe, BTI is No. 2 in vaping, with 17% share in Germany and 23% in France.

(Source: investor presentation)

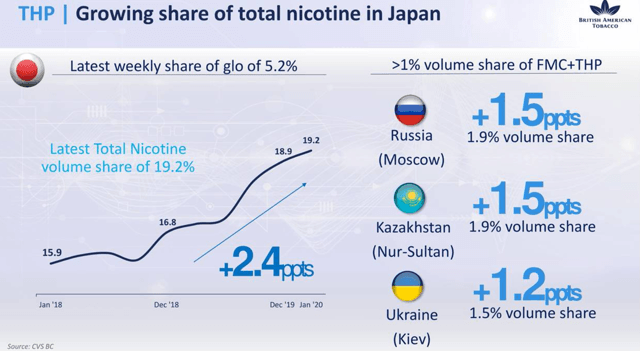

The list of positive progress continues in Japan, where its Glo brand now commands 19.2% of sales. And its Russian and eastern European market shares are 1.5%-1.9%, up 300%-375%.

Management expects continued strong growth for Glo going forward in those nascent markets.

(Source: investor presentation)

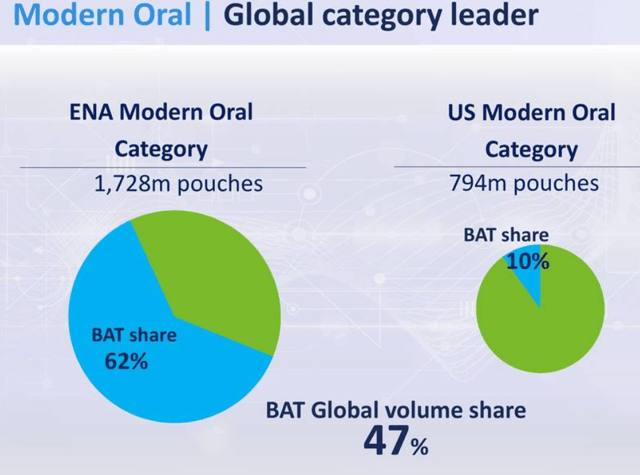

In nicotine pouches, it commands 47% global market share, with a 10% share in the U.S. Management expects to gain market share in America off this low base.

(Source: investor presentation)

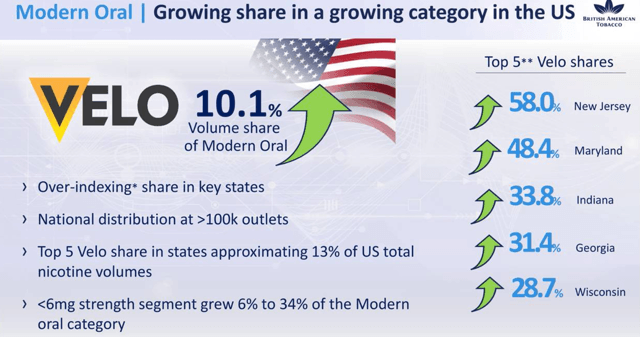

BTI’s Velo nicotine brand has seen robust growth in the U.S. Market share gains have been ranging from 29% in Wisconsin to 58% in New Jersey.

(Source: investor presentation)

Its nicotine pouches now command:

- 75% share in Denmark

- 41% in Switzerland

- 27% in Russia

Over in Norway, growth is over 50%, and it’s over 100% in Sweden. As for emerging markets, both Kenya and Pakistan are showing promising early signs in trial sales of these reduced-risk products.

In short, this is how a well-run tobacco company adapts to secular changes in its market.

(Source: investor presentation)

Focus On BTI’s Fundamentals

For everyone upset that BTI’s price has been weak, we would urge you to focus on the fundamentals.

Last year, cigarette volumes declined 4.4%. They’ve been falling for decades, what with the ever-present regulatory and ESG risks at play.

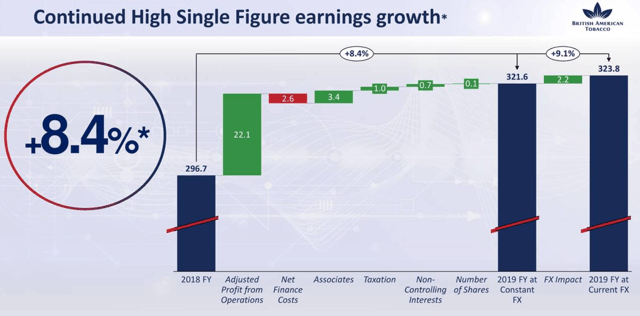

Yet BTI’s EPS grew 8.4% in 2019, objectively proving bears wrong and increasing intrinsic value by a similar amount.

(Source: investor presentation)

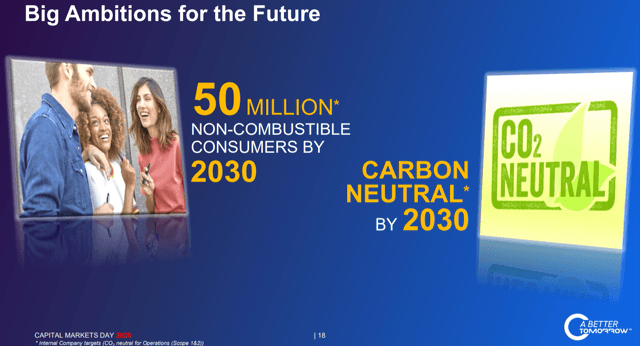

By 2030, the company expects to have 50 million, up 354% from its current 11 million RRP customers. It also plans to be carbon-neutral within 10 years.

