NextEra Energy (NEE) is one of the world’s leading energy companies. It currently operates some of the most impressive utilities and power companies. In fact, NextEra Energy operates one of the largest utilities in FPL (Florida Power & Light) and one of the largest renewable power companies in NextEra Energy Resources. While the coronavirus has negatively impacted NextEra Energy, the company is still very well-positioned over the long term.

NextEra Energy reported lukewarm results in its latest quarter, beating non-GAAP EPS estimates but missing revenue estimates. Despite these underwhelming results, it is one of the most promising energy companies. The company’s core regulated utility business will provide stability and predictability, whereas its renewable energy business will drive long-term growth.

Investing in Renewables

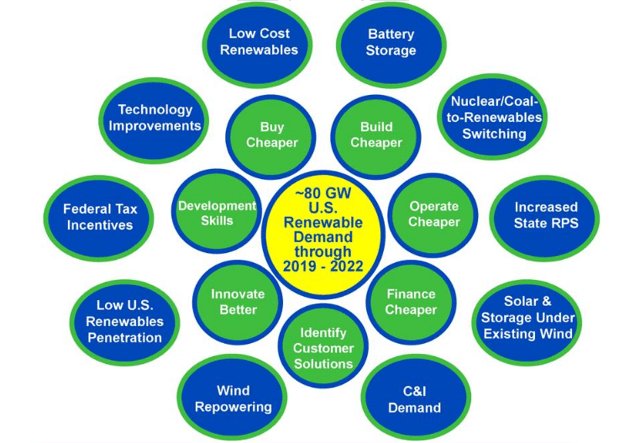

There is arguably no other major energy company as committed to renewables as NextEra Energy. Given how rapidly the energy industry is transitioning towards renewables, NextEra Energy’s growing focus on this emerging energy sector makes sense. The company appears to be doubling down on renewables as its long-term growth engine.

NextEra Energy’s Energy Resources subsidiary is now one of the largest clean energy companies in North America. Energy Resources has 24 GW of generation, 19 GW of which comes from wind and solar. More impressively, it already has 13 GW of renewables in its backlog. Energy Resources has more renewable assets than even some of the largest renewable pure plays.

NextEra Energy is also one of the largest energy storage companies in the world with an energy storage capacity of 140 MW. Energy storage pairs particularly well with solar and wind.

Source: NextEra Energy

With the LCOE (levelized cost of electricity) for wind and solar declining at such a fast pace, the company’s mix of wind and solar will likely only grow moving forward. To gain some perspective on how fast wind and solar costs are falling, the LCOE of wind and solar was $55-65 and $140-150, respectively, in 2010. These figures are now expected to drop to $10-15 and $25-35 for wind and solar respectively in 2020.

While NextEra Energy has a clear interest in renewables, the company is still heavily invested in more traditional utilities. In fact, its principal subsidiary, FPL, is Florida’s largest electric utility and services ~5 million customers. Despite the coronavirus-related issues plaguing Florida’s tourism industry, NextEra Energy is relatively shielded from these issues given FPL’s relatively low exposure to the industry. Moreover, Florida’s population is booming, which puts FPL in a great position long term as a result of increased electricity usage.

Energy Resources is one of the largest renewable energy companies in the world and has plans to expand significantly in the coming years.

Source: NextEra Energy

Aggressive Approach Could Backfire

NextEra Energy’s more aggressive growth approach has worked wonders for the company so far. This diversified energy company has been one of the best performers in the industry for many years now. However, this approach is particularly risky in the current environment. Given the unpredictability of the coronavirus, a high-growth strategy could backfire.

NextEra Energy is pouring billions of dollars into emerging energy technologies like wind, solar, and even battery storage. While this makes NextEra Energy stand out, especially among more traditional utilities, it also adds an element of risk to the company. Technologies like wind, solar, and batteries are still relatively immature compared to more established energy technologies.

NextEra Energy does have a strong balance sheet, which should allow the company to take a greater degree of risk. In fact, it has a net liquidity position of ~$12 billion. The company’s track record of strong revenue growth and healthy financials should allay investor fears to some degree.

NextEra Energy’s aggressive approach has worked out well for shareholder so far. The company has experienced an adjusted earnings per share CAGR of 8.4% over the past 15 years.

Source: NextEra Energy

Conclusion

The power industry is undergoing dramatic changes with the emergence of new promising energy technologies. NextEra Energy is taking full advantage of this changing landscape by investing heavily into these new technologies. However, this strategy is made riskier by the presence of a global pandemic.

At NextEra Energy’s current market capitalization of $120 billion and forward P/E ratio of 27, it is clearly not valued like traditional utilities. Despite the company’s relatively high valuation, it still has more upside in the long term. NextEra Energy is one of the most innovative power companies in a rapidly shifting industry.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

|

|

Leave a Reply

You must be logged in to post a comment.