Investment Thesis

Enbridge Inc. (ENB) is a leading operator of critical infrastructure supplying the vital energy needs of the North American economy. The liquids and natural gas pipelines, storage and transmission network owned by Enbridge comprise a set of irreplaceable, non-substitutable assets that generate cash flow on a long-term contracted basis. Enbridge is frequently in the news for project delays and regulatory challenges related to challenges arising from the company’s growth plans. These delays are largely transitory issues that do not materially affect the long-term viability of Enbridge’s core business operations.

While the company is currently working through challenges on Line 5, the critical nature of this infrastructure ensures that the current interruption will be limited. As the partial shutdown on Line 5 has captured headlines, Enbridge has made significant progress towards the completion of the much more significant Line 3 Replacement project; the largest capital undertaking in the company’s 71-year history.

Looking past the headlines, the long-term investment thesis for Enbridge remains intact. Investors with a long-term view should take advantage of Enbridge’s current share price weakness to capitalize on the company’s historically high dividend yield. At nearly 8%, the current dividend offers shareholders an opportunity for a robust total return from a company that has a 25-year record of growing its dividend.

Line 5 Updates

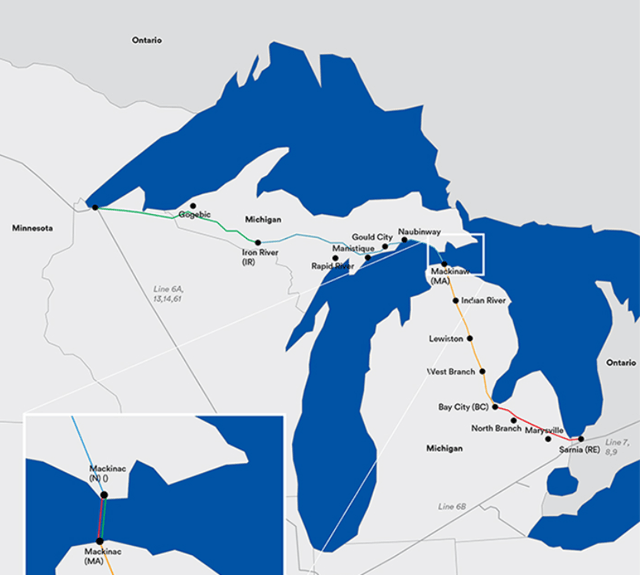

Enbridge’s Line 5 transports up to 540,000 bpd of light oil and natural gas liquids from Superior, Wisconsin, to Sarnia, Ontario. The 30” diameter pipeline supplies 55% of Michigan’s propane needs. At 645 miles in length, the Line 3 pipeline has been in operation for over 65 years without a leak.

Source: Enbridge

On June 25, 2020, Enbridge was ordered to shut down a section of its Line 5 pipeline in Michigan after it was discovered that a support brace for the underwater section of the pipeline had shifted. This section of pipeline built in 1953 spans the Straits of Mackinac for 4.5 miles between Lake Michigan and Lake Huron.

Source: Bloomberg

After a little more than a week, Enbridge was granted permission to partially restart the western pipeline out of concerns that supply interruption could threaten supplies. An inline inspection confirmed that there were no dents or instances of internal or external metal loss on the western leg. The eastern pipeline remains closed at this time pending an investigation from the Pipeline and Hazardous Materials Safety Administration.

Any news of court-ordered pipeline shutdowns is unnerving for investors following the July 6, 2020 court order to shut down the Dakota Access Pipeline after three years of operation. However, there are few similarities between the two shutdowns. Line 5 shutdown is an acute maintenance issue that will be addressed through repairs on a pipeline that is scheduled to be replaced shortly. The Dakota Access Pipeline, however, will require an additional environmental review due to permitting errors related to Army Corps of Engineers approvals.

Line 5 is a critical piece of infrastructure that supplies almost 2/3 of the propane to the Upper Peninsula and meets the energy needs of Northern Michigan. The pipeline also supplies regional refineries and much of Detroit’s aviation fuel needs. With no viable alternatives to transport such a significant quantity of energy daily, it is unlikely that Line 5 will remain partially closed for an extended period. Without significant investment in crude-by-rail or an alternative pipeline, Enbridge estimates that a shut down of Line 5 would result in an energy shortfall of 4.4-7.7M gallons a day of gas, diesel, jet fuel and propane in Michigan alone.

Where Line 5 terminates in Sarnia, Ontario, refineries have raised concerns that any supply disruption will result in higher fuel prices. Suncor Energy Inc. (SU), Royal Dutch Shell plc (RDS.A) (NYSE:RDS.B) and Imperial Oil Ltd. (IMO) all operate refineries in Ontario. Suncor and Shell suggested that shortfalls in refinery feedstock could be felt in as quickly as a week, whereas Imperial which operates 232,000 bpd of refining capacity in the region said in a statement that “Should Line 5 remain out of service for an extended period, into mid-July, production rates at our two refineries will be reduced”.

Line 5 has long been a target of politicians and environmental groups concerned about the potential of an oil spill in the Great Lakes. In 2017, Enbridge signed agreements with previous Michigan Governor Rick Snyder committing to a replacement of the pipeline with a US$500M tunnel drilled 100 ft. below the deepest part of the lakebed. Initial tunnel boring is scheduled to take place in late 2021, with testing and commissioning to occur in 2024.

According to Joe Gemino, Sr. Equity Analyst at Morningstar:

“It’s likely that the issue is resolved within a few weeks to months, and it shouldn’t have a material impact on the company’s financial results given that the Mainline system is running at reduced rates as a result of lower crude oil demand across North America.”

While Line 5 on its own only accounts for approximately 2% of Enbridge’s EBITDA, losses could be more significant in the event of a longer-term shutdown. According to Bloomberg, losses could reach 5% of EBITDA if the shutdown of Line 5 adds to bottlenecks in other parts of the Enbridge system.

Line 3 Updates

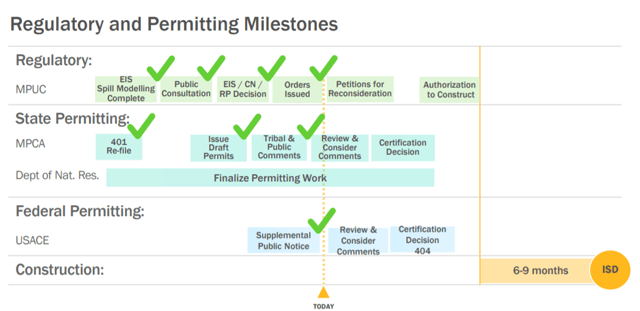

While the shutdown at Line 5 has been in the headlines, Enbridge has received positive news on its Line 3 Replacement project in Minnesota. When I last wrote about Line 3 in October 2019, the Minnesota Supreme Court had just denied further appeals on the project. Since that time, Enbridge has completed a new environmental impact study that has received approval by the MPUC (Minnesota Public Utilities Commission). The May 2020 decision by the MPUC recertifying the project represents the last significant regulatory hurdle for the U.S. portion of the Line 3 replacement project.

Source: Investor Presentation

With the Canadian and U.S. portions costing C$5B and US$3B, respectively, the 760,000 bpd project is the largest undertaking in Enbridge’s 71-year history. The Canadian portion of Line 3 entered service on December 1, 2019 with an interim surcharge of US$0.20 per barrel. Morningstar anticipates an in-service date near the end of 2021, while Robert Kwan, an analyst at RBC Capital Markets, has a “best-case scenario” target date of Q3 2021. While there is always a chance that there could be further delays, there is little doubt now that the project will be completed.

Accounting for roughly 38% of the current year’s capital allocation, the Line 3 Replacement project represents the lion’s share of Enbridge’s current C$10B capital plan. On Enbridge’s Q1, 2020 earnings call, EVP & CFO Colin Gruending emphasized the incremental cash flow anticipated from the Line 3 project and the 2020 capital plan:

“Importantly, we don’t anticipate any material impact to in-service dates, given the flexibility and contingency built into our project plans and prior guidance. Once in-service, the secured growth will add an incremental $2.5 billion of highly reliable cash flows and advance our strategic priorities. So execution pace is obviously still our objective.”

Resilience Throughout COVID-19

While not immune from COVID-19, Enbridge is exactly the kind of stock that investors can hold through a crisis with long-term confidence. Approximately 98% of EBITDA is buttressed by cost of service, long-term contracts or take-or-pay agreements. Enbridge has a diverse set of businesses that serve investment-grade counterparties. Gas transmission, distribution & storage are utility-like businesses that account for 41% of 2019 EBITDA. These businesses, along with Enbridge’s renewable energy division that contributes an additional 4% of EBITDA, are largely insulated from commodity price risk and the impact of COVID-19.