If so, that could potentially boost its ESG ratings. Combined with deleveraging, this might be enough to result in an A-credit rating, which would reduce its cost of capital and allow for improved profitability.

More funding could be freed up as well for potential buybacks if shares remain undervalued.

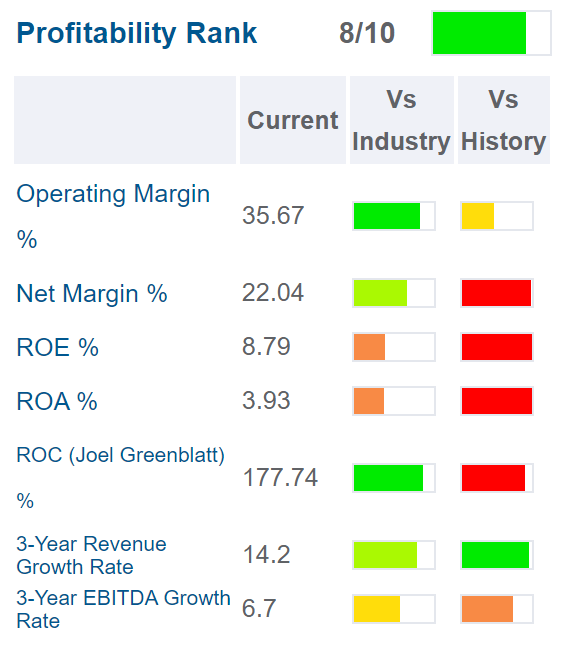

(Source: Gurufocus)

Tobacco is a highly lucrative industry. Yet even compared to its peers – and factoring in the much lower profitability that initially resulted from acquiring Reynolds – BTI is a standout, wide-moat, 3/3-quality business.

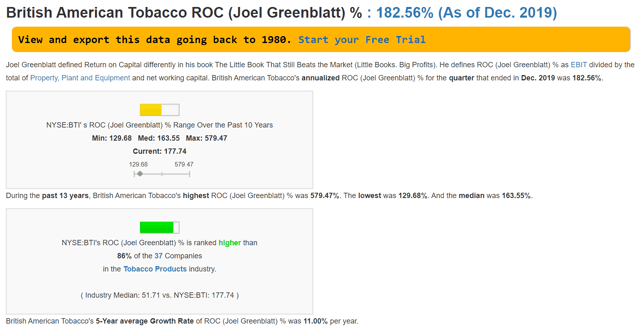

(Source: Gurufocus)

BTI finished 2019 generating 183% returns on capital (pre-tax profit/operating capital). That’s almost 4x the industry median.

Return on capital, Joel Greenblatt’s gold standard proxy for company quality and moatiness, has been trending higher by an 11% compound annual growth rate over the past five years. And it’s above the 13-year median of 164%.

Basically, BTI is a profit-minting machine and an attractive potential long-term investment at the right price.

Finally, we come to management quality. Here, I concur with Morningstar’s assessment of the executive team:

“Our stewardship rating for British American Tobacco is standard. In our opinion, capital allocation at BAT has been mixed. The company has been fairly acquisitive over the past decade, and some of its most recent deals – Protobacco in 2011 and Reynolds in 2017 – were executed at (11x and 10x) enterprise value/EBITDA, respectively, multiples at the high end of the spectrum for developing-market transactions that we think were a little rich.

“The Reynolds transaction was executed at a level neutral to our valuation of BAT, and it has structurally lowered the ROIC of the overall business, although the value may increase with top line synergies in the future. In addition, the firm began ramping back its share-repurchase program in 2012, when the stock was already on the way to a rerating. This is a stable business (our uncertainty rating is medium) that has historically had a fairly strong balance sheet, and we would have preferred management to have been more opportunistic in the downturn by buying shares at deeply discounted prices, rather than at levels much closer to our fair value estimate.

“Jack Bowles, former COO of the international business, replaced Nicandro Durante as CEO on April 1, 2019. We are not convinced Bowles is setting optimal targets to turn the business around, and we would prefer BAT’s people be incentivized by profitable growth, rather than revenue alone, given the uncertain profitability profile of NGPs.”

For our part, we rate management/dividend culture 2/3 average, though we disagree that BTI’s stronger focus on RRPs is a negative.

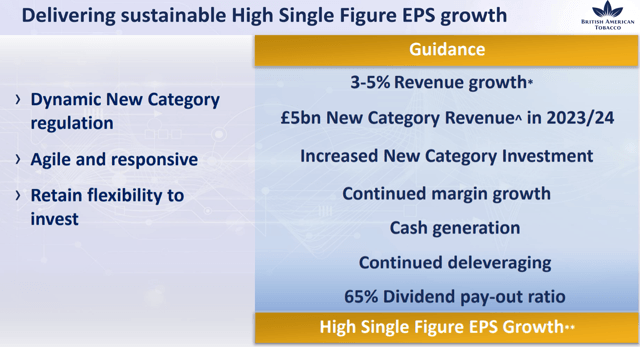

(Source: Bond investor presentation)

Management’s long-term guidance is for 7%-9% growth. That’s expected to be driven by modest 4% sales growth, primarily from rising cigarette prices and rapid growth in reduced-risk products.

