I recently became the president of my homeowner’s association, where I now oversee around 40 houses. Between that and what I do for a living… it’s safe to say I follow local real estate.

We moved here around seven years ago, appreciating its growth prospects. And apparently we chose well. Last year, I had my house appraised at 15% higher than my buy price, translating into about 2.5% annual growth.

Yet there are still many new homes under construction across single-family and multi-family developments. There’s a new neighborhood across the street meant to hold more than 100 homes. And not far away is another apartment complex-in-the-making with more than 400 planned units.

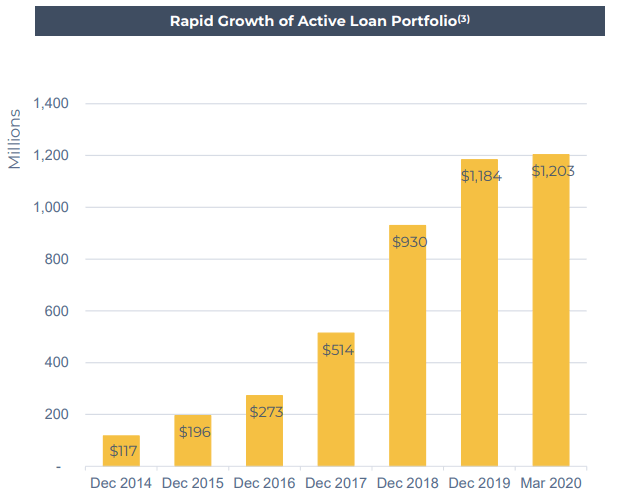

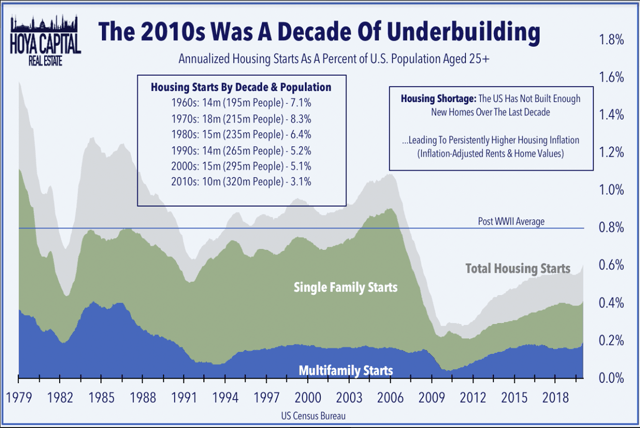

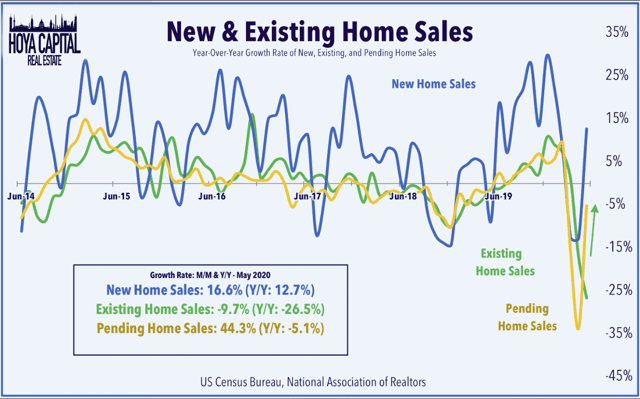

One particular home was recently finished and immediately went under contract, with good reason. Apparently, the U.S. hasn’t been building enough new houses:

Source: Hoya Capital Real Estate

This has led to:

