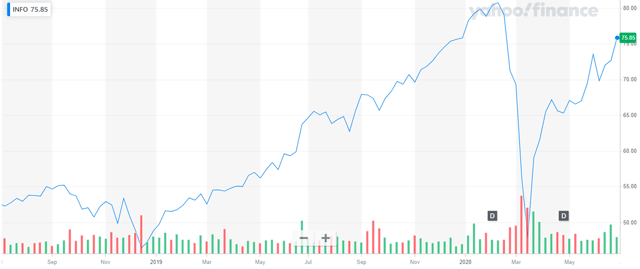

Consulting services player IHS Markit (INFO) is one of the few stocks in the market which has escaped the investor eye despite solid growth prospects. The company’s revenues for the second quarter ending May 31, 2020, were around $1.03 billion, a YoY decline of 9.59% and lower than the consensus by $22.0 million. However, IHS Markit’s second-quarter non-GAAP EPS of $0.69 managed to surpass consensus by $0.02.

Despite the mixed results, there is much to look forward to in this company. The demand for data and services related to pricing and valuation of indices, equities, and derivatives business has remained solid. Although the COVID-19 pandemic negatively affected the company’s sales in the enterprise solutions business, transportation business, and resources business, this trend is bound to revert as people gradually return to normal operations in the coming quarters.

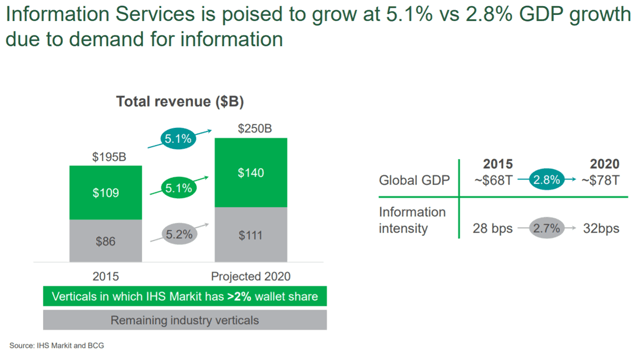

While there are some short-term headwinds, the pandemic has not caused any structural change in the business environment for the company. Data and insights will continue to be key drivers of the global economy. The company is all set to capture additional market share in this ever-growing market. Additionally, IHS Markit also stands to benefit from increasing information intensity or the rising financial worth of the information used. Based on its diversified business model and strong presence in the critical analytics and solutions business, IHS Markit is well-positioned to benefit from this secular tailwind. The company is just 0.66% up on YTD (year-to-date) basis and has much more upside left for 2020.

IHS Markit has built an economic moat in the data and research business

IHS Markit is a prominent player in the fast-growing information services segment.

We see that increasing demand for information, and an increase in information intensity will drive secular growth in this industry.

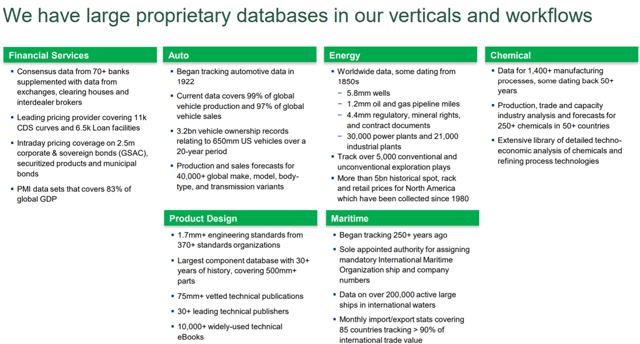

IHS Markit has created a strong economic moat in the data and research services business. The company’s extensive and high-quality database is its core asset and is the most important competitive advantage over other players in the industry. IHS Markit enjoys an enviable position in its target markets since it is extremely costly for competitors to create such a deep and broad database.

As seen above, this database contains financial data calibrated from more than 70 banks, exchanges, clearinghouses and dealers. Moreover, the database is also fed with 3 million quotes on a daily basis covering more than 10,000 CDS (credit default swap) curves which are collected from 3,800 CDS entities and all major credit indices. IHS Markit also provides mark-to-market pricing data for over 6,500 private loan facilities on a daily basis. The database also includes pricing data for over 2.5 million corporate and sovereign bonds and PMI data for over 40 economies worldwide. A major portion of this pricing data especially related to credit products and bonds involves significant technical complexity and is not easily available.