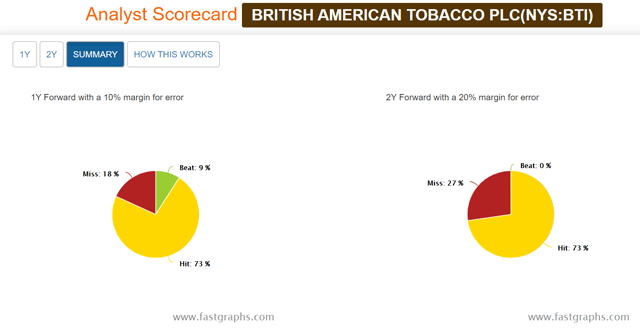

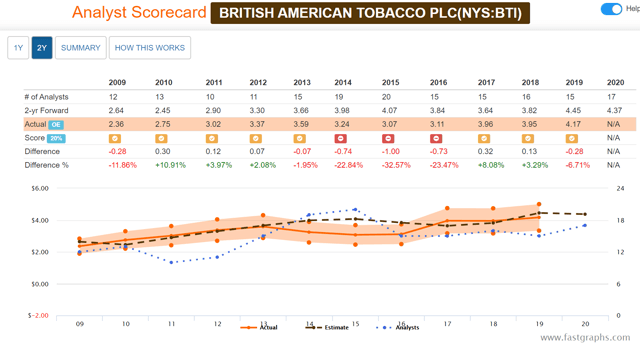

According to management’s guidance – which it has a good track record of achieving – BTI is not a dying company. It’s a thriving one. That’s also true according to the 19 analysts who collectively know this company very, very well.

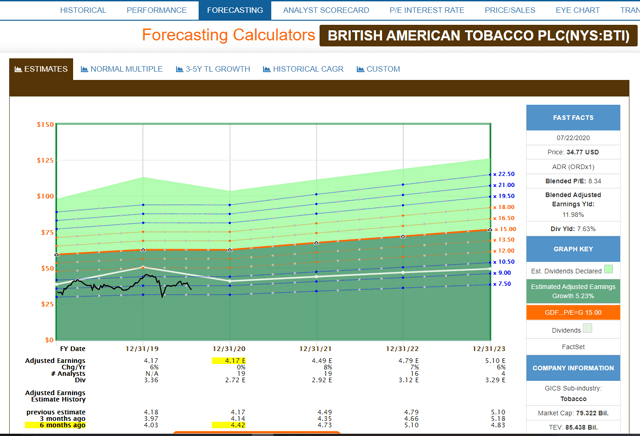

The latter have reduced near-term EPS and cash flow estimates, however, due to current economic and associated conditions.

(Source: YCharts)

(Source: YCharts)

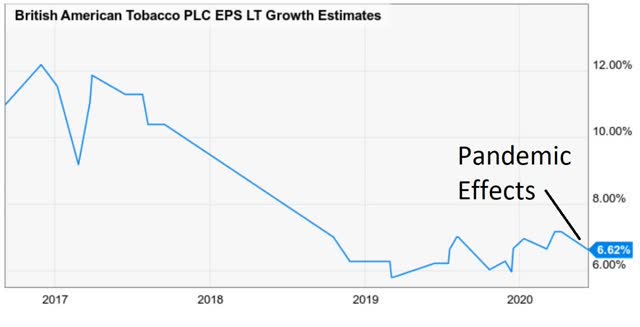

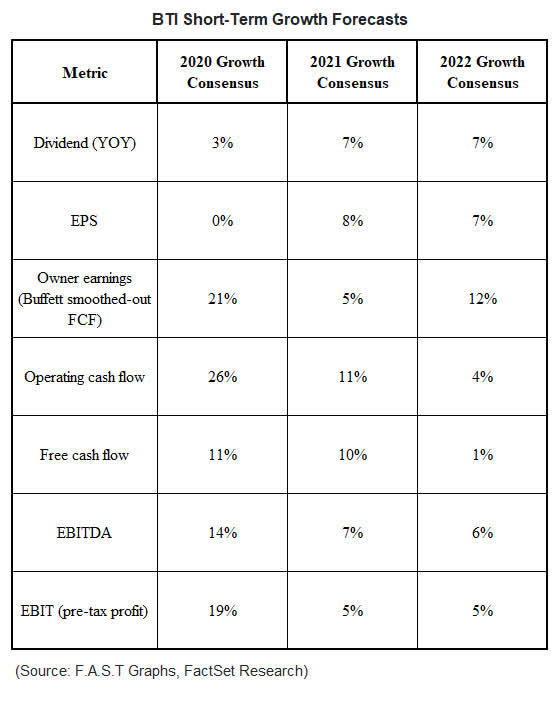

Even so, BTI’s overall growth profile remains the strongest of any tobacco blue chips, with a:

- FactSet growth consensus through 2023 of 5.2% CAGR

- FactSet long-term growth consensus of 6.7%

- YCharts long-term growth consensus of 6.6%

- Reuters’ five-year growth consensus of 6.2%

- Management long-term guidance of 7%-9%

- Historical growth rate: 2%-10%

The historical margins of error on analyst BTI forecasts are -33% to +10%. So, the historical margin of error consensus growth range is 4%-7% CAGR.

