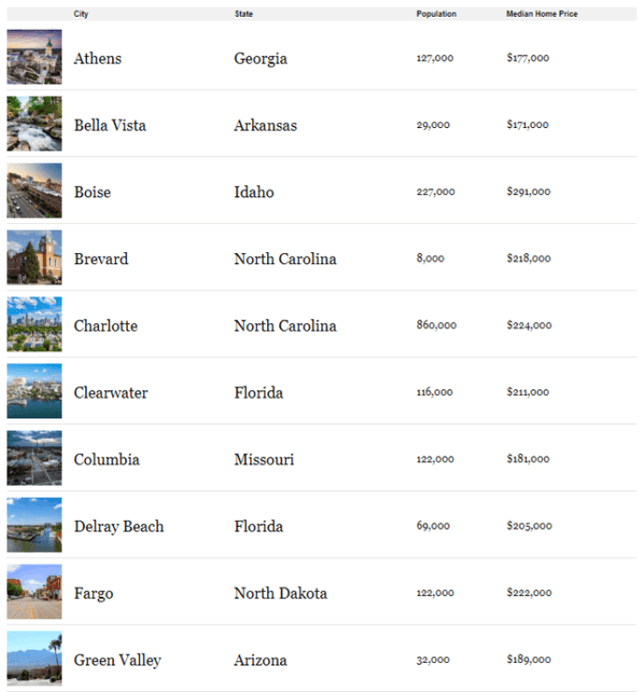

Last week, I published “Retire Rich With REITs, Even During Covid-19.” The article included Forbes‘ list of “the best places to retire that offer both affordability and a high quality of life.”

(Source)

An interesting read, both for professional and personal reasons, it prompted me to ponder my own retirement.

Where should I live when I reach that point? For me, it’s fairly easy to decide.

Marketing research shows that 45% of American baby boomers plan to move after retirement. In How to Retire Happy, Wild, and Free, Ernie J. Zelinski explains four reasons retirees cite for that relocation:

- Economic – They want to stretch their retirement income.

- Scenic – They want to stay somewhere beautiful.

- Adventurous – They want to experience certain sights, scents, sounds, etc.

- Familial – They want to be closer to children, grandchildren, or other support structures.

Applied to Forbes’ list, those reasons point me to Brevard, North Carolina, a town of around 8,000. Just over an hour from where I live now, it has a moderate climate and many cultural activities.

I used to own a Papa John’s franchise there. And, before that, while playing basketball for Presbyterian College in Clinton, South Carolina, I would travel to Brevard to engage one of our rival teams.

The more I think about it – maybe it’s time for a road trip to scope it out again. After all, I love getting away from the computer to enjoy my favorite topic of the day…

Location. Location. Location.

From the Ground Up

For over two decades, I was a net lease developer. By that, I mean I’d travel across the southeastern U.S. in search of sites for retail chains such as:

- Advance Auto Parts

- Econo Lube

- Payless ShoeSource

- Blockbuster Video

In most towns, I’d simply seek out the closest Walmart store and look for outparcel opportunities nearby. Having developed for them as well, I knew firsthand that the company knew where to locate.

Generally, I’d find the best sites right smack in front of their stores.

At the time, I often purchased sites from REITs such as Simon Property Group (SPG) and CBL Properties (CBL), because they often owned some of the best assets in town.

Regardless, my job was to find high-traffic sites that would enable my customers to generate strong sales. And after developing over 50 free-standing stores I became somewhat of an expert myself in identifying highly-profitable sites.

Much like investing in REITs, the key was (and still is) rooted in due diligence. You need to spend adequate time in the markets you’re buying into in order to determine worthwhile supply and demand generators.

And, most importantly, you need that hands-on experience – or access to someone who has hands-on experience – to find property that can be acquired with a reasonable margin of safety.

A REIT Lesson From Ralph Block

As Ralph Block explained in Investing in REITs:

“… during the infancy of the REIT industry, it was believed important for a REIT to be well-diversified by property sector and geographic location. Such diversification was deemed important for the reduction of investment risk.”