Besides financial data, IHS Markit also boasts of extensive data and insights related to vehicle registration and VIO (vehicle in operation). The database covers national monthly new vehicle registration data across 80 countries, covering 97% of global vehicle sales. The company also records analysis and forecasts for 90% VIOs in more than 45% of countries globally. This data is used by automotive OEMs, national sales companies, and dealers to develop and assess their strategies. IHS Markit’s database also includes records for almost all wells drilled and produced in the U.S. all the way back to 1859. Besides, the company has also recorded data for more than 739,000 international wells.

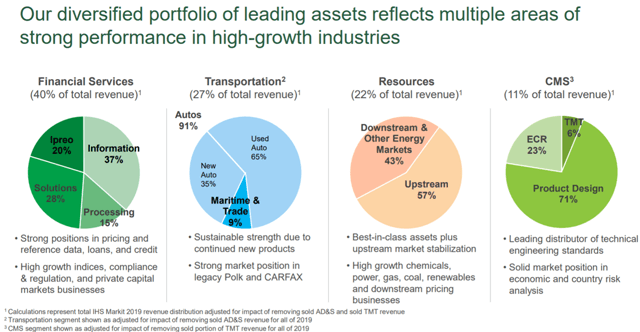

IHS Markit is not overly dependent on any single product or end market. The product mix is well-diversified and capable of sustaining any jolts in today’s uncertain environment.

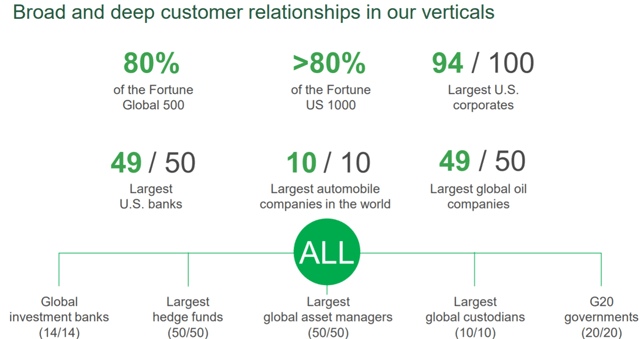

The company also has a diversified client base across areas such as financial services, transportation, natural resources, engineering, and product design. The commendable part here is that the company’s relationships run deep and include almost all key players in its target markets. IHS Markit’s deep penetration and broad reach is also a key competitive advantage.

The company enjoys significant revenue visibility

Investors are increasingly gravitating towards technology stocks with high revenue visibility in these times of heightened uncertainty. IHS Markit is also faring well on this criterion.

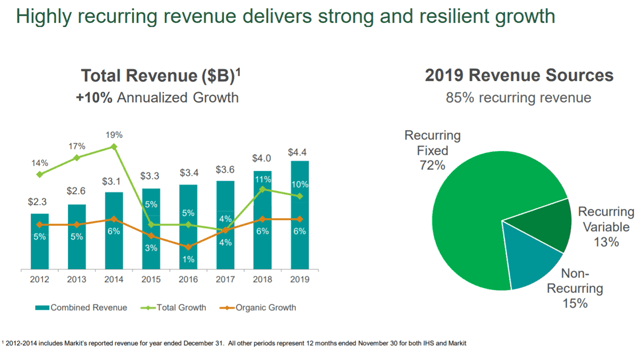

The company will also not require to take significant price cuts despite the ongoing recessionary environment. This is because almost 85% of its revenues are recurring, while 72% of its revenues are not only recurring but also flowing from fixed-price contracts. Hence, chances of extreme revenue volatility are significantly low even in the direst of circumstances. Additionally, the company does not have to spend significantly to acquire a major chunk of its revenues annually, which implies higher margins than otherwise asset-heavy companies.