In a year when most companies are reporting large declines in earnings and cash flow, BTI is expected to post impressive growth – even after factoring in the most recent guidance revisions from the pandemic effects.

That growth is expected to continue through 2022, showing BTI’s resilient recession-resistant business model. So, it makes sense that its five-year total return potential range right now is 20%-24% CAGR.

Applying BTI’s historical 14.00-15.5 market-determined fair value to the 4%-7% CAGR margin of error-adjusted analyst consensus growth range, we get a 20%-24% CAGR total return potential over the next five years.

BTI 2022 Consensus Return Potential

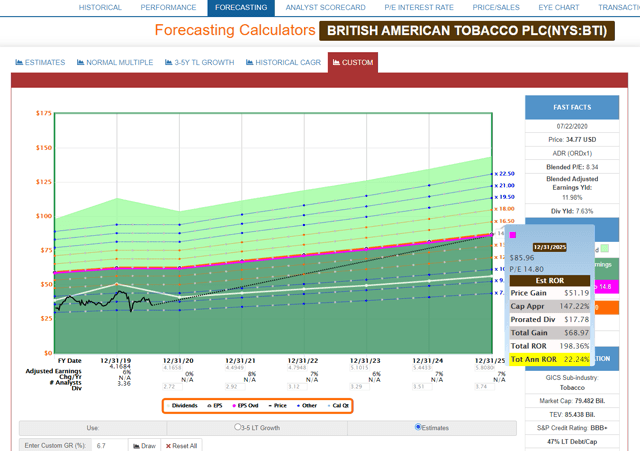

(Source: F.A.S.T Graphs, FactSet Research)

BTI 2025 Consensus Return Potential

(Source: F.A.S.T. Graphs, FactSet Research)

If BTI grows as expected and returns to market-determined historical fair value – which prices in all its risk factors – then, it could potentially triple your investment over the next five years.

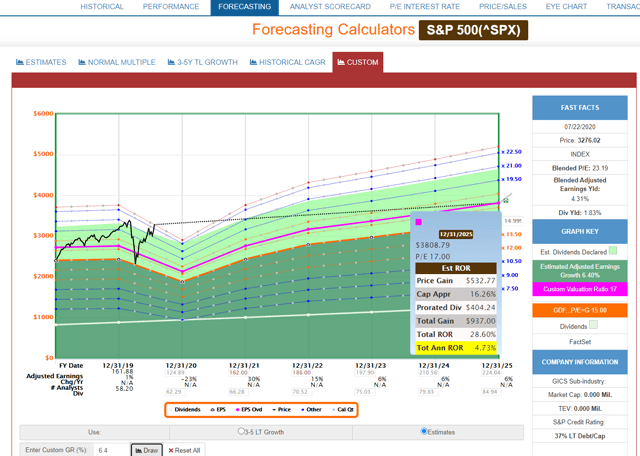

Compare that to the 39% overvalued S&P 500.

(Source: F.A.S.T. Graphs, FactSet Research)

(Source: F.A.S.T. Graphs, FactSet Research)

Valuation Profile Is Exceptionally Attractive In This Overvalued Market

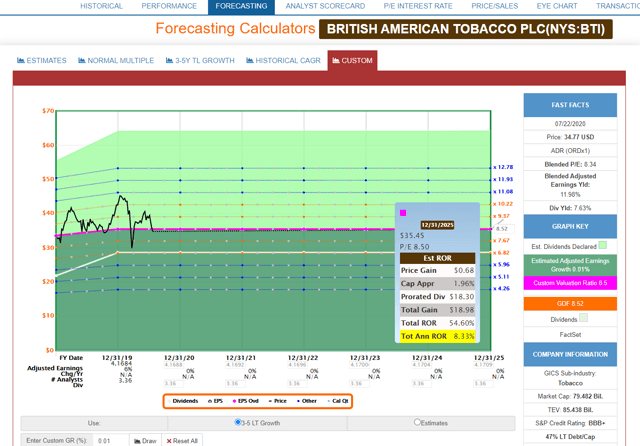

BTI is an anti-bubble stock. Right now, that means it’s incorrectly priced for negative growth. So, 0% growth is required to earn strong returns.

Which means it’s very likely to make money for investors who get in at these depreciated levels.

BTI Zero Growth Forever Return Potential

(Source: F.A.S.T. Graphs, FactSet Research)

While there’s a 20%-40% probability that analysts are wrong, the chances of it failing to deliver at least flat growth is extremely small.

Besides, according to its historical six-year bear market, it should return to fair value by the end of 2023. A fair value that’s marching steadily higher each year.