However, Block argued that’s out-of-date thinking because:

- “… the major expansion of the REIT industry has allowed investors to create their own diversified property portfolio by owning a substantial number of REITs, each operating in a different location and owning a different property type.”

- “… local market knowledge is a very important key to success in the property investment business… each property sector has its own unique set of operating and investment characteristics. To buy, manage, and develop properties well requires a deep familiarity and extensive experience with a property sector and specific markets.”

In other words, “Location. Location. Location.” And understanding location. As Block also says:

“Local, specialized knowledge gives a REIT several advantages in its markets. Its management will be more likely to hear of a distressed seller who must unload properties, or the availability of a great development site. It will therefore be able to take advantage of unusual opportunities, and similarly, it may be able to close a deal before it’s put out for competitive bidding.

“If it has development capabilities, it will know the best and most reliable contractors and will be familiar with the challenges and politics of getting zoning permits and variances.

“It will be very much aware of local economic conditions and which local markets are becoming more desirable. If it is a retail REIT, it will have good access to the up-and-coming regional retailers.”

Bottom line? Block says that, overall, “REITs that focus intensively on specific geographic regions have a significant competitive edge.”

Wise words.

Who Wants to Talk Office?

Given the disruptive forces behind COVID-19 – and the market turbulence that comes with it – it seems timely to write on some of the most volatile property sectors. I want to provide some ground-level analysis on each one…

With a few of our top picks thrown in there as well, of course.

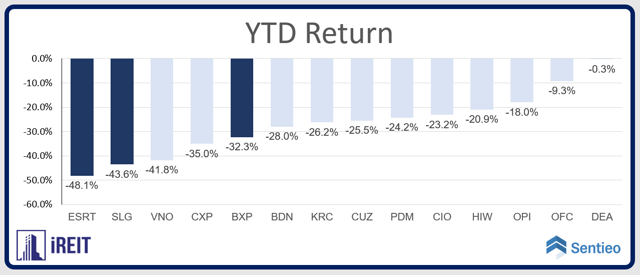

For this article in particular, let’s focus on offices. These REITs have collectively declined by 29% year-to-date, making them the sixth-worst sector.

As Hoya Capital Real Estate explains, these businesses are “generally segmented into two distinct categories:

“‘Gateway REITs’ hold portfolios that are concentrated in the six largest U.S. cities. And ‘non-gateway REITs’ (are) concentrated in cities outside of these ultra-dense cities.”

Keep that in mind as we go on.

No doubt, you’ve heard about the “mass exodus” from New York City in particular. But that’s offset by the city’s diverse private-sector employment base, which provides a leading deep and diverse talent pool.

NYC is home to 65 Fortune 500 companies, with strong, financial, media, technology, and (rapidly growing) life-science sectors.

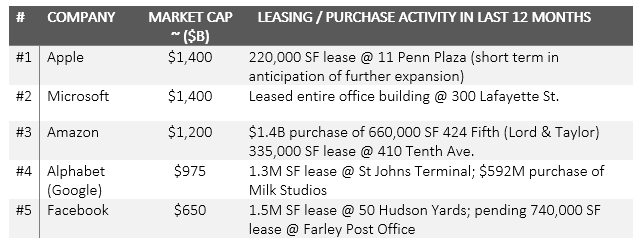

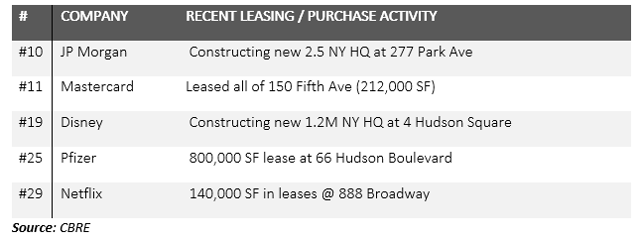

And over the last 12 months, there have been several large employment expansions from such entities as Google, JPMorgan, Amazon, and Disney.

Several other firms have also announced plans to grow their bases there, spending significant capital expenditure in the process.

These firms are the greatest creators of American wealth and, not coincidentally, the most reliant on pure intellectual capital.

It’s true they were all founded elsewhere. But they’re increasing already substantial commitments to ensure continued access to talent.

