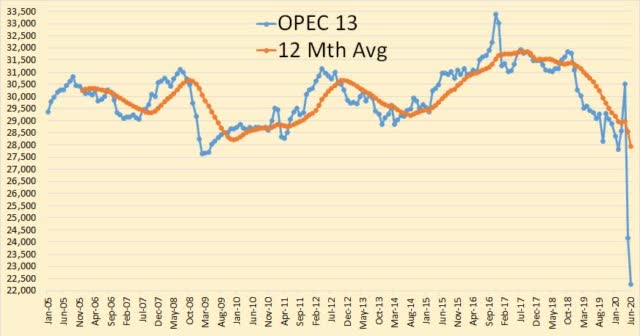

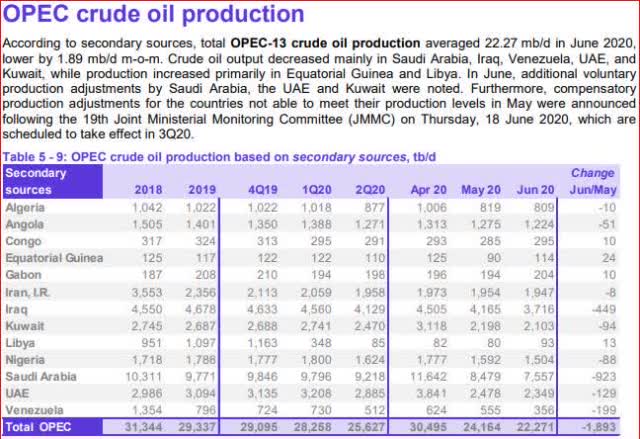

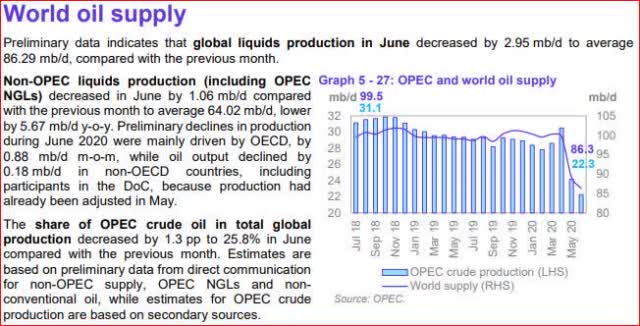

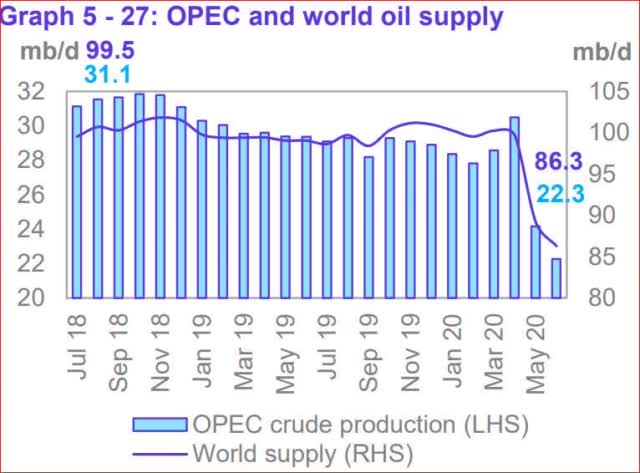

All OPEC data below is from the July 2020 OPEC Monthly Oil Market Report.

All OPEC data is through June 2020 and is in thousand barrels per day. All copied and pasted texts are in italics.

OPEC cut further in June, down almost 1.2 million barrels per day. They are down about 6.8 million barrels per day since November 2019.

All OPEC major producers cut production in June. The tiny producers didn’t seem to bother.