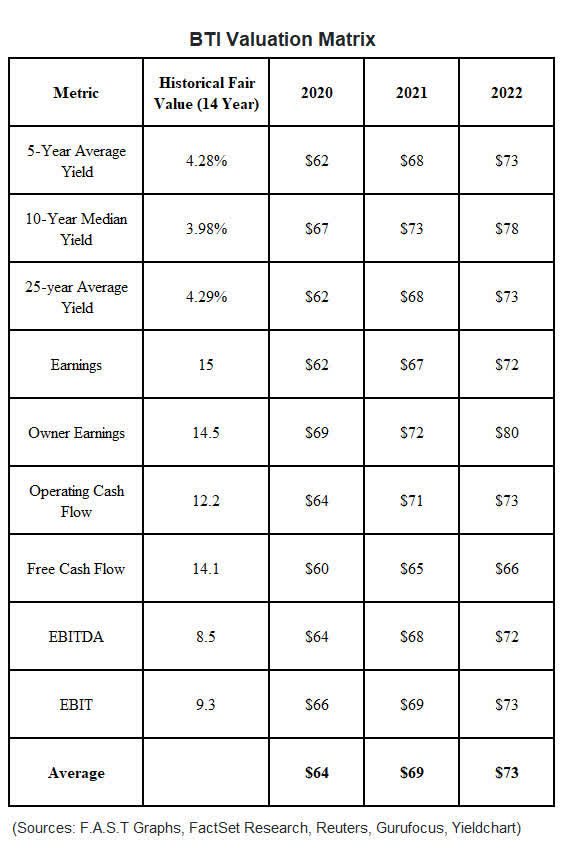

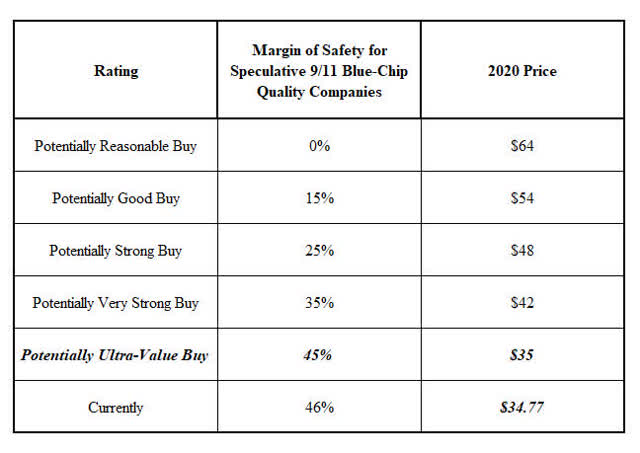

There’s an 80% probability that BTI’s intrinsic value lies between $60 and $69. And we use the average historical fair value of $64 as a reasonable estimate of what its consensus fundamentals are worth this year.

Note that, next year, BTI’s fair value is expected to be $69. In 2022, it should be $73. By the end of 2023, it could become a $78 stock.

BTI is an ultra-value/anti-bubble buy right now – the highest buy rating Dividend Kings has

So, let’s put it all together to see how prudent a high-yield investment it’s during this irrational market bubble.

A Potential High-Yield Investments Conservative Income Investors Can Consider

Dividend Kings never recommends or buys a company without first running it through its Investment Decision Tool. This factors in every important investing concept that matters:

- Always pay a sensible price that compensates you for a company’s risk profile.

- Don’t lose your money.

- Get your money back.

- Get a good return on your money.

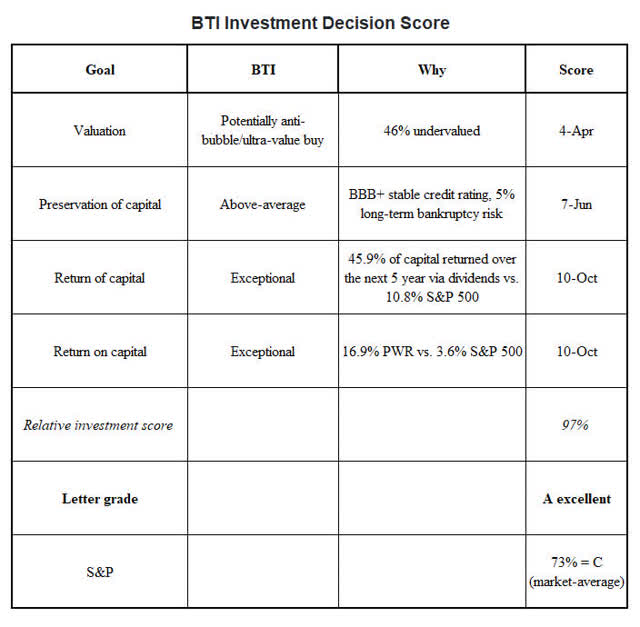

We just saw that BTI is an ultra-value buy at its approximate 46% discount to historical fair value. That makes it a 4/4 on valuation.

(Sources: Dividend Kings Investment Decision Tool, S&P, University Of St. Petersburg)

BTI’s Investment Decision Score looks like this:

- Valuation: 4/4 46% undervalued = potentially anti-bubble/ultra-value buy

- Preservation of capital: BBB+ stable credit rating = 5% 30-year bankruptcy risk = 6/7

- Return of capital: 7.7% yield and 6.7% CAGR growth rate = 9.2% average yield on cost over the next five years = 45.9% dividend return on investment vs. 10.8% S&P 500 (327% better) = 10/10

- 5-year probability-weighted return: 16.9% CAGR vs. 3.6% S&P 500 (370% more) = 10/10

- Relative Investment Score: 97% vs. 73% S&P 500

- Letter Grade: A excellent vs. C market-average S&P 500

In a market gone mad… with speculators bidding up some companies to insane levels, BTI represents a prudent potential investment for conservative income investors.

