July Summary

I have decided to begin John and Jane’s Retirement Account articles with the basic summary of how much income each retiree has generated in their Traditional IRA and Roth IRA for each respective month. Additionally, I have decided that I want to begin tracking the cash balance of each account more closely so that readers can see how each retirees’ liquid cash fluctuates on a regular basis.

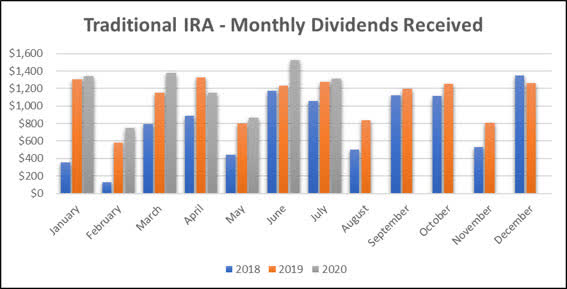

Traditional IRA – Dividend Income

- July 2019 – $1,274.75 of dividend income.

- July 2020 – $1,315.16 of dividend income.

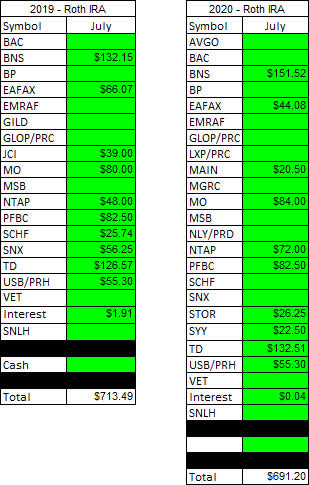

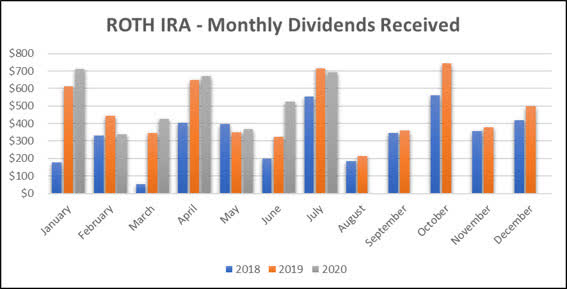

Roth IRA – Dividend Income

- July 2019 – $713.49 of dividend income.

- July 2020 – $691.20 of dividend income.

In total, Jane’s income generated from her Traditional and Roth IRAs for July 2019 totaled $1,988.24 of dividend income compared with July 2020 total dividend income of $2,006.36.

There wasn’t a significant amount of activity that took place in Jane’s Retirement Account during the month of July, there were two notable events worth pointing out.

- PolyOne (POL) changed its name to Avient (AVNT).

- EPR Properties Preferred Series E (EPR.PE) paid its first dividend since we added the shares several months ago.

Traditional IRA – Cash Balances

- June 2019 – cash balance of $6,321.98.

- July 2020 – cash balance of $8,459.37.

Roth IRA – Cash Balances

- July 2019 – cash balance of $4,925.93.

- July 2020 – cash balance of $3,643.50.

I was concerned that July would be an awful month for the dividend income coming into Jane’s Retirement Accounts and was glad to see that the cumulative total dividend income between the Traditional and Roth IRAs was higher than it was during the month of July 2019.

Background

For those who are interested in John and Jane’s full background please click the following link here for the last time I published their full story. Here are the key details about John and Jane that readers should understand.

- This is a real portfolio with actual shares being traded.

- I am not a financial advisor and merely provide guidance based on a relationship that goes back several years.

- John retired in January 2018 and is only collecting Social Security income at this point in time.

- Jane is working part-time and will continue to do so for the remainder of 2020. Whether or not she continues to work will depend on whether or not her employer requests that she stays on in 2021.

- John and Jane have no debt and no monthly payments other than water, power, property taxes, etc.

I started helping John and Jane with this because I was infuriated by the fees and gimmicky trades made by their previous financial advisor. I do not charge John and Jane for anything that I do and all I have asked of them is that they allow me to write about their portfolio anonymously in order to help spread knowledge and to make me a better investor in the process.