Other top-30 market capitalization firms making large recent commitments to NYC include:

Again, the primary ingredient to these firms’ overall results is access to talent. That and a historical resiliency is what makes NYC such an attractive long-term location for employers.

Up, Up, and at ‘Em!

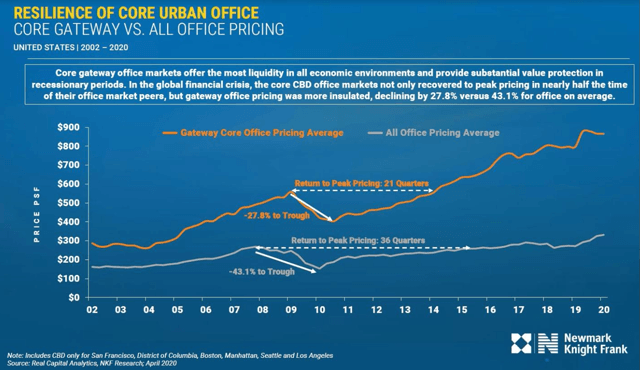

While no city is completely insulated from macro events, NYC has a history of not only recovering, but thriving.

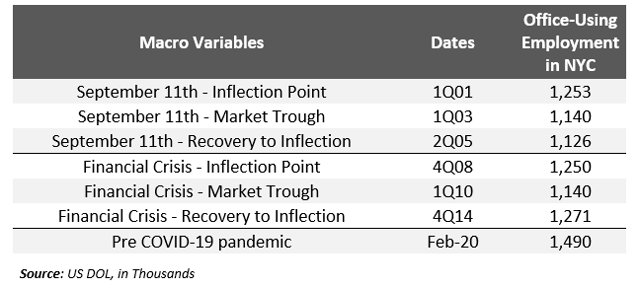

The best examples of this are to look at how it recovered after 9/11 and the 2008 Global Financial Crisis. As shown below, total office-using employment surpassed pre-crisis peaks in both instances.

Even if NYC lost 10% of its permanent workforce today, surpassing the last two recessions, it would still have more than 100,000 more jobs than it did at the last two peaks.

Those are just some of the reasons why this iconic area – along with other gateway markets – should be a critical defensive piece of any institutional real estate portfolio.

And here’s another reason to think so: The GBD Innovation Club voted NYC as one of the top two gateway centers best positioned for office growth. As KPG Funds explains, this “is based in part on a strong correlation between robust working-age (25-45), population growth, and income growth to office rent growth ratios.”

(Incidentally, a big thanks to KPG Funds for pinspiring this larger article!)

The concentration of talent, unparalleled business efficiency, and instant connectivity are fundamental strengths of global business districts (GBDs).

Greenstreet Advisors also has something to say on the subject. It turns out that NYC is ranked No. 1 for the percentage of college degrees per capita, at 78%. That makes for another compelling metric for employers.

In addition, NREI ranked it as one of the top nine most resilient markets. Besides, the New York office market has had sustainable rent growth of approximately 4% since 1942.

Working From Home Might Not Be So Popular After All…

A few weeks ago, I wrote an article on Empire State Realty Trust (ESRT). In that bullish piece, I did mention the argument that people always will want to work from home. And many readers took to throwing darts at it.

To their credit – several surveys have since come out showing that both employers and employees want to get back to the office.

Colliers, for one, reports that only 12% of respondents want to work four or more days from home post lockdown. And almost half (49%) said they’d like to limit it to two days a week.

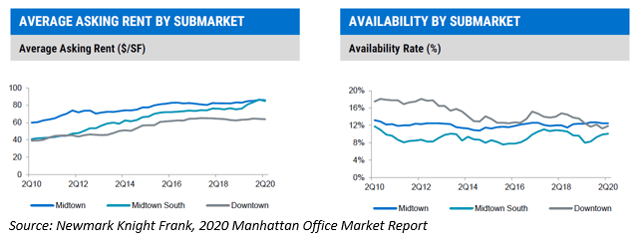

There’s been hard data over the last two months on rents holding their value, with several long-term leases and a large end user taking over 200,000 square feet for its first U.S. location. According to Newmark Knight Frank, average asking rents and availabilities by submarket have remained relatively steady through Q2.