Risks To Consider: Why BTI Isn’t For Everyone

BTI faces two key short-term fundamental risks, with the first being that regulators have been cracking down on RRPs recently:

- Mexico has banned vaping for now due to the pandemic.

- Russia has banned nicotine pouches.

South Africa – one of the world’s leading coronavirus hotspots – has banned smoking for now. According to Moody’s, that’s a credit negative in the broader context of pandemic-related effects in other emerging market countries.

But analysts already have adjusted their consensus earnings for these effects. And earnings estimates have fallen by 6% since before the pandemic.

(Source: F.A.S.T. Graphs, FactSet Research)

The previous 6% 2020 EPS growth expectations are now 0%, with strong 6%-8% growth expected through 2023.

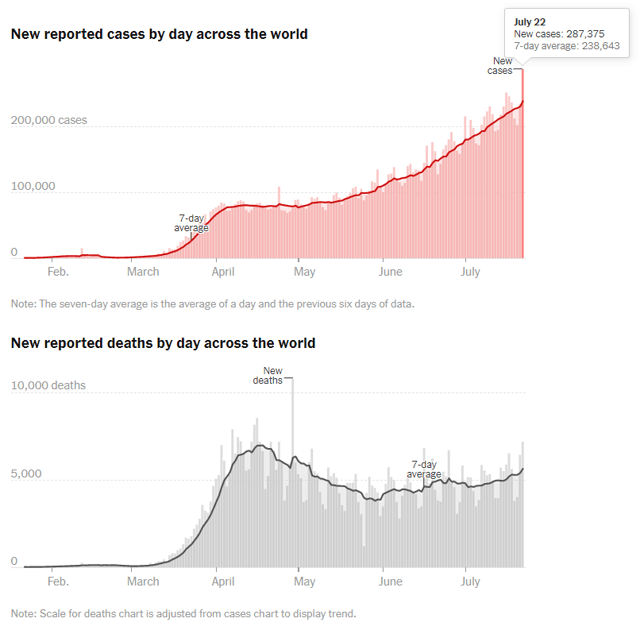

However, the pandemic could rage out of control in much of BTI’s important markets. In which case, governments might crack down on tobacco products in general. In which case, cash flows might not come in as expected this year, or in 2021.

(Source: NYT COVID-19 tracker)

On July 22, the world smashed its single-day record, reporting 287,375 new cases. And British American Tobacco is very well aware of what that could mean.

So is Moody’s, which gave its analysis of management’s recently lowered guidance on June 9 (emphasis added):

“On 9 June, British American Tobacco p.l.c. (Baa2 stable) announced in its 2020 first-half pre-close trading update that coronavirus will reduce both its revenue and earnings growth compared to its previous guidance and that, given an unchanged dividend pay-out, its reported adjusted net leverage will improve to around 3x by the of 2021, compared to below 3x previously.

“The company is also expecting slower growth in the new categories of vaping, heated tobacco, and modern oral. We view the less ambitious targets as credit negative, although this will not affect BAT’s Baa2 rating because (it’s) already well positioned at the current level.

“In terms of net revenues, BAT now expects 1%-3% growth this year compared to the previous guidance of “around the lower end of the 3%-5% range.” Earnings (adjusted and diluted) will increase in mid-single digits at constant currency compared to high-single digits before. BAT also expects to grow revenues in the new categories more slowly than it previously thought.

“Although these are performing well, according to management, the coronavirus pandemic has disrupted consumer activation plans and led to the scaling back or postponement of some launches. The company now expects to reach its £5 billion revenue target by 2025, compared to 2023/24 previously.”

Management now expects global cigarette volumes to fall 7% this year instead of just 5%. Though, U.S. volumes are expected to fall 4% rather than 5%.

And then, there’s the constant risk of litigation and regulatory risks as well.