- Home sales spiking

- New home sales rising 16% year-over-year as of May 2020

- Pending home sales increasing over 44% year-over-year

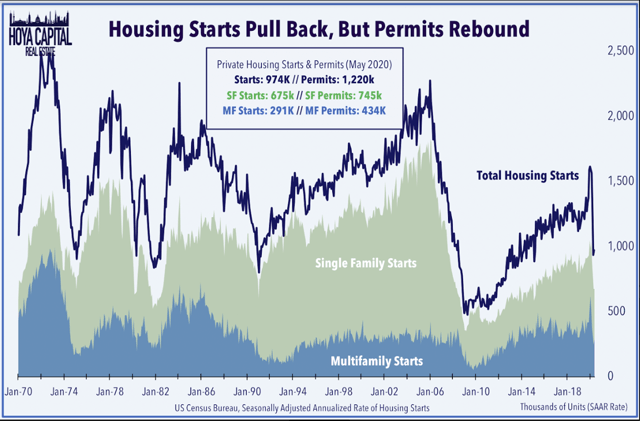

Source: Hoya Capital Real Estate

Although housing starts pulled back during COVID-19, new building permits have rebounded, signaling builder confidence is coming back.

Source: Hoya Capital Real Estate

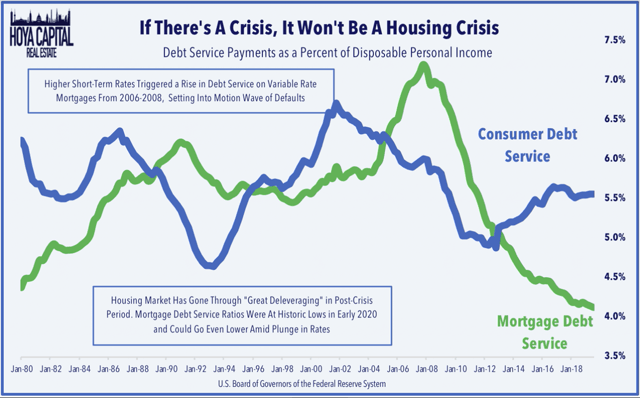

If there’s a crisis, it won’t be a housing one this time.

In 2006-2008, higher short-term rates prompted a push toward variable rate mortgages, eventually triggering waves of defaults. But the housing market has deleveraged significantly since, and mortgage debt service ratios were at historic lows in early 2020.

They could go lower still.

Source: Hoya Capital Real EstateThe Business Model

One way to play this housing boom is to own shares in Broadmark Realty (BRMK). It’s a new commercial mortgage REIT that began as a special purpose acquisition company, or SPAC.

I wrote about it back in September: How it was forming “a publicly-traded, internally-managed mortgage REIT with an expected equity value of $1.5 billion.” At the time, its pre-merged partner liked how it:

“… maintains a competitive advantage in the marketplace through its proven lending process and its proprietary network of borrowers and capital providers. It is a highly profitable lender that enjoys multiple avenues for sustained growth across existing and new markets.”

