So you want to analyze preferred shares better? You’re in the right place. Strap in for some quick lessons in preferred share analysis.

Which Preferred Shares Do You Cover?

I’ve put together a table showing the various preferred shares we have under coverage, though we plan to add a very small number to the list:

| Ticker | Price | Annual Dividend | Stripped Yield | Annualized YTC | Floating Starts | Floating Spread |

| AGNCN | $22.65 | $1.75 | 7.74% | 12.21% | 10/15/2022 | 5.111% |

| AGNCM | $21.87 | $1.72 | 7.87% | 11.60% | 4/15/2024 | 4.332% |

| AGNCO | $21.55 | $1.63 | 7.55% | 11.24% | 10/15/2024 | 4.993% |

| AGNCP | $20.92 | $1.53 | 7.33% | 11.37% | 4/15/2025 | 4.697% |

| AIC | $22.82 | $1.69 | 7.46% | 180.78% | ||

| AIW | $23.88 | $1.66 | 7.05% | 109.58% | ||

| AI.PB | $18.76 | $1.75 | 9.37% | 27.18% | ||

| AI.PC | $19.80 | $2.06 | 10.47% | 17.37% | 3/30/2024 | 5.664% |

| ANH.PA | $22.60 | $2.16 | 9.56% | 189.01% | ||

| ANH.PC | $20.04 | $1.91 | 9.53% | 434.61% | ||

| ARR.PC | $21.39 | $1.75 | 8.23% | 11.93% | ||

| CHMI.PA | $22.10 | $2.05 | 9.29% | 15.22% | ||

| CHMI.PB | $20.56 | $2.06 | 10.05% | 15.59% | 4/15/2024 | 5.631% |

| CIM.PA | $21.07 | $2.00 | 9.56% | 23.63% | ||

| CIM.PB | $19.15 | $2.00 | 10.53% | 18.61% | 03/30/2024 | 5.791% |

| CIM.PC | $18.54 | $1.94 | 10.54% | 17.09% | 09/30/2025 | 4.743% |

| CIM.PD | $19.06 | $2.00 | 10.58% | 18.83% | 03/30/2024 | 5.379% |

| CMO.PE | $22.48 | $1.88 | 8.36% | 199.52% | ||

| DX.PB | $22.99 | $1.91 | 8.30% | 156.22% | ||

| DX.PC | $21.82 | $1.73 | 7.92% | 10.91% | 4/15/2025 | 5.461% |

| IVR.PA | $21.89 | $1.94 | 8.87% | 249.35% | ||

| IVR.PB | $20.13 | $1.94 | 9.71% | 15.09% | 12/27/2024 | 5.18% |

| IVR.PC | $19.78 | $1.88 | 9.56% | 13.17% | 9/27/2027 | 5.289% |

| MFA.PB | $21.50 | $1.88 | 9.00% | 334.01% | ||

| OTC:MFA.PC | $18.11 | $1.63 | 9.33% | 17.68% | 3/31/2025 | 5.345% |

| MFO | $23.20 | $2.00 | 8.80% | 1783.21% | ||

| MITT.PA | $15.00 | $2.06 | 14.47% | 1241.89% | ||

| MITT.PB | $15.09 | $2.00 | 13.92% | 1221.61% | ||

| MITT.PC | $14.80 | $2.00 | 14.20% | 30.86% | 9/17/2024 | 6.476% |

| NLY.PD | $24.40 | $1.88 | 7.75% | 53.60% | ||

| NLY.PF | $21.04 | $1.74 | 8.33% | 16.78% | 9/30/2022 | 4.993% |

| NLY.PG | $20.15 | $1.63 | 8.13% | 16.95% | 3/31/2023 | 4.172% |

| NLY.PI | $21.28 | $1.69 | 8.00% | 12.37% | 6/30/2024 | 4.989% |

| NYMTP | $18.58 | $1.94 | 10.45% | 605.92% | ||

| NYMTO | $18.66 | $1.97 | 10.57% | 595.96% | ||

| NYMTN | $18.47 | $2.00 | 10.85% | 15.65% | 10/15/2027 | 5.695% |

| NYMTM | $18.57 | $1.97 | 10.62% | 18.18% | 1/15/2025 | 6.429% |

| PMT.PA | $21.63 | $2.03 | 9.49% | 13.78% | 3/15/2024 | 5.831% |

| PMT.PB | $21.33 | $2.00 | 9.47% | 13.90% | 6/15/2024 | 5.990% |

| TWO.PA | $22.51 | $2.03 | 9.21% | 10.89% | 04/27/2027 | 5.660% |

| TWO.PB | $20.97 | $1.91 | 9.28% | 12.05% | 7/27/2027 | 5.352% |

| TWO.PC | $20.43 | $1.81 | 9.05% | 14.13% | 1/27/2025 | 5.011% |

| TWO.PD | $21.93 | $1.94 | 8.85% | 247.00% | ||

| TWO.PE | $21.16 | $1.88 | 8.88% | 319.11% | ||

| XAN.PC | $13.67 | $2.16 | 16.47% | 36.88% | 5.927% |

Now which number do you focus on?

We don’t have a simple “dividend yield” listed because we don’t want to waste the space.

We’re using the stripped yield instead of the dividend yield because it is a more useful number. It adjusts for the dividend accrual so far. Consequently, it can distinguish between two very similar shares where one went ex-dividend yesterday and the other goes ex-dividend tomorrow.

That makes it a very useful number, but you should still look deeper.