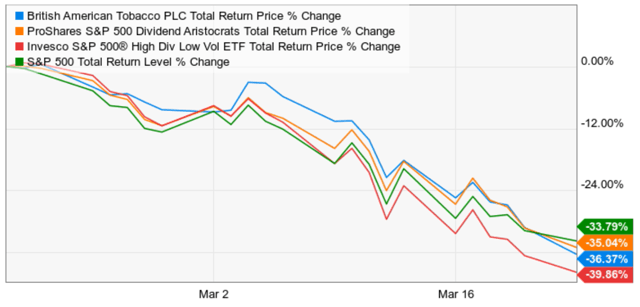

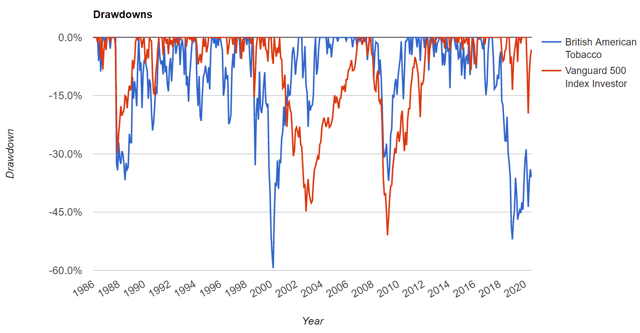

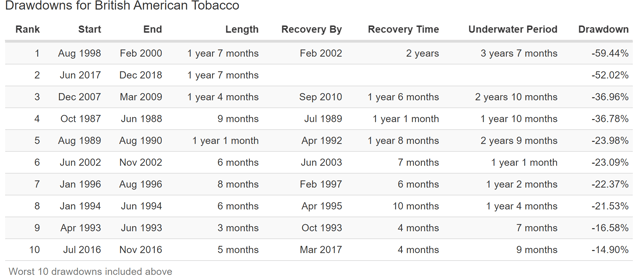

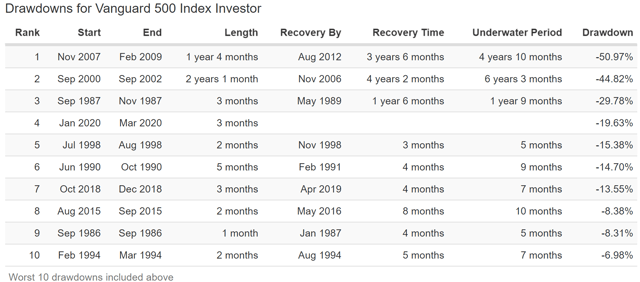

On the plus side, valuation risk is minimal, since BTI is now priced for negative growth. But volatility risk – as we mentioned before – is something that even undervalued companies face, as we saw during the March crash.

March 2020: When Low Volatility and Low Valuations Didn’t Help

(Source: YCharts)

Even low volatility stocks fell 40% in March, actually performing worse than the broader market. Dividend Aristocrats also underperformed, which is unusual for them since their average annual volatility is 4% lower than the typical stock’s.

As for BTI specifically, it bottomed at a 6.6 price-to-earnings, which was its lowest valuation in 20 years.

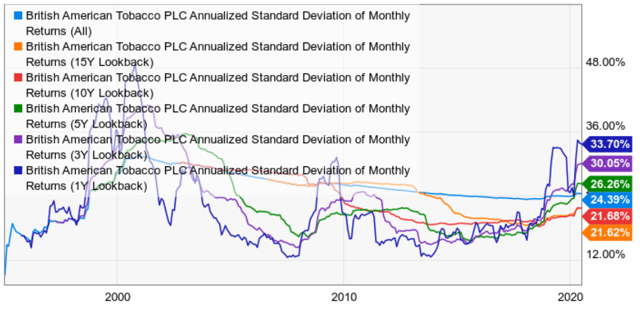

BTI’s Volatility Can Itself Be Volatile

(Source: YCharts)

BTI’s volatility is normally about 21.6% annually over the last 15 years. But volatility can spike as high as 48% per year, as it did during the Tobacco Master Settlement period.

This year, it’s hit 34%.

Volatility by itself isn’t a true measure of fundamental risk, it’s just short-term market illiquidity for a company’s stock. And remember that BTI has beaten the S&P 500 by 32% annually for 34 years now.

You just have to put up with volatility like this to get those gains.

(Source: Imgflip)

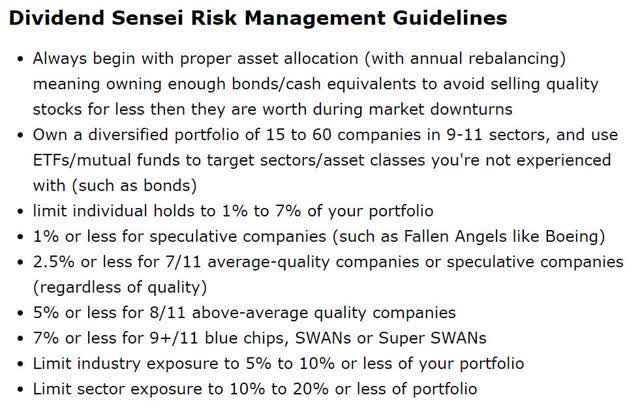

How To Construct A Bunker SWAN Portfolio Around BTI

The key to sleeping well at night is having a bunker portfolio with strong risk management that helps you avoid becoming a forced seller.

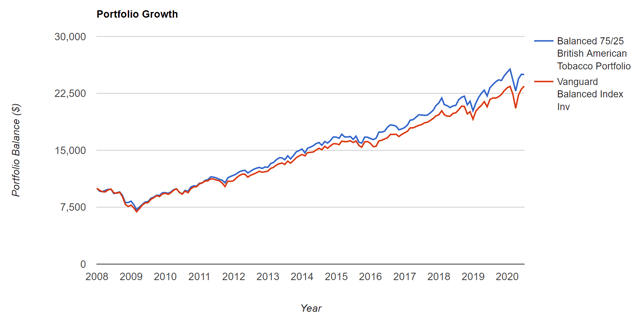

Let us show you what we mean through a prudently diversified and risk-managed portfolio example. It involves a 75/25 stock/bond allocation – “the new normal.”