Generating a stable and growing dividend income is the primary focus of this portfolio and capital appreciation is the least important characteristic.

Dividend And Distribution Decreases

There were no new stocks that made dividends cuts, suspensions, or eliminations in the Taxable Account for July 2020.

Dividend And Distribution Increases

A total of two companies paid increased dividends/distributions or a special dividend during the month of July in Jane’s Traditional IRA and Roth IRA.

Both of these companies were discussed in the Taxable Account article for the month of July. For this reason, I have included, I will include a summary of the dividend increase but will not write another update.

Realty Income – The dividend was increased from $.233/share per month to $.2335/share per month. This represents an increase of .2% and a new full-year payout of $2.80/share compared with the previous $2.79/share. This results in a current yield of 4.48% based on a share price of $62.68.

W. P. Carey – The dividend was increased from $1.04/share per quarter to $1.042/share per quarter. This represents an increase of .2% and a new full-year payout of $4.168/share compared with the previous $4.16/share. This results in a current yield of 5.72% based on a share price of $72.83.

Retirement Account Positions

There are currently 22 different positions in Jane’s Roth IRA and 33 different positions in Jane’s Traditional IRA. While this may seem like a lot, it is important to remember that some of these stocks cross over in both accounts and are also held in the Taxable portfolio.

Traditional IRA – The following stocks were added to the Traditional IRA during the month of July.

- PPL Corp. (PPL) – Purchased 25 Shares @ $25.97/share.

- Archer-Daniels-Midland (ADM) – Purchased 25 Shares @ $38.12/share.

- PPL – Purchased 25 Shares @ $24.39/share.

- EPR.PE – Purchased 25 Shares @ $24.87/share.

- International Business Machines (IBM) – Purchased 10 Shares @ $125.93/share.

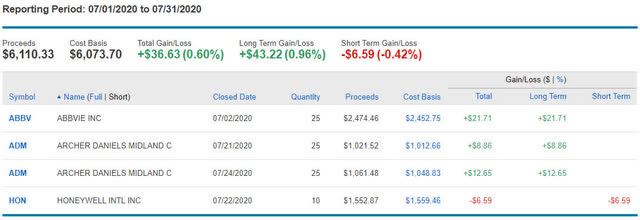

The following shares were sold in the Traditional IRA during the month of July.

- AbbVie (ABBV) – Sold 25 Shares @ $98.98/share.

- ADM – Sold 25 Shares @ $40.86/share.

- Honeywell (HON) – Sold 10 Shares @ $155.29/share.

- ADM – Sold 25 Shares @ $42.46/share.

Roth IRA – The following stocks were added to the Roth IRA during the month of July.

- Store Capital (STOR) – Purchased 25 Shares @ $21.49/share.

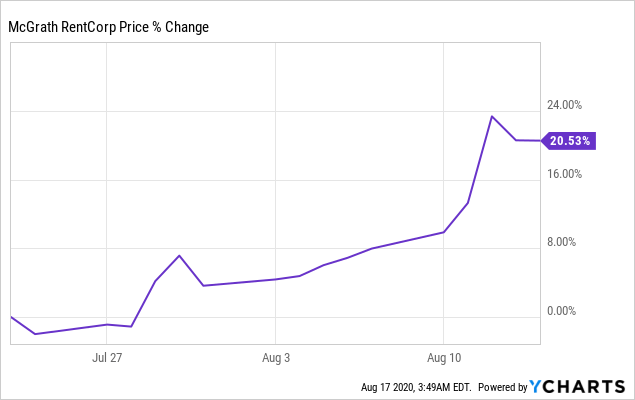

- McGrath RentCorp (MGRC) – Purchased 25 Shares @ $54.80/share.

As you can see from the trades above it was a mixed month where we were able to sell our high-cost portion of certain positions while simultaneously being able to lower Jane’s cost basis by purchasing shares at prices well below what we had sold them for. Additionally, we pulled the trigger and added MGRC to the Roth IRA on 7/23/2020. MGRC went on a tear after this purchase so it was a great time to add another company with a lengthy history of dividend increases to the portfolio.