An Alternative Technique

Investors are often so focused on dividend yield metrics that they can easily overlook simpler techniques. This is especially important if you’re analyzing shares that are listed as FTF, which means Fixed-to-Floating. You wouldn’t actually want to invest all your analysis into evaluating the yield using a fixed rate that will only be there for another few years.

We recently suggested investors pick AGNCP over AGNCM. Which share we suggest will alternate over time as the price swings. At the time of our suggestion, the difference in the share price was $1.40. This was our simple explanation:

The difference in price is large enough to make AGNCP the pick. AGNCP is cheaper by about $1.40 today. The difference in dividends during the fixed-rate period is $.19 per year. It would take 7.3 years to earn $1.40 from the difference in dividends. Before we reach that period (7.3 years from now), the shares will both have switched over to floating-rate. At that point, the investor gets paid more each period for owning AGNCP.

Too many investors will simply be looking at the difference in yields today, but are not evaluating that money over time. The 7.3 year payback period is never reached.

Hypothetically: The investor who buys 100 shares of AGNCP today and keeps $140 in cash, would consistently have a higher cash balance than the investor who bought AGNCM. The only way for AGNCM to “win” in this scenario is if interest rates spiked dramatically higher during the very brief period where AGNCM is floating but AGNCP is not. If rates do not spike dramatically at that period, then AGNCP’s extra year before floating gives it another little edge.

This is such a simple technique, but few investors notice it. When you’re comparing two preferred shares from the same mortgage REIT, you’ll gain a huge advantage if you can think outside the box. Analyzing with this technique is very fast and it puts investors in a better position.

This technique should be part of the overall process whenever you need to compare similar shares. The beauty of the process is that it strips the decision down to the most fundamental traits. It makes the math easy and that makes decisions easier.

The Wrong Path

For anyone who isn’t familiar with the wrong path, the wrong path would be to attempt to predict all future cash flows based on investing precisely the same amount in each position. That’s precisely what you would be taught to do in an MBA class. It’s the default suggestion because it makes sense. In theory, if you follow that process all the way through, you’ll reach the same decision in almost every situation. The problem is that it takes dramatically longer because you have to come up with predictions for 3-month LIBOR (or the replacement rate when LIBOR is discontinued). That puts investors in a far more difficult position. Now they are trying to predict key interest rates years in advance.

Was there any need to do that? No, none. All you needed to know was that the investor in AGNCM would NEVER earn back the premium they paid. The floating rate would kick in first and AGNCP would get a larger payment from then onwards.

Why Is The Payment Bigger?

- AGNCM’s spread will be 4.332%

- AGNCP’s spread will be 4.697%

Why does that make AGNCP’s payment larger when both shares are floating?

Because adding 4.697% will always increase a number more than adding 4.332%. I prepared a section to demonstrate that, then decided it was too stupid to publish.

What About Yield to Call

Investors put way too much emphasis on that metric. Take two shares trading at $23.00 with the same dividend.

Note: I can already feel that someone is going to change the scenario and then make a strawman argument. Please don’t be that guy.

Which of those shares would have a higher yield to call?

Whichever one has less call protection. Do you want to give up call protection for absolutely nothing? In the options market, investors demand a premium for giving the other party the ability to call shares.

You might think a call at $25.00 sounds nice. However, if the company decides to call at $25.00, it will almost always be after the price has risen. The share that still had call protection would most likely be trading between $25.25 and $26.00 in that scenario. The investor who focused on the yield to call would’ve picked the wrong share.

Does Something This Simple Work?

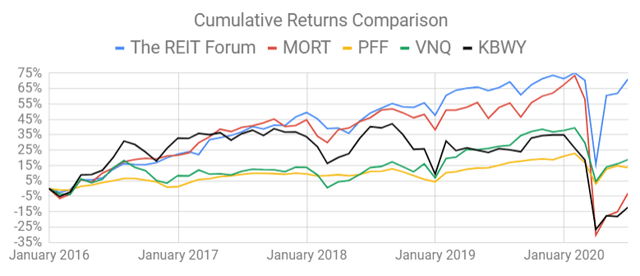

We evaluate our performance against several ETFs that cover many of the same investments. If we are beating those ETFs, then we’re probably providing alpha. Four of the main ETFs to use are:

- VanEck Vectors Mortgage REIT Income ETF (MORT)

- iShares Preferred and Income Securities ETF (PFF)

- Vanguard Real Estate ETF (VNQ)

- Invesco KBW Premium Yield Equity REIT ETF (NASDAQ:KBWY)

Almost every investment we make will be in at least one of those ETFs. We used these simple techniques to help us make decisions about how to reallocate capital during the incredible plunge in March 2020. It let us reduce losses and amplify gains:

Source: The REIT Forum

Preferred shares from mortgage REITs were an important part of that performance. The call value didn’t change. While many mortgage REITs needed to reduce their common dividend to conserve cash, the preferred dividend doesn’t get reduced. The company has the right to suspend it, but only a few suspended and most of them have already reinstated their preferred dividend.

You can learn to improve your ability to pick preferred shares. You don’t need an MBA. You don’t need to go into extensive modeling. You do need to be ready to learn.

Want the best research? It’s time to raise your game. Get access to several features you won’t find on the public side.

You can get access to everything we have to offer right now. Try our service and decide for yourself.

Disclosure: I am/we are long NLY-F, NLY-I, AGNCO, AGNCP, NLY-G, , NRZ, NLY, AGNC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

|

|

Leave a Reply

You must be logged in to post a comment.