Municipal Market Overview

We have made no secret that the municipal bond sector is one of our favorites. It has been hard to feel confident in this space in the last couple of months due to both liquidity concerns at the outset and credit concerns more recently. Munis were hit by the thought that state finances would be in significant peril from the pandemic (and that may be).

The combination of these two risks pushed the ratio of AAA muni yields to Treasuries to highs rarely seen. That ratio is typically in the 80% – 90% range (reflecting the tax exemption) but had reached levels above 200%. But that spike has come back into line now as muni prices have caught a bid and Treasury rates have moved higher. The 10-year muni-to-treasury ratio recently stood at 100%.

Here’s some commentary from Raymond James:

The muni rally has officially come to a halt. On Friday MMD (the AAA yield curve) was cut on the long end for the first time in over a month with a cut of 5 basis points. Ratios are now sitting close to 100% of Treasuries. This sharp move by tax-exempts has pushed out crossover buyers and our generalist population. Traditional muni buyers are still involved but are losing some of their euphoria that we saw over the past few weeks. Demand outweighing supply and June/July redemptions will continue to support our markets.

The V-shaped recovery is now firmly what the market is trading on, as well as lingering supply issues.

Tax-exempt supply has been noticeably low as the corporate investment grade market, assisted by federal facilities, has prompted many municipal issuers to issue taxable bonds instead of tax-exempt — both for new money and advance and current refundings. Taxable issuance at 35% of total municipal issuance year-to-date has created scarcity in the tax-exempt space.

Hospitals, higher education issuers, convention centers, and airports are among the sectors facing the most pressure and challenges amid the COVID-19 crisis — from loss of revenue and additional costs due to new safety procedures to overall uncertainty — and will certainly contribute to the absence of tax-free issuance going forward.

While muni bond prices have rebounded sharply since the March depths, there’s still some value out there in muni CEFs. Ideally, we’d want to see double discounts available to us. That is, the underlying bonds trading at a discount to par and the closed-end fund itself at a discount to NAV. That can often be hard to find today outside of high yield, floating rate loans, and non-agency mortgages. In munis, the underlying bond is no longer at a discount to par but they are still below their pre-pandemic levels of mid February.

What about high yield munis?

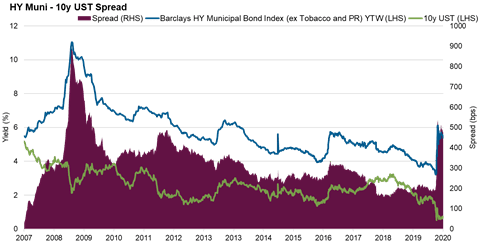

Many investors are focusing on quality, as I am. High-yield munis have been really hit hard as investors anticipate seeing a wave of muni defaults. That certainly is a possibility but looking less likely to me.

- Over an eight-week period beginning in early March, high-yield municipal bond funds saw record outflows, totaling nearly $15 billion and over 10% of the entire high yield muni fund complex.

- There has been negative news flow on high profile municipal projects as the economic impact of COVID-19 threatens more speculative issues.

- The extended period of outflows, negative news flow and related selling has driven yields higher for high-yield munis, a stark contrast from investment grade munis with short-term AAA munis currently experiencing record low yields.

- The result is spreads on high-yield munis are at the highest level seen relative to Treasuries, Investment Grade munis, and high-yield corporates (after-tax) in many years.

(Source: PIMCO)

(Source: PIMCO)

Where to Invest?

The last month has seen rapidly-rising muni CEF NAVs. During these periods, waiting for the discount-based timing flag to flip from HOLD to BUY can result in a higher purchase price. I continue to add to my muni positions though my purchases have slowed dramatically in the last two weeks as prices got away from me. However Thursday’s “reset” should bring some relief.

We have revamped the Muni Core portfolio tab, breaking it down into better-defined groupings to help members categorize their options.

- National Buy-and-Hold: The top conviction funds. These funds “check every box,” but can get expensive.

- National Buy-and-Hold (alternatives): Funds to consider if the top conviction funds are too expensive or if you want to compliment them with more diversity. Caution: Some may have much lower trading volumes.

- National Opportunistic (Recent Distribution Increase): These funds are generally selling around their 52-week average discounts but have recently raised their distribution, possibly leading to capital gains. These are funds that also are strong fundamentally but have some flaws (like semi-annual reporting). Muni CEFs must distribute virtually all of their income by year-end, so it wouldn’t surprise us to see some of these funds cut the distribution back at a future date.

- National Opportunistic (Wide Discount): These are funds that have many (but not all) of the characteristics we seek but also are trading at an anomalous discount to their NAV.

- National Low IG Choices (high yield): These are funds with higher amounts of non-investment grade holdings. With munis, much of the non-IG portfolio is unrated. This opens the door for active managers to identify mispriced securities and generate excess returns.

- Single State Buy-and-Hold: Top conviction funds that are state specific. Highest priority given to the fundamentals as opposed to requiring every state to be represented.

- Single State Alternatives: Other single state choices that exhibit good fundamentals.

- Term Trusts: Funds that are structured to liquidate at a certain point in the future at NAV. This feature tends to prevent wider discounts. Distribution yields tend to be lower than perpetual funds because of shorter maturity holdings. And fund payouts tend to drop as liquidation approaches.

- No / Low Leverage: These are our preferred muni CEFs that employ little or no leverage.

- Open-End Mutual Funds: These are options in the mutual fund space. Be careful of loads and transaction fees. This section is still under review.

For CEFs, leverage costs have plummeted, especially since March. The SIFMA index is down to 11 bps, the lowest level in more than five years. A year ago, the index, which is a benchmark for muni CEF leverage costs, was at 1.4%. That’s a 92% reduction in interest expense, and a nice boost to the earning power of the fund.

(Source: Raymond James)

CEF Research

Here’s a condensed recap of our thesis on why we selected many of the funds we did on the muni core tab.

National Buy-and-Hold (incl. alternatives)

BNY Mellon Muni Bond Infrastructure (DMB): A relatively new fund with very strong performance since inception (2013). Very low redemption exposure with just 9% of the portfolio callable over the next two years and only 3.8% maturing in the next five years. 30% of the portfolio is non-investment grade. Duration of 8.6 years (on the low side) and a weighted average dollar price of $94.70. Double discount!

Mainstay MacKay Shields DefTerm Muni Opps (MMD): Another relatively new fund (2012) characterized by distribution stability and exceptional portfolio management. The fund ranks first out of 72 in NAV total return over the last five years, assuming reinvested dividends. It’s No. 1 assuming cash dividends as well. 18% of the portfolio is in Puerto Rico, but the vast majority of that is insured. The high near-term call exposure reflects the fact that the fund’s high-coupon PR debt cannot be refinanced at present.

Overall, we continue to favor the Blackrock funds over most other fund families. Their results were very strong in May. Half of the national muni funds took distribution increases, and about half had double-digit percentage monthly increases in UNII.

We have six national muni conviction funds: (MQY), (BBK), (MQT), (BKN), (MEN) and MUH. (The latter two are listed as alternatives but all six are best discussed together). Unless there’s something troublesome lurking in their portfolios, there are simply no concerns with any of them. They all score at or near the top using our methodology which values yield, discount, coverage, UNII balance and trend, and estimated two-year redemption exposure. Ranking them is always a challenge because we are doing so on a relative basis vs. other strong Blackrock funds. For example, MEN and MUH get “downgraded” a tad for coverage even though the latest figures are over 100%. That’s because the Blackrock cohort is so strong that 100% coverage puts you in the lower third of the family.

Our favorite Blackrock funds have UNII balances and call exposures that rivals like PIMCO, Nuveen or Invesco would kill for! As in previous months, based on our scoring, my next Blackrock muni dollar would probably go to BBK: Strong 115% coverage, almost 9 cents of UNII and growing fast, 4.9% tax-free yield and wide -7% discount. Plus the increase in distribution announced on June 1 is an added vote of confidence. This month, however, one could arguably make the case for MQT as the top dog. (MQY’s narrower discount sets it apart.)

The other “alternative” fund I really like and have been buying is MFS IG Municipal (CXH). At a -10% discount, the shares are about a point below their one-year average discount, have a 4.8% distribution yield, and coverage at 96.6% with UNII at a very strong 7.1 cents. Remember that the MFS funds adjust their dividends monthly to match the fund’s performance.

National Opportunistic (Recent Distribution Increases)

With May’s strong results, and the announcement of distribution increases, three other Blackrock funds improved enough to warrant inclusion: BFK, MFT and MUI. On virtually every measure we track, these funds match our top Blackrock picks listed above, but have a bit higher redemption exposure. However we don’t see that as a concern given their high levels of UNII and the fact that Blackrock just raised the payouts. One thing to note is that MUI is an intermediate duration fund. Whereas all the other Blackrock funds sport durations in the 13-14 year range, MUI is 9.

Also in this grouping are the familiar large and liquid NAD and NEA funds from Nuveen. We highlighted Nuveen funds about two weeks ago in “Nuveen Monthly Fundamental Update | UNII Report for April 2020.” Our concluding thoughts there were:

“Overall, nothing too compelling here. NEA is the best fund option even though it only has 91% coverage and marginally positive UNII. For now, we will keep NEA, NAD (and NMZ) on the list as they check off everything on our checklist to make it a conviction fund. However, when compared to other conviction funds, they are definitely less compelling. I still hold a decent-sized position in NEA and see no reason to sell. But my marginal dollar is being invested elsewhere. Especially in the Blackrock choices on our list.”