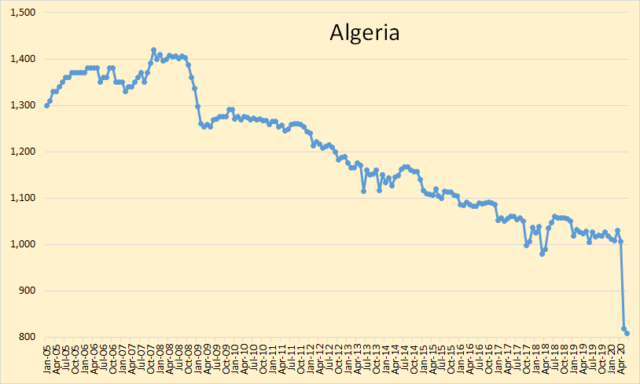

Algeria has cut about 200 Kb/d over the last two months.

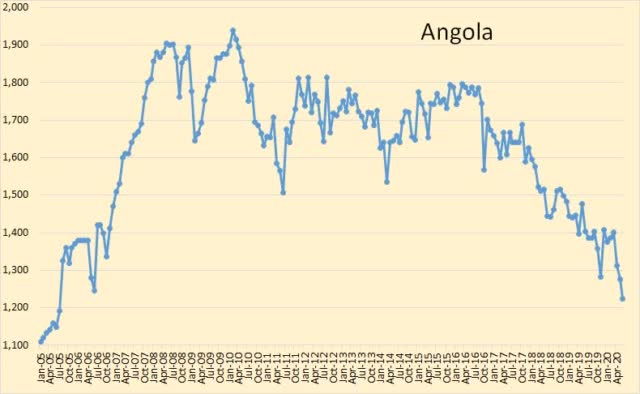

It’s hard to tell whether Angola is cutting or just declining further.

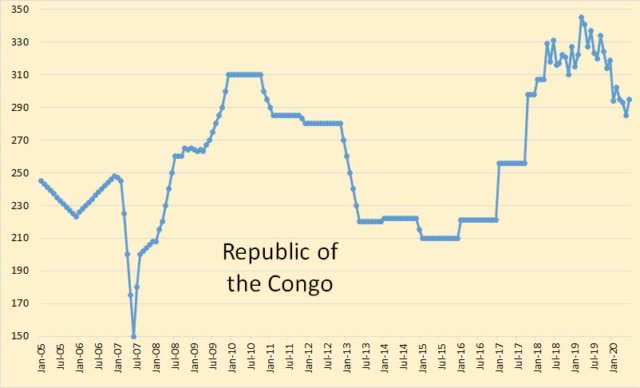

Nothing much is happening, oil-wise, in the Republic of the Congo.

Ditto for Equatorial Guinea.

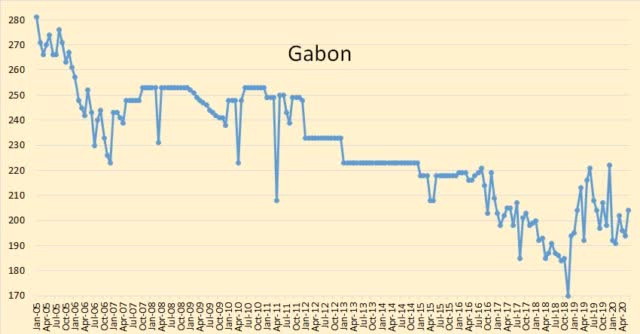

Ditto again for Gabon.

Iran is still suffering under sanctions. They say all their storage is now full and has been for some time. They now have a lot of wells shut down. It will likely take them about a year to ramp completely up when sanctions are lifted.

Iraq finally got the riot act read to them by Saudi Arabia. They are down almost 800 kb/d over the last two months.

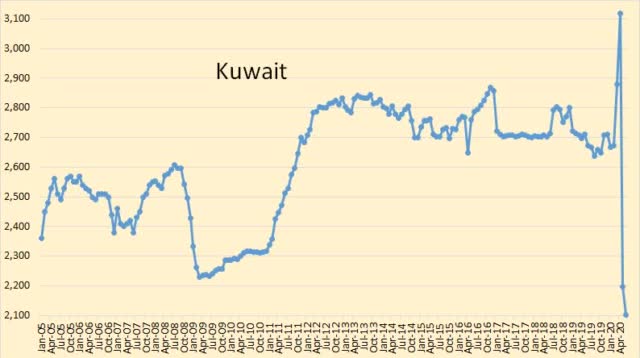

Kuwait cut a bit further in June, down 94 Kb/d in June.