Data by YCharts

Data by YChartsMGRC is approaching fair-value again in the low $70/share range. We will look to purchase additional shares on any dips and would prefer to wait until we see prices back in the $63/share or lower range.

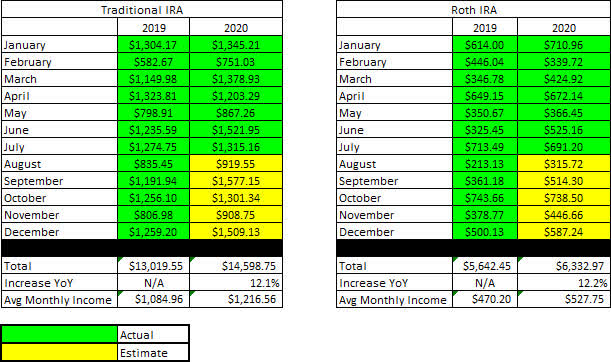

July Income Tracker – 2019 Vs. 2020

Income for the month of July was up significantly year-over-year and there were a number of factors that contributed to this as stated in the introduction of this article. Even as dividend income has disappeared due to suspensions and cuts the portfolio has put up another strong month of income (especially when compared to the income from June 2019).

SNLH = Stocks No Longer Held – Dividends in this row represent the dividends collected on stocks that are no longer held in that portfolio. We still count the dividend income that comes from stocks no longer held in the portfolio even though it is non-recurring. All images below come from Consistent Dividend Investor, LLC.

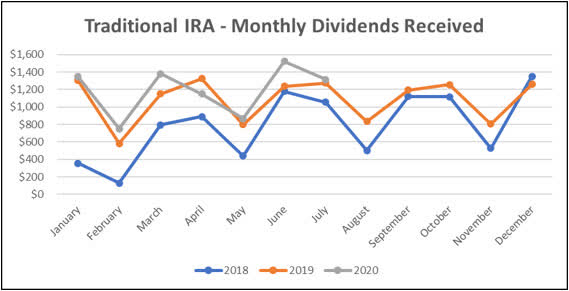

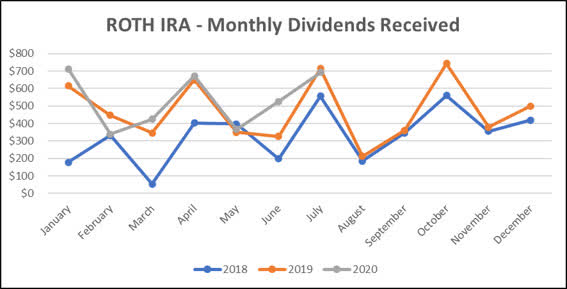

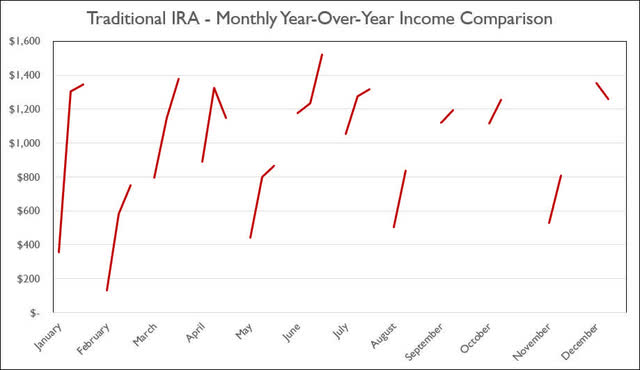

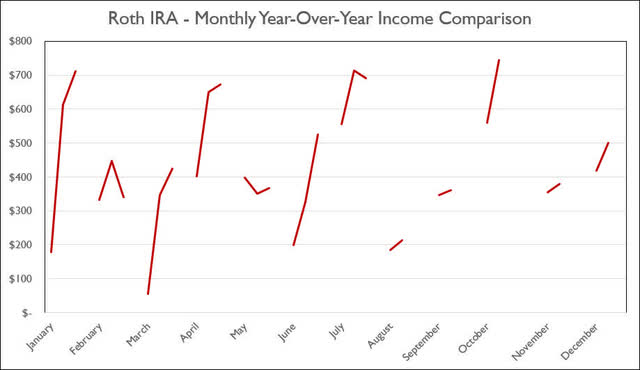

Here is a graphical illustration of the dividends received on a monthly basis for the Traditional and Roth IRAs.