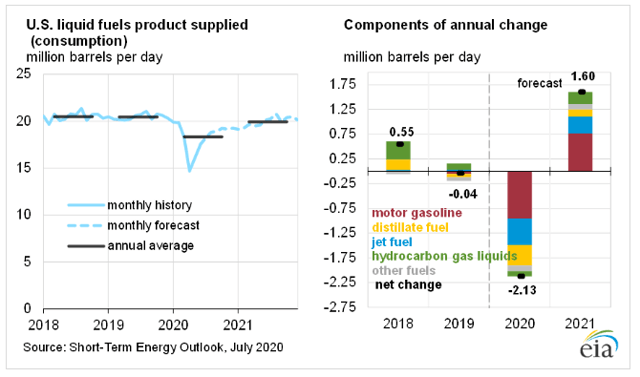

Enbridge’s liquids business accounts for 55% of EBITDA and principally serves refinery and integrated customers across North America. From January 20-April 20, North American jet fuel demand dropped by 60% while gasoline demand fell by 38%. Responsible for transporting 25% of North American crude and 20% of the natural gas consumed in the United States, Enbridge has expectantly seen a drop in transportation demand as a result of COVID-19 and recent oil price weakness. April deliveries on the mainline ranged from 70% of normal volume in Eastern Canada, to 76% in the U.S. Gulf Coast and 88% in Minnesota and Chicago. While this unprecedented drop in energy demand called for reduced transportation volumes, forecasts from the U.S. Energy Information Administration anticipate largely restored consumption in 2021.

Source: U.S. Energy Information Administration

Despite the reduction in volumes in the first few months of 2020, Enbridge has been able to reiterate its full-year guidance for 2020 based on strong performance across its business segments. The company has also reduced expenses by C$300M and expects to defer about C$1B from its capital plan due to delays caused by COVID-19. According to Enbridge CEO Al Monaco:

“Our full year financial performance will be impacted by the degree and pace of recovery of Mainline throughput. However, given the strength and stability of our broader business portfolio, and accounting for our current assessment of headwinds, tail winds and cost reduction actions, we continue to expect to generate DCF within our original guidance range of $4.50 to 4.80 per share.”

Dividend Yield

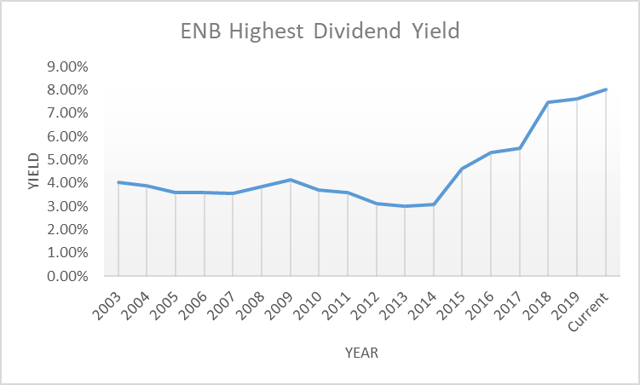

At current levels, Enbridge is offering investors a yield that has recently neared 8%. This surge in yield is chiefly the result of Enbridge’s share price falling nearly 30% over the past 5 months. These relatively low levels present an attractive entry point for investors with long-term time horizons. Compounding this price-driven jump in yield was a 9.8% increase to the firm’s quarterly dividend in early 2020 to C$0.81 per share. With a 5-year average yield of approximately 5%, the current dividend yield represents a 60% premium to the company’s historical levels. For investors seeking stable current income, Enbridge is trading at its most attractive level in recent memory.