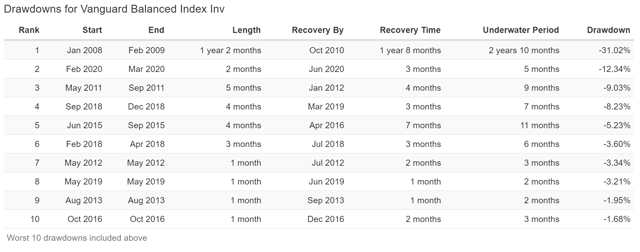

(Source: Portfolio Visualizer)

Here, we’ve used BIL as a proxy for cash, SPTL as a proxy for long-duration U.S. Treasuries, and VIG as a proxy for blue-chip dividend growth stocks. Though, today, we would use:

We’ve selected these ETFs purely because they existed before the Great Recession and thus allow us to stress test our risk management during the second-largest market crash in U.S. history.

While every downturn is different, it’s reasonable to assume that, if your risk management did well in the financial crisis, it will be able to stand up to any realistic economic/market crash.

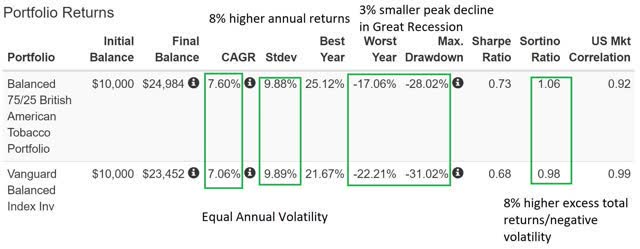

(Source: Portfolio Visualizer)

(Source: Portfolio Visualizer)

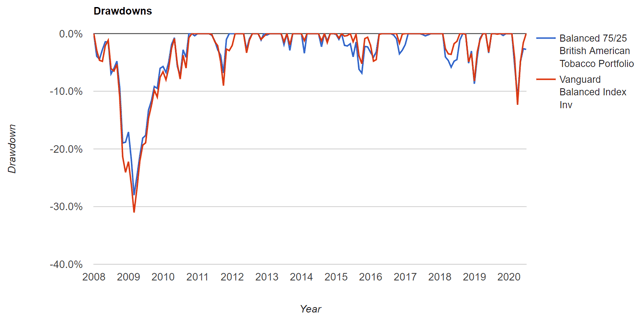

Despite being 7% in a stock that’s down 52% from its all-time highs – and can become extremely volatile at times – and being 15% more weighted toward equities, this 75/25 portfolio matched a 60/40 stock/bond portfolio for volatility over time:

- It fell 3% less in the Great Recession.

- It delivered 8% better annual returns.

- It delivered 8% better negative volatility-adjusted excess returns.

That’s in part because VIG is a blue-chip dividend growth ETF. And dividend stocks tend to have lower volatility than the average company.

Meanwhile, the S&P 500’s historical volatility is 15% CAGR. Then, again, it’s a collection of 500 companies whose average volatility on their own is about 15%.

Thus, we can safely construct a more stock-heavy portfolio without increased short-term volatility risk.

(Source: Portfolio Visualizer)

Despite being 15% more in stocks, this portfolio fell 1.3% less in the March crash. BTI, which is 7% of this portfolio, fell slightly more than the S&P 500.

And during the late 2018 correction, when stocks fell 19.8%, this portfolio fell 8.7%.

This is the power of diversification and prudent risk management. Portfolio construction historically determines 90% of total returns over time.

If you own any blue-chip within a SWAN portfolio, you can almost assuredly ride out any bear market, assuming you have proper asset allocation for your individual risk profile and needs.

There’s also a way to safely, profitably own BTI if your goal is to achieve merely decent returns with minimum volatility.

One way or the other though, well-diversified and prudently risk-managed portfolios aren’t hard to build. You just have to understand the basics of portfolio mechanics and what building blocks to use.

The Lowest Valuation In 18 Years Might Be A Great Time To Buy BTI

We can’t tell you when the market will stop hating British American Tobacco. We’re not market timers, after all, just a disciplined long-term, fundamental, and risk-management focused investor.

What we can tell you is there is no fundamentally justified reason that BTI should be trading at an 8.3 P/E right now.

- The company is NOT at high risk of insolvency.

- Regulatory/ESG risks are NOT significantly greater than they’ve been in recent years. They’re a lot lower in fact than during the Master Settlement period.

- BTI is NOT facing shrinking earnings or cash flow.

- The dividend is NOT at high risk of a cut.

- The growth prospects have NOT significantly declined relative to historical norms.

- Management has a prudent plan for delivering steady EPS, FCF, and dividend growth in the future.

- Management’s track record on the execution of that plan is good.

When a company’s price becomes so disconnected from fundamental reality, then the opportunity for unlocking incredible safe yield and value – even in this market bubble – is immense.

At least, it is for those who understand the basics of sound long-term income and value investing.

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

WHO PAID RENT? WHO CUT DIVIDENDS?

We just launched iREIT Earnings Headquarters:

- Revamped Dividend Cut Tracker

- Real-Time Rent Collection Tool

- Real Estate Earnings Calendar (with 200+ companies)

- Quick Take commentaries.

* Limited to first 100 new members * 2-week free trial * free REIT book *

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in BTI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

|

|

Leave a Reply

You must be logged in to post a comment.