Based on the current knowledge I have regarding dividend payments and share count, the following tables are a basic prediction of the income we expect the Traditional IRA and Roth IRA to generate in FY-2020 compared with the actual results from 2019.

Based on the current knowledge I have regarding dividend payments and share count, the following tables are a basic prediction of the income we expect the Traditional IRA and Roth IRA to generate in FY-2020 compared with the actual results from 2019.

Below is an expanded table that shows the full dividend history since inception for both the Traditional IRA and Roth IRA.

Below is an expanded table that shows the full dividend history since inception for both the Traditional IRA and Roth IRA.

I have included line graphs that better represent the trends associated with Jane’s monthly dividend income generated by her retirement accounts. As year three begins, we should continue to see a more stable pattern that comes from the deposit of regular dividend income. The images below represent the Traditional IRA and Roth IRA, respectively. There may be additional volatility in monthly dividends received due to dividend suspensions/cuts as a result of COVID-19.

I have included line graphs that better represent the trends associated with Jane’s monthly dividend income generated by her retirement accounts. As year three begins, we should continue to see a more stable pattern that comes from the deposit of regular dividend income. The images below represent the Traditional IRA and Roth IRA, respectively. There may be additional volatility in monthly dividends received due to dividend suspensions/cuts as a result of COVID-19.

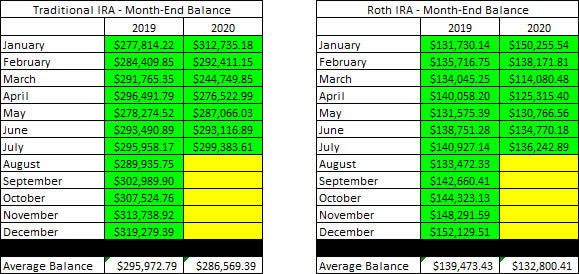

Here is a table to show how the account balances stack up year-over-year (I previously used a graph but believe the table is more informative).

Here is a table to show how the account balances stack up year-over-year (I previously used a graph but believe the table is more informative).

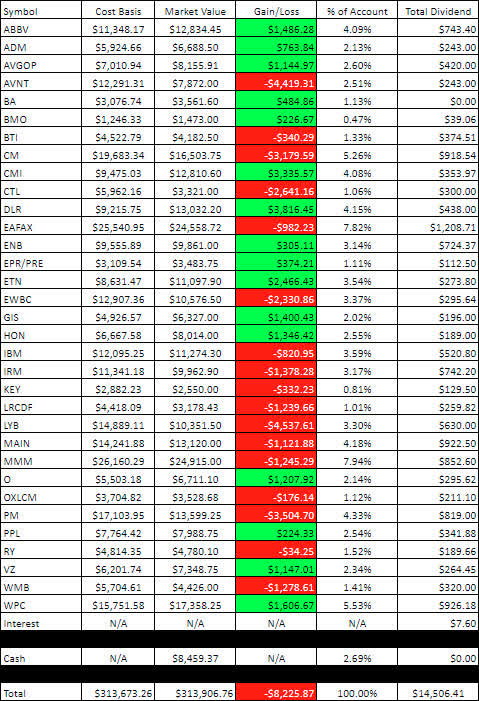

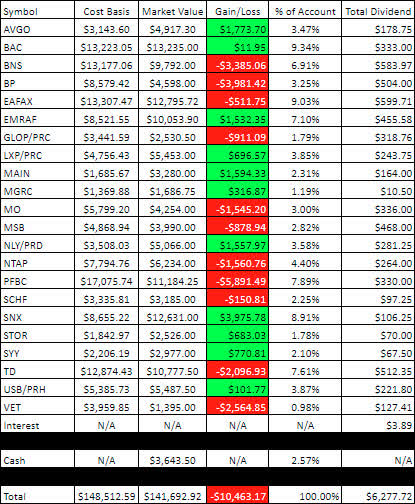

Lastly, on the topic of transparency, I like to show readers the actual unrealized gain/loss associated with each position in the portfolio because it is important to consider that in order to become a proper dividend investor, it is necessary to learn how to live with volatility. The market value and cost basis below is accurate as of the market close on August 14th.