Below is further good news for NYC office REITs:

- Since May, over half of all office lease transactions were completed north of $90 per square foot. The top four deals averaged $110.

- The average lease term since May was approximately seven years.

- TikTok and Australia Super recently selected NYC for their U.S. headquarters and paid over $100 psf.

And here’s one final consideration…

New construction accounts for only 1% of the NYC office market, which isn’t enough to meet current demand.

There’s been approximately 26.1 million square feet of major redevelopments and new construction there since 2016 – with 64% of it already leased.

This new-product appeal indicates that more space could be leased before coming to market. That would lower the availability rate even further.

In fact, COVID-19 has only exacerbated the trend of tenants leasing highly improved space.

Enough Debunking. Let’s Get Down to Business…

So now you can see why I’m so bullish on the office REIT sector these days, despite how the five companies with NYC assets are down roughly 40% year-to-date (we discuss three of these in this article below).

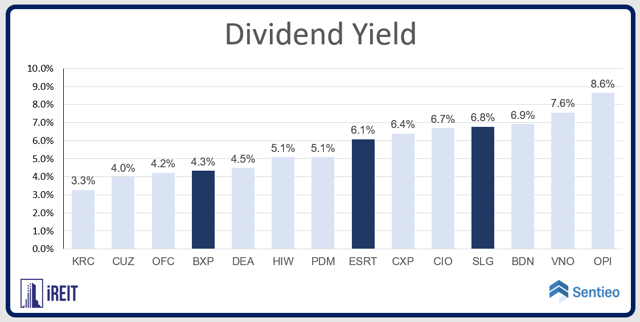

Now take a look at their dividend yields:

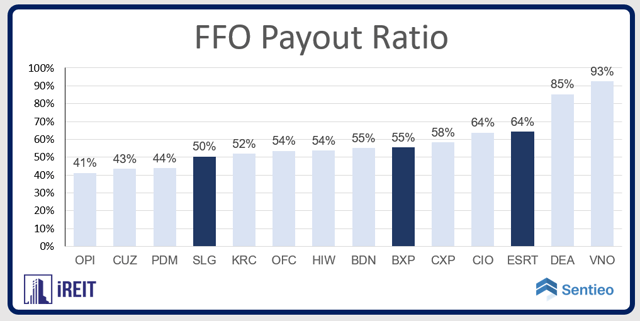

And their payout ratios:

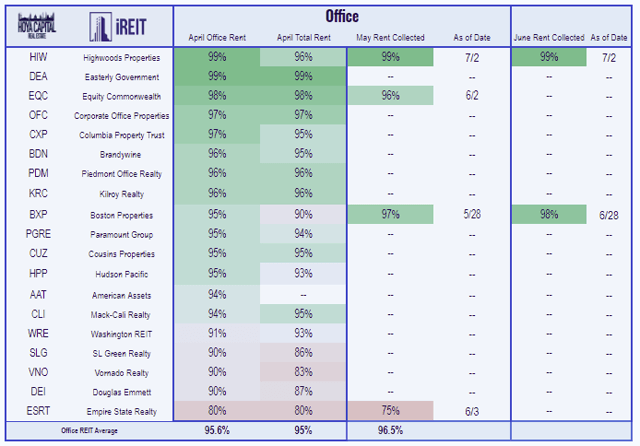

As for rent collection, we can see below how most office REITs have reported good rent collection. Notably, Boston Properties (BXP) reported 98% as of June 28.