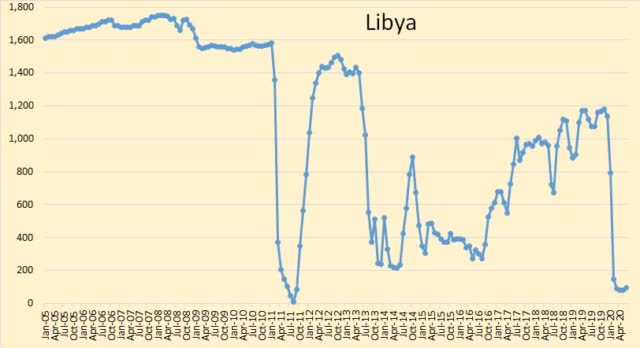

Libya says the blockade is over but the rebels say it is not. Their production will likely be up slightly in July but they are not going to increase production very much any way soon.

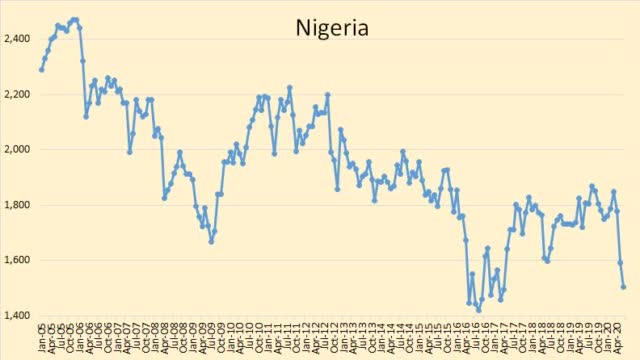

Nigeria appears to be doing their fair share of cutting.

Saudi has cut more than two million bpd off their average of the recent past.

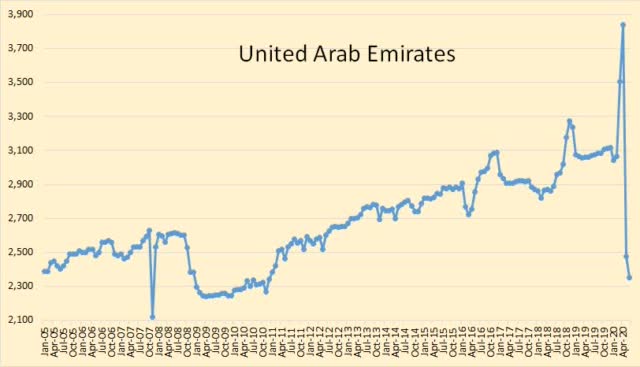

The UAE is down about 700 kb/d from their average of a few months ago.

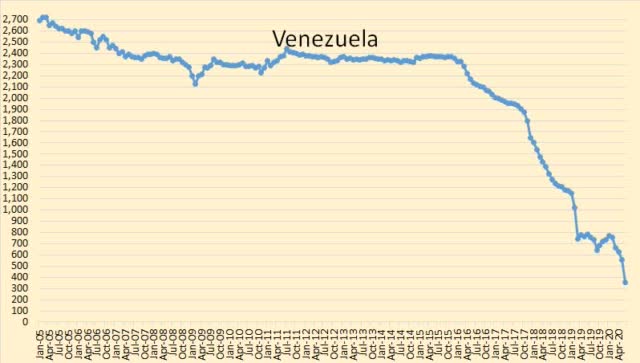

Venezuela just can’t get a break. Their economy is in shambles and their oil production is suffering, not just from sanctions but from neglect as well. Venezuela could now be considered a failed state.

This is where the vast majority of OPEC production comes from. They are down about 4.5 million barrels per day from their recent average.