I still own a decently large position in NEA and have not sold any shares and will not unless valuations gets frothy.

Two Eaton Vance funds are in this category, EIM and EVN, having raised their payouts recently. Both sell at or near double-digit discounts. Over the last year, these are two of the strongest NAV performers in the muni category. As measured by NAV total return, arguably the single best metric for evaluating a CEF portfolio manager, EVN ranked fifth of out 72 funds over the last 12 months, which helped pull its 5 year ranking up to No. 2, behind only MMD. EIM is the No. 1 fund out of 72 funds on NAV total return over the last 52 weeks, but only No. 14 when measured using share price. We are hoping the market recognizes the disparity and closes the gap.

Alliance Bernstein’s national muni fund AFB will be unfamiliar to most subscribers. We have generally dismissed it out of hand because it’s a semi-annual reporter that does not break out call exposure. The fund makes the list because of the recently declared massive 16% distribution increase. The fund is 97% IG, very low duration for a muni CEF, and sells at a double-digit discount.

Finally, Amundi Pioneer’s MAV gets a mention because of its recent 13% distribution hike and deep double-digit discount. Similar to AFB, it’s a semi-annual reporter that does not break out call exposure by year. It also has a low duration but unlike AFB it holds 30% lower rated and unrated bonds. We would view this as a short-term, opportunistic hold only.

National Opportunistic (Wide Discount)

One fund met our criteria for this category, BNY Mellon Strategic Muni Bond (DSM). DSM’s current discount exceeds -8%, well above its 52-week average discount of just -3%. Like its sister fund DMB, it’s a semi-annual reporter that publishes a quarterly fact sheet. We believe the 5% distribution yield should be enough to attract investors to close the discount. NAV growth has been strong over the last month but share price has lagged. Investors should be aware that the call exposure over the next 18 months is higher than we’d like, however the fund trimmed the payout toward the end of 2019 with that in mind. The fund shows zero pre-refunded bonds so redemptions from maturities should be minimal. We would view this as a short term, opportunistic hold only.

National Low IG Choices

Readers will recognize all of the funds in this category. They have all been on the conviction list for a long time. We decided it would be prudent to more clearly segregate those that are more skewed on the HY/IG spectrum. As a category, high-yield munis have been slower to recover from March’s market dislocation. Funds in this category are generally still showing double-digit declines YTD (through May 31) in terms of total return. This is in sharp contrast to the heavy IG funds which, at least prior to Thursday’s sell-off, are getting closer to breakeven.

None of the Invesco national muni funds have looked particularly appealing for a very long time, outside of Invesco Muni Income Opps (OIA), and that one looks less and less healthy as time passes. Coverage fell to 94.1% in April on a rolling basis, with UNII slightly negative and declining very slowly. At only 32%, OIA has always been the lowest IG fund, not just among our picks but among all 150-plus national and state muni CEFs. (This claim to fame was recently bested by Nuveen’s newest junk fund NMCO at 30% IG). All of the other national Invesco muni funds have been utilizing ROC with coverage ratios in the low 90s and large negative UNII balances – we wouldn’t touch them.

The MFS funds are my second favorite family after Blackrock at the moment and probably the funds I’ve been buying the most of recently. The funds are trading at nice discounts compared to the averages. Our most recent discount model identified MFS Municipal Income (MFM) as the single “cheapest” national fund, calculating that the discount should be a full five points tighter.

For those with a positive forward view on high-yield munis (which I do have, although Commish less so), you could also look at MFS High Income Muni (CXE). This is a roughly 68/32 blend fund (68% investment grade, 32% non-investment grade) that has now raised twice in two months from $0.0165 to $0.021. Yield is approximately 5.50%. The discount is -7.3% which is almost four points below its 52 week average. It hasn’t fully recovered from the cut they took in April. Now that the payout has been completely restored, we think the discount could close again.

Single-State Buy-and-Hold

Readers will recognize two of the Blackrock state-specific conviction funds:

- Blackrock MuniHoldings NJ Quality (MUJ) pushed back over 97% coverage in April, and the high UNII balance eroded less than 4%

- Blackrock NY Muni Income II (BFY): 106% coverage and the most UNII (10 cents/share) of any non-term-trust Blackrock fund

Given BFY’s strong fundamentals and its 5% yield, we are no longer recommending BNY as an alternative.

BlackRock MuniHoldings CA Quality Fund (MUC) is our California choice. After a very long string of months with coverage over 100%, it fell to the mid 90s during the recent market dislocation. But virtually no UNII was consumed and the reserve bucket was a full 5 cents/share as of the end of April. A double-digit discount and an approximately 4.4% double-tax-free yield to CA residents makes MUC very attractive at present.

We have also added BlackRock MuniYield Arizona (MZA) based on strong fundamentals: Plenty of UNII, solid coverage and very low redemption exposure. Buyers need to be aware that this fund is very thinly traded.

All four of these Blackrock state picks raised their distribution on June 1.

We also continue to recommend high-yielding Invesco PA Value Muni (VPV) even though it reported a very small amount of ROC last month. Coverage is 98.8% on a rolling basis with UNII flat at +2.6 cents.

We have dropped PYN and NUM from the recommended list.

Term Trusts

We have added two high performing term trusts to the Google sheet. First is the Eaton Vance Municipal Income 2028 Term Trust (ETX). Like MMD and DMB, ETX is a relatively new fund which means that it will continue to benefit from any newly-issued municipal bonds purchased at the IPO that still have call protection today. Sure enough, the call exposure is listed as 2% for the remainder of 2020, 0% in 2021 and just 5% in 2022. Investment grade holdings are 82% of the portfolio and duration is just 6.5 years. The monthly distribution has been constant since the fund’s inception in 2013, save for this past April which saw a one-month cut that was quickly restored. We like the fund any time you can get a -3% discount or wider. Investors will receive NAV at liquidation. One issue challenging ETX (and almost all muni funds for that matter) is their holdings of senior living / life care bonds which have been hit hard by the pandemic. It was 10% of ETX’s portfolio at the end of March and we expect management here and elsewhere to minimize the impact.

Also added is the Blackrock Municipal 2030 Target Term Trust (BTT). BTT has actually been our highest scoring Blackrock fund for some time, but has never been considered for a conviction pick due to its “low 3% yield.” The fund sets the benchmark for coverage (123%), a large UNII balance (over 9 cents/share) that’s growing at double-digit percentages by the month, and an estimated ultra-low two-year redemption exposure of under 10%. IPO’d about six months before ETX, the concept of a maturing CEF is the same but there are some notable differences.

First, BTT is targeting to return $25.00/share by Dec.31, 2030. Having a target NAV value usually leads to distribution cuts late in the fund’s life if NAV is coming up short. On the contrary, if NAV exceeds $25.00, the investor gets the benefit. Second, Blackrock already has established a pattern of reducing the monthly payments on a regular basis. The initial distribution rate at the IPO has been reduced four times since 2012, and is now down about 37% from the start. Current yield is still above 3% however. For those who value the benefits of a target term trust, we like the shares at a -6.5% discount or wider.

No / Low Leverage

There are approximately a dozen national muni CEFs that do not use leverage. For a long time Western Asset Municipal High Income (MHF) was our choice. Although the 4% yield is remarkably high for a non-leveraged fund, we’ve been a bit disappointed in total return performance, especially in down years. So we went looking for a second option. In our normal monthly review of all the Nuveen funds, we realized that our single highest-ranked national fund, Nuveen Select Tax-Free Income Portfolio 3 (NXR), might be a better choice than MHF despite its lower yield.

However, readers need to realize this is a muni fund managed for total return not maximum yield. It has benefited from being heavy in tax-penal California (25%) and zero-coupon (38%) bonds. That formula has worked well over the last one-, three- and five-year periods. Total return has ranged 6%-7% annualized; that’s exceptional. As long as interest rates stay low, we expect the fund’s NAV and share price to maintain strength.

There’s certainly no rush to sell MHF. NAV growth has been good the last month, distributions were announced as unchanged through Sept. 1, and there are 3-4 points of discount closure opportunity to pick up just to get back to the annual average of -6%.

PIMCO

PIMCO funds, which tend to exhibit more volatility, also tend to be the top performers thanks to the company running leverage much hotter. We covered the PIMCO muni CEFs in our update on all of PIMCO in “PIMCO UNII Report April 2020 | Nothing To Worry About.”

We would be trimming/selling PIMCO muni CEFs in favor of other holdings on our conviction lists. We can rebuy funds after they trim the distribution and investors sell off the shares.

Concluding Thoughts

We have updated the buy under and sell over thresholds based on the new NAV yields and all the distribution changes since June 1. That should help direct members to the most prized funds at the best values. Right now, we would be focused on the Blackrock and MFS funds along with DMB and MMD (in that top section).

We still like the muni space but do think the easier money has been made. If interest rates continue higher, the free pass that munis have received is unlikely to be sustained as the muni-to-Treasury ratio is closer to being in-line with long-term averages.

Our Yield Hunting marketplace service is currently offering, for a limited time only, free trials and 20% off the introductory rate.

Our member community is fairly unique focused primarily on constructing portfolios geared towards income. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today. We also have expert guidance on individual preferred stocks, ETFs, and mutual funds.

Check out our Five-Star member reviews.

Disclosure: I am/we are long MUNI CORE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

|

|

Leave a Reply

You must be logged in to post a comment.