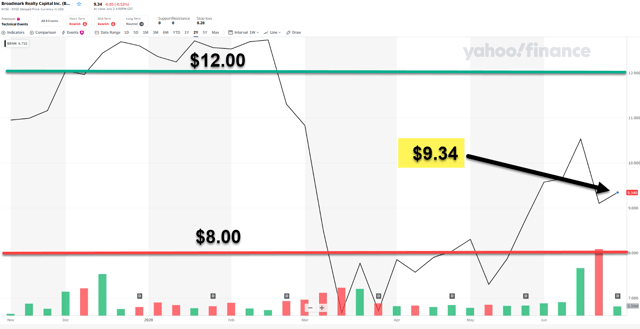

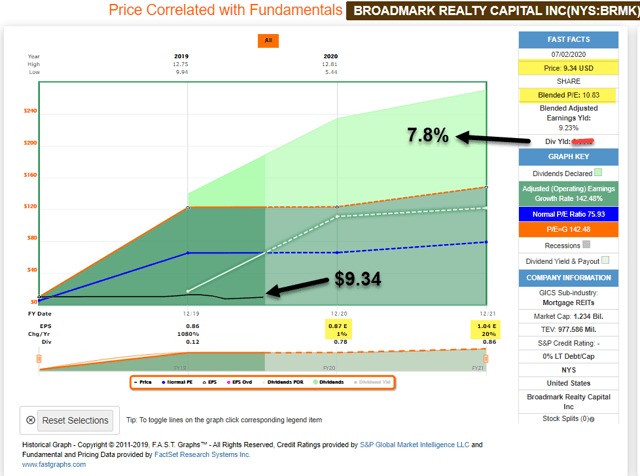

A snapshot of Broadmark’s share-price history shows it trading as high as $12, falling below $8 in the early shutdown stages, and now trading at $9.34.

Source: Yahoo Finance

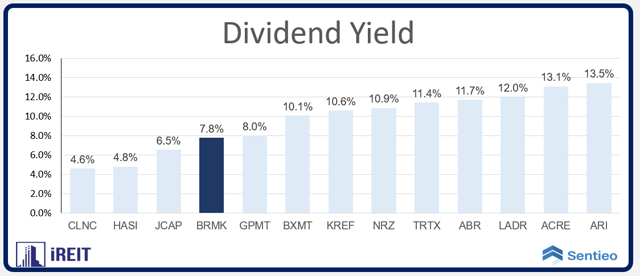

On April 13, the company declared a $0.06/share monthly dividend, down from its last payout of $0.08. The stock now yields 7.8% vs. the average commercial mREIT’s 9.7%.

But let’s explore Broadmark further anyway.

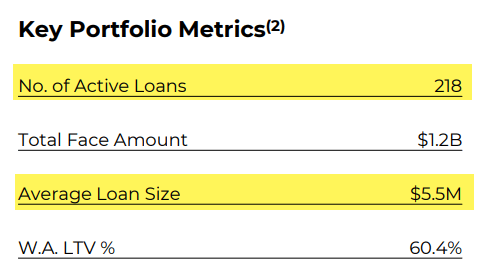

It’s originated approximately $2.4 billion in loans since formation, with a total outstanding loan balance of around $1.2 billion. That consists of 218 active loans in 13 states and D.C.

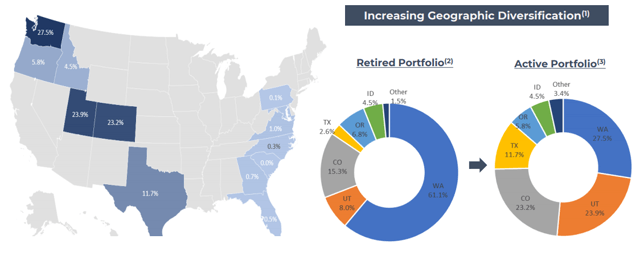

As viewed below, Broadmark targets states with favorable demographic trends and non-judicial foreclosure laws:

- Pacific Northwest – 37.8%

- Mountain West – 58.8%

- Southeast – 1.5%

- Mid-Atlantic – 1.9%.

Meanwhile, its portfolio consists of:

- Vertical Construction Loans – 70%

- Horizontal Development Loans – 18.9%

- Commercial/Other – 17.9%.

Or you can break it down by:

- For-Sale Residential – 34.5%

- For Rent Residential – 20.2%

- Horizontal Development – 18.9%

- Commercial/Other – 17.9%.

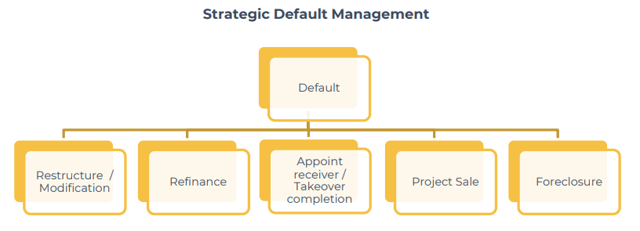

As of March 31, 32 loans were in default, representing 14.3% of total portfolio face value. Yet defaults allow BRMK to enforce its lender’s rights and provide greater control over the project and collateral.