Here is the Unrealized Gain/Loss associated with Jane’s Traditional and Roth IRA’s.

The following graph was suggested by one of my readers (see I do listen to and respond to constructive feedback) and incorporated back in April 2020. The graph shows how dividend income has increased, stayed the same, or decreased in each respective month on an annualized basis. I believe that the graph will continue to become more valuable as we enter into years four and five.

Conclusion

July was a great month for adding to existing positions and building new ones like MGRC. At the same time, we were able to sell portions of other positions and reduce the overall cost basis of those positions. You will notice that any positions where we liquidated shares still have a considerable number of shares and this is because we added to these positions over the last several months when the market dropped as a reaction to COVID-19. In other words, our sale of these positions is really intended to “right-size” that specific position and to rebuild cash reserves so that we can continue to be opportunistic in the event of another market correction.

We are also continuing to focus on building cash reserves because I am always focused on keeping enough cash on hand to meet Jane’s distribution needs when/if she decides that she needs the money. Jane will be officially retiring at the end of this year and the whole goal of setting up the account this way is to meet her needs in retirement.

July Articles

I have provided the link to the July 2020 Taxable Account below.

The Retirees’ Dividend Portfolio: John And Jane’s July Taxable Account Update

New Article Format: Let me know what you think about the new format (what you like or dislike) by commenting, liking, following, etc. I appreciate all forms of criticism and would love to hear what I can do to make the articles more useful for you!

In Jane’s Traditional and Roth IRAs, she is currently long the following mentioned in this article: AbbVie (ABBV), Archer-Daniels-Midland (ADM), Broadcom (AVGO), Avient (AVNT), Broadcom Preferred Series A (AVGOP), Boeing (BA), Bank of America (BAC.PK), Bank of Montreal (BMO), Bank of Nova Scotia (BNS), BP (BP), British American Tobacco (BTI), Canadian Imperial Bank of Commerce (CM), Cummins (CMI), CenturyLink (CTL), Digital Realty (DLR.PK), Eaton Vance Floating-Rate Advantage Fund A (MUTF:EAFAX), Enbridge (ENB), EPR Properties Preferred Series E (EPR.PE), Eaton Corporation (NYSE:ETN), Emera Inc. (OTCPK:EMRAF), East West Bancorp (EWBC), General Mills (NYSE:GIS), GasLog Partners Preferred C (GLOP.PC), Honeywell (HON), International Business Machines (IBM), Iron Mountain (IRM), KeyCorp (KEY), Laurentian Bank of Canada (OTCPK:LRCDF), Lexington Realty Preferred Series C (LXP.PC), LyondellBasell (LYB), Main Street Capital (MAIN), McGrath RentCorp (MGRC), 3M (MMM), Mesabi Trust (NYSE:MSB), Altria (NYSE:MO), Annaly Capital Preferred Series D (NLY.PD), NetApp (NTAP), Realty Income (O), Oxford Lane Capital Corp. 6.75% Cum Red Pdf Shs Series 2024 (NASDAQ:OXLCM), Preferred Bank (NASDAQ:PFBC), Philip Morris (NYSE:PM), PPL Corporation (NYSE:PPL), Royal Bank of Canada (NYSE:RY), Schwab International Equity ETF (SCHF), Synnex Corp. (NYSE:SNX), STORE Capital (STOR), Sysco (SYY), Toronto-Dominion Bank (NYSE:TD), U.S. Bancorp Preferred H-Series (USB.PH), Vermilion Energy (VET), Verizon (VZ), Williams Companies (WMB), W. P. Carey (WPC).

Disclosure: I am/we are long ABBV, ADM, CTL, DLR, ETN, HON, IBM, MAIN, MMM, SCHF, VET. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article reflects my own personal views and I am not giving any specific or general advice. All advice that is given is done so without prejudice and it is highly recommended that you do your own research. This article was written on my own and does not reflect the views or opinions of my employer.

|

|

Leave a Reply

You must be logged in to post a comment.