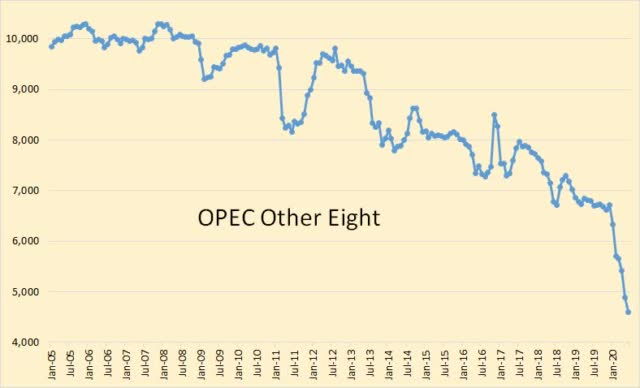

However, the rest of OPEC is down about 2 million barrels per day from late 2019. Some of this is natural decline. How much? We will just have to wait to find out.

This chart, enlarged below, is very interesting.

The data here is apples and oranges. The OPEC data is crude only while the World supply data is total liquids, including condensate, NGLs, and biofuels. However, total liquids is down about 14 million barrels per day in the last two months.

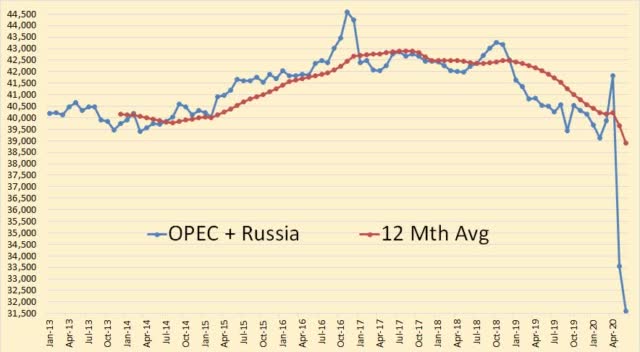

The only other nation whose June data is available is Russia. They were down 64 Kb/d in June for a total two-month decline of 2,016 Kb/d for the last two months. Their production in June was 9,323 Kb/d.

OPEC Crude only + Russia C+C comes to 31,594 Kb/d. That is about 9 million barrels per day below their 2019 average and over 11 million barrels per day below their average high in August of 2017.

Below are two links to articles I found on the web yesterday. The first says the US has peaked, the second says the World has peaked. I agree with both. I have only copied and pasted a small part of each article.

Shale boss says US has passed peak oil, bold mine

US crude production has already peaked, according to one of the country’s leading shale executives, as producers battered by the price crash shun new output growth and start trying to become profitable.

Matt Gallagher, chief executive of Parsley Energy, one of Texas’s biggest independent oil producers, said the record output level struck earlier this year would be the high-water mark. “

I don’t think I’ll see 13m [barrels a day] again in my lifetime,” the 37-year-old Mr Gallagher told the Financial Times.

“It is really dejecting, because drilling our first well in 2009 we saw the wave of energy independence at our fingertips for the US, and it was very rewarding . . . to be a part of it.”

American oil output plunged by as much as a quarter this spring, as crude prices crashed in the wake of a Saudi-Russia price war and the coronavirus outbreak, prompting several operators, including Parsley, to shut wells and slash planned spending.

After one of the most dramatic stretches in its history, the oil industry is slowly recovering. March and April saw the toxic combination of depressed demand, excessive supply, limited storage capacity, and intense financial speculation that turned prices on one index negative. Although concerns about a second wave of coronavirus infections remain high, demand is now back on the rise, and supply is in check.

But that doesn’t mean that the industry is out of the woods. For now, though, the greatest source of uncertainty for oil producers is structural in nature, not cyclical. In fact, there is an increasing sense that peak oil-the moment when oil production reaches its point of maximum before starting a structural decline-has finally arrived. Since the 1950s, there has been plenty of speculation about an imminent shortage of crude oil. Such speculation has proved consistently wrong, as all predictions tended to underestimate both the true amount of global oil reserves and the ability of technology to overcome physical constraints.

____________________________________________________________________________

If the US has peaked, and I believe it has, then the world has peaked. True, if all sanctions were lifted and all political problems were settled, and if everyone suddenly started producing flat out. We could probably surpass the November 2018 peak. But these things are just not going to happen. And, by the time this Covid-19 demand problem is over, and with the US post-peak, the rest of the world will have declined enough that the 2018 peak will never be reached again.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

|

|

Leave a Reply

You must be logged in to post a comment.