Source: iREIT on Alpha

With all of that in mind, here’s what we’re buying right now…

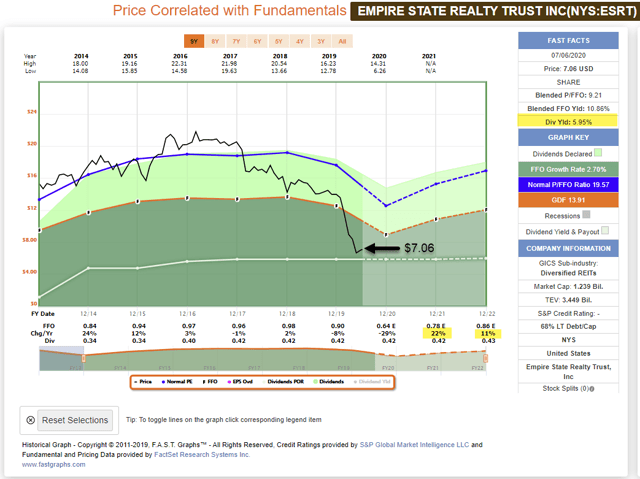

Empire State Realty Trust now trades at $7.06 with a 5.9% dividend yield. Its 2020 funds from operations (FFO) per share is estimated at $0.64, which would be a 29% decline. But those numbers rise to $0.78 in 2021 (+22%) and $0.86 in 2022 (+11).

We maintain a Strong Spec Buy.

FAST Graphs

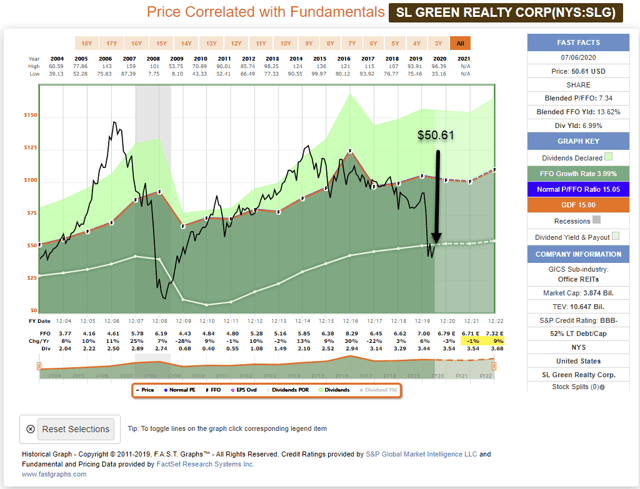

SL Green (SLG) now trades at $50.61 with a dividend yield of 6.99%. Its 2020 FFO per share is estimated at $6.79, which would be a 3% decline. But analysts expect $6.71 for 2021 (-1%) and $7.32 for 2022 (+9%).

We maintain a Strong Spec Buy.

FAST Graphs

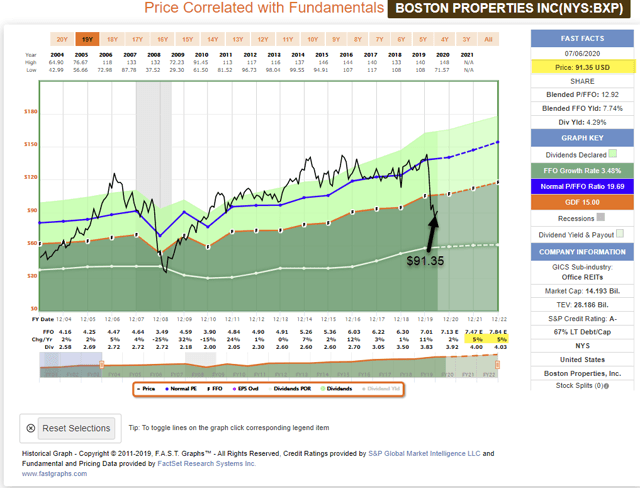

Boston Properties (BXP) now trades at $91.35, with a dividend yield of 4.29%. Its 2020 FFO per share is estimated at $7.13, which would be a 2% gain over 2019. Meanwhile, that number should rise further to $7.47 for 2021 (+5%) and 2022 (+5%).

We maintain a Strong Buy.

FAST Graphs

Stay tuned for my next article in a series on “location, location, location.“

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

The Most In-Depth REIT Coverage On The Planet

Investors need to remain disciplined with their investment process throughout the volatility. At iREIT on Alpha we offer unparalleled research. “There is great opportunity” to take advantage of the mispricing and to build a portfolio powered by repeatable sources of divided income.. subscribe to iREIT on Alpha (2-week free trial).

Disclosure: I am/we are long ESRT, SLG, BXP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

|

|

Leave a Reply

You must be logged in to post a comment.