Read on to see how…

Further Insights Into Broadmark’s Business

On its recent earnings call, Broadmark CEO Jeff Pyatt discussed these defaults, explaining how (emphasis added):

“Defaults are not an immediate or permanent loss of principle. This is not the same as a person defaulting on their car loan or their home mortgage, where the bank has to write it off, take a steep loss by seizing and reselling the asset.”

The builders BRMK lends to tend to be small with significant equity in their projects. And since it doesn’t lend above a 65% loan-to-value ratio, builders have to put a good chunk of capital.

Moreover, the company requires personal guarantees given to further incentivize its customers to hold up their ends of the bargain. As such, most defaults are resolved easily enough.

“Specifically, in the past three years, we have experienced 62 incidents of default and only 9% resulted in foreclosure. Funds going to default more often than not, they come out of default and Broadmark captures its principle, interest and penalties, just over a longer time horizon.

“… So a default for Broadmark is a way to engage proactively with our borrowers and work for the successful completion of a project… as long as it continues to satisfy our underwriting criteria, we would work with borrower.”

As Pyatt put it, “it’s just good business” that way.

“Our view is that if we can protect our capital now, while still maintaining our good relationships with borrowers, they will provide both near and longer-term solutions in the future.”

In other words, borrowers won’t forget who was willing to work with them and who wasn’t. It’s an attitude that’s worked well for it over the last 10 years, leading to about two thirds of its customers coming back for more.

Best-in-Class Balance Sheet

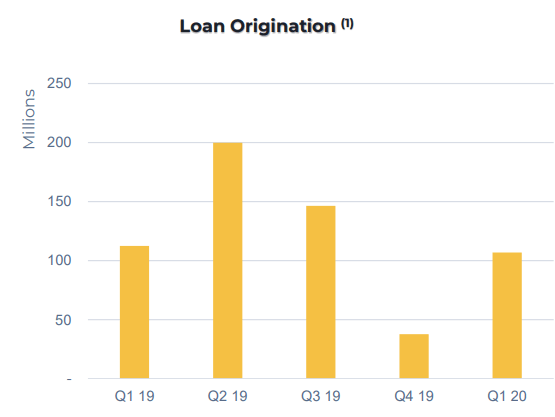

Broadmark has an industry-leading balance sheet with zero debt and strong liquidity that supports expanding into new markets. In Q1-20, it originated:

- 21 loans from…

- 8 states with a total face amount of…

- $107 million and a weighted average origination loan-to-value (LTV) ratio of…

- 61.5%.

On the earnings call, Pyatt explained:

“… we have not stopped originations. We continue to see ample opportunities to lend at attractive yields on high-quality collateral. And, most importantly, we have the liquidity to do so. Between March 31 and May 8, we’ve closed on four additional loans. And our pipeline remained significant, within a range of $200 million to $250 million.”

Broadmark currently has $258.4 million of cash on its balance sheet. As its CFO remarked:

“… our pipeline of opportunities currently exceeds our available capital. And we are looking for sources of capital to execute on strategic opportunities that has and continues to be presented to us.

“For longer-term capital efficiency and cash management, we continue to evaluate the most appropriate balance, which may include a modestly sized working capital credit facility…

“We would look to add an appropriately sized credit facility by the end of 2020, assuming market conditions remain conducive.”

He then stressed, “Again, we do not plan to run our business at a high level of leverage” (emphasis added). However, BRMK does want to be well positioned to use its capital as efficiently as possible.

There are too many “significant opportunities and dislocations” it’s “seeing in the market” right now. And it doesn’t want to miss them.

Show Me the Money

With the dividend now right-sized (thanks to COVID-19), Broadmark appears to be perfectly positioned to grow. In Q1-20, it generated:

- Generally accepted accounting principles (GAAP) net income of $0.21 per diluted common share

- Core Earnings of $0.21 per diluted common share.