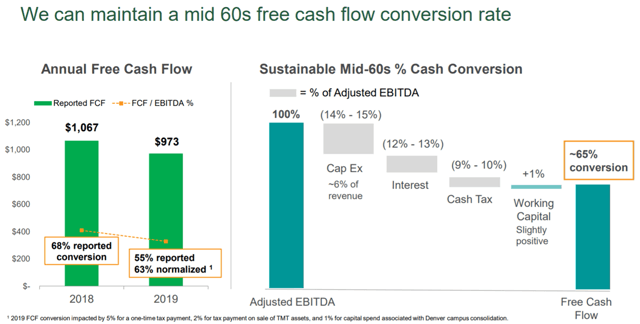

IHS Markit is a company with high operating leverage, which has translated not only in high margins but also a robust mid-60s free cash flow conversion rate.

Investors should consider these risks

Although IHS Markit is a company with solid fundamentals and a secular growth story, the company has not completely escaped the turmoil caused by the COVID-19 pandemic. In its second-quarter earnings call, the company revised downwards its overall guidance to better reflect the growth prospects in the current environment. The company may be forced to further reduce the guidance, in case the recession turns out to be lengthier and deeper than expected. Transportation businesses may get disproportionately affected by an exceptionally deep recession.

IHS Markit’s offerings geared towards events market have taken a beating as conferences had to be canceled during the pandemic. The three flagship events of CERAWeek, Chem Week, TPM have definitely been major branding exercises for the company. The upside here is that this business only accounts for about 1% of the revenues and hence is not materially significant for the company’s financial performance.

A bigger impact is being felt in the Resources business, where the pandemic has caused structural issues in the upstream oil & gas business. IHS Markit expects some of the customers to go out of business, while the company has itself provided price concessions to some players. In the worst-case scenario, the company expects these factors to have a maximum of -2% impact on the revenues of its resources business in 2021.

IHS Markit’s net debt of $5.4 billion seems a tad bit high considering that a gross leverage ratio is 3.0 times on bank covenant basis and 2.9 times net of cash. This is at the higher end of the company’s target leverage and is also slightly higher than what is normally seen for technology companies.

What price is right here?

According to finviz, the 12-month consensus target price for the company is $84.60. The company is currently trading at PE multiple of 38.42x, a forward PE of 24.00x, and PS multiple of 6.93x. These multiples seem low when we consider the valuations at which businesses with high revenue visibility such as SaaS (Software as a Service) stocks or payment industry players are trading today. I believe that the target price of $90 is a better reflection of this company’s growth potential in the next 12 months.

At end of May 31, 2020, IHS Markit had cash of $208 million and an untapped revolver worth $750 million on its balance sheet. The company’s free cash flow in the second quarter was $209 million. The company has also been consistently returning value to shareholders. The company’s dividend yield is 0.90%, while the company has completed share repurchases worth $852 million in 2020 YTD.

The majority of analysts feel optimistic about the company. On June 24, Baird analyst Jeffrey Meuler raised target price to $84 from $69 and reiterated Outperform rating. On June 24, Wells Fargo analyst William Warmington raised target price to $90 from $70 and reiterated an Overweight rating. On June 24, BMO Capital analyst Jeffrey Silber raised target price to $82 from $62 but kept Market Perform rating. On June 24, RBC Capital analyst Seth Weber raised target price to $90 from $84 and reiterated an Outperform rating. On June 24, SunTrust analyst Andrew Jeffrey raised target price to $87 from $65 and reiterated a Buy rating. On June 24, Barclays analyst Jeffrey Meuler raised target price to $85 from $70 and reiterated an Overweight rating. On June 24, UBS analyst Alex Kramm upgraded the company’s rating to Buy from Neutral and target price to $85, up from $63. On June 23, Stifel analyst Shlomo Rosenbaum upgraded the company to Buy from Hold and raised target price to $89, up from $61.

IHS Markit can prove to be a solid pick despite the ongoing pandemic, thanks to its high revenue visibility, well-diversified and asset-light business model, and solid niche offering. Hence, I believe retail investors with above-average risk appetite and investment horizon of at least one year should consider this stock for their portfolio in July 2020.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

|

|

Leave a Reply

You must be logged in to post a comment.