Graph Source: Author, Data Source: Canadian Dividend All-Star List

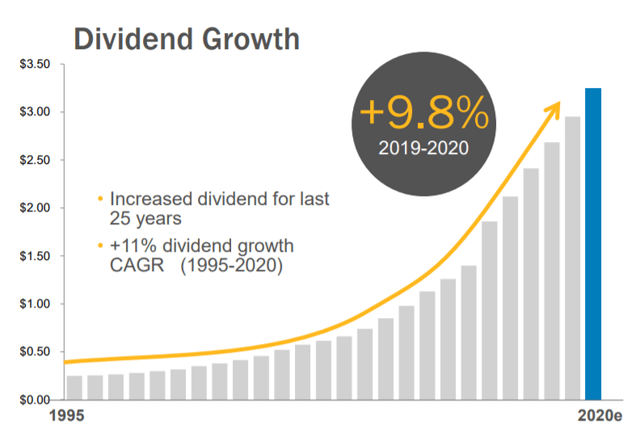

Dividend Growth

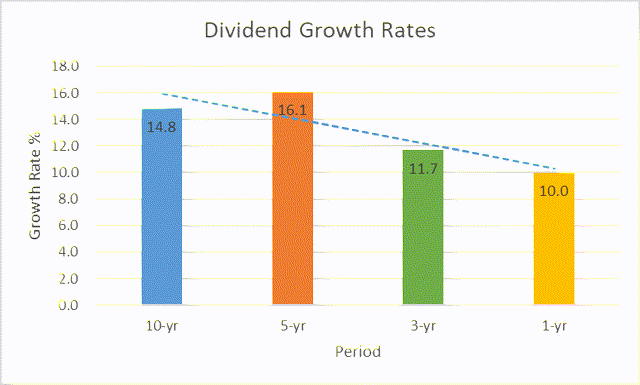

Enbridge has rewarded shareholders with 25 years of consecutive dividend growth. This incredible record saw average dividend payouts grow at an average annualized rate of 11% between 1995 and 2020. With decades of double-digit dividend growth, the firm’s payout ratio is now been stretched beyond the company’s target of 65% of DCF. Enbridge’s current annual payout of C$3.24 is at 72% of the company’s low-end guidance of C$4.50 in DCF.

Source: Investor Presentation

As Enbridge pursued major growth projects and debt-financed acquisitions in recent years, the company’s rate of dividend growth began to decelerate. The company is nearing the end of its commitment to grow its dividend 10% annually from 2018-2020. Beyond 2020, Enbridge has offered guidance that the company’s dividend increases will more closely follow DCF growth, currently projected at 5-7% annually. This more prudent level of dividend growth will enable the company to better position itself to self-fund capital projects. Enbridge plans to achieve about 1-2% DCF growth in 2020 through operational efficiencies and system optimizations, while rate-base growth and the C$10B in secured growth projects should add another 4-5% to DCF. Despite challenges stemming from COVID-19, Enbridge has been able to maintain its full-year DCF/share guidance of C$4.50-4.80.

Graph Source: Author, Data Source: Canadian Dividend All-Star List

Risk Analysis

While Enbridge’s earnings are relatively stable due to its highly contracted utility-like business model, shares of the company are subject to event-based volatility. Announcements regarding permitting challenges and construction delays can put pressure on Enbridge’s share price. Enbridge has minimal exposure to commodity price risk; however, as evident through the recent energy demand slowdown during the COVID-19 pandemic, the company is exposed to volumetric risk.

Enbridge’s key headwind to continued growth is regulatory risk. High profile projects including the Line 3 and Line 5 replacements have drawn the attention of activists and the scrutiny of regulators, leading to material project delays and lengthy legal battles. While large projects can stall, Enbridge has enough breadth across its portfolio of assets that the company can pursue many smaller projects that will continue to add incremental EBITDA. Excluding the Line 3 Replacement project, the average project size within Enbridge’s current capital plan is approximately C$420M. These relatively smaller projects are distributed across Enbridge’s business divisions and include less controversial natural gas utility and renewable projects. These project characteristics reduce overall execution risk for Enbridge while still adding meaningful cash flow growth.

Investor Takeaways

While many segments of the stock market have been impacted by COVID-19, Enbridge’s business model continues to be resilient. The company’s projects are commercially underpinned by long-term contracts or cost-of-service agreements. Approximately 98% of EBITDA is structured this way leaving very little of the company’s cash flow at risk.

Long-term investors can take advantage of Enbridge’s current share price softness to avail themselves of the company’s historically high dividend yield. At nearly 8%, the current dividend yield is a 60% premium to the company’s 5-year average and is supported by stable contracted cash flow. Positive developments on the Line 3 Replacement Project and the anticipation of a prompt resolution on the Line 5 partial shutdown, Enbridge has a clear path towards DCF growth and continued dividend increases.

Disclosure: I am/we are long ENB. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

|

|

Leave a Reply

You must be logged in to post a comment.