As previously referenced, the new monthly dividend rate is $0.06 per share. That translates to a quarterly dividend of $0.18/share (85% payout ratio).

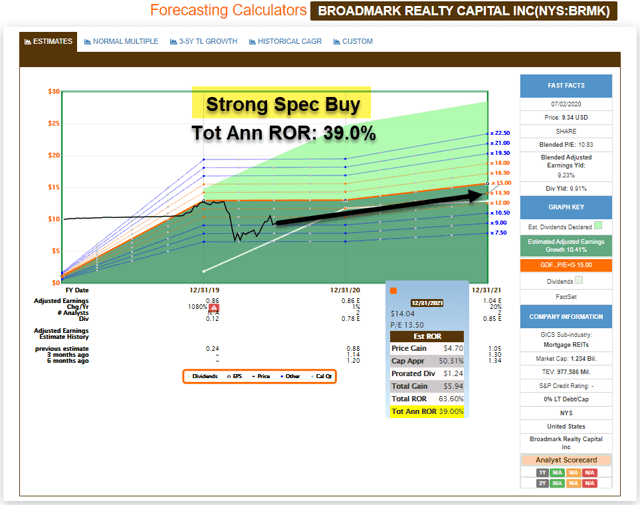

Notably, analysts forecast earnings per share of $0.87 in 2021 – $0.2175 per quarter – and 20% growth in 2021, or $1.04 EPS.

Source: FAST Graphs

Risks include:

- A slowdown in construction activity

- A reduction in residential sales and availability of take-out financing

- A longer recovery period for COVID-19

However, we also need to consider Broadmark’s:

- Strong balance sheet and liquidity position

- Vetted client list

- Experience in managing workouts and completion of projects

Here at iREIT on Alpha, we’re betting on the latter list beating out the former.

Besides, at the risk of being repetitive, I’m going to say it again anyway… If there’s going to be a crisis, it probably won’t be a housing one.

Not Just Holding. We’re Upgrading.

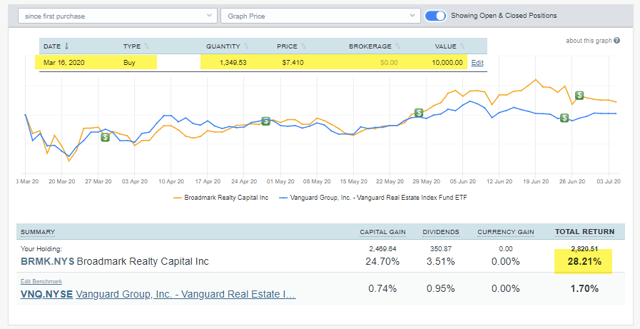

After assessing Broadmark the way we have, we’re upgrading it to a Strong Spec Buy.

Keep in mind that more than 1% of the Cash Is King Portfolio is in this position. At the same time, we’re positioned more defensively during this COVID-19 cycle and I must play the hand of caution.

As you know, we downgraded both prison REITs recently. Broadmark looks like an excellent replacement idea.

It’s no blue chip, mind you. But we do see significant upside, as its management team has deep experience in the sector. Most importantly, mortgage debt service ratios are at historic lows and could go even lower.

FAST Graphs

P.S. I’ll keep you informed about my experiences leading the neighborhood homeowners’ association. I’m sure it will give me plenty of things to write about in the weeks and months ahead.

P.P.S. The Cash Is King Portfolio is up 28.2% since March 16, including dividends.

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

The Most In-Depth REIT Coverage On The Planet

Investors need to remain disciplined with their investment process throughout the volatility. At iREIT on Alpha we offer unparalleled research. “There is great opportunity” to take advantage of the mispricing and to build a portfolio powered by repeatable sources of divided income.. subscribe to iREIT on Alpha (2-week free trial).

Disclosure: I am/we are long BRMK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

|

|

Leave a Reply

You must be logged in to post a comment.