Yaskawa Electric Corporation (OTCPK:YASKY) recently published its 1Q20 results and presented its investors with estimates of next quarter’s financials. This article is divided into three sections, and the first section is a review of the main points of my last article. Part two and three will cover Yaskawa’s 1Q20 results and the updates of my relative valuation model, respectively. I improved my model to reflect better by business unit results and updated it to reflect the new information recently provided by the company.

I would like to take a minute to remind you of the risk associated with investing in Yaskawa. The company suffered from political turbulence that occurred between China and the United States. Their 2019 sales were highly concentrated in the Asian Markets (67%). Besides being a listed company in Japan, the company is also listed on the pink sheets here in the United States. Though it is not a penny stock, the OTC regulations are a little more relaxed when compare to the NASDAQ or the NYSE.

Overview Of Past Article And Estimates

The robotics industry grew, as measured by new installations, by 19% during the period 2013 to 2018. According to the IFR, the new number of units sold from 2019 until 2022 should have a CAGR of 12%. The problem with these estimates is that they do not include the adverse effects of the novel coronavirus. I attempted to estimate the impacts of COVID-19 on the industry by using data from the Financial Crisis of 2008, and I arrived at a CAGR of 7.5% during the same period.

The Robotics Industry is going through an evolution in two crucial areas that make this industry risky. First, the industry is less reliant on one client industry (the automotive industry). In 2013, the automotive industry was responsible for almost 40% of all robotic installations, and five years late, it is only responsible for about 30% of all installations.

Yaskawa’s 1Q20 results

The following information can be found at Yaskawa’s Investor Relations page. All information is presented in millions of yen unless otherwise stated.

YASKY’s revenue decreased by 15.5%, from 107,44 to 90,802 y-o-y. The company’s EPS decreased by 16.15% compared to 1Q19 (17.29 to 20.61). The fact that the company’s revenue decreased by 15.5%, and yet there EPS decreased by 16.15%, makes me believe that they were able to adjust their fixed expenses temporarily. Only that this adjustment was not enough to prevent the EPS from dropping an additional 65 bps beyond what he should have declined due to the decrease in revenue.

Yaskawa believes that its 1S20 revenue will be about 180,802, and its operating profit should be 10,727. These estimates would give the company an operating margin of 5.93%, 93 basis points less than this quarter’s operating margin of 6.86%. The adjustments in operating expenses that were accomplished by the company during 1Q20 are not permanent, as it seems by the decrease in operating margins on a quarter over quarter basis.

Updated Relative Valuation Model Estimates

My Original estimates for the company’s 2025 revenue was 626 billion yen. After updating my model with the new information from the company’s 1Q20 results, I decreased its revenue to 567 billion yen.

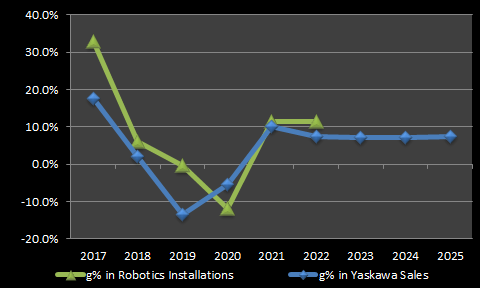

Figure 1 – Robotic Industry’s Growth Vs. Yaskawa’s

Source: Analyst’s estimates based upon data from IFR

When analyzing Figure 1, it is essential to remember that almost three months of this year’s sales are included in the company’s 2019 results. That is one of the reasons why my estimates of Yaskawa’s 2020 growth is slightly higher than that of the industry.

I used data from four companies to calculate YASKY’s peer P/S ratio. These companies are Semperit Aktiengesellschaft Holding (OTCPK:SEIGF), ABB Ltd (ABB), Fanuc Corporation (OTCPK:FANUF), and KUKA Aktiengesellschaft (OTCPK:KUKAF). The average peer P/S ratio is 2.93x, and YASKY is currently trading at 2.25x, which I believe means that the company is undervalued.

Conclusion

Based on the above data, I believe that YASKY is undervalued, and its fair value is $ 115. In my opinion, YASKY has a possible upside of 59% in the long-term. Yaskawa is dependent on the automotive industry, and the Asian markets like most robotics companies are, but they are less dependent than some of its peers that I mentioned above. Yaskawa, I believe, should be more successful than its peers in the coming years due to its ability to provide other industries and markets with robotic solutions.

If you like what you read, please “Follow” me via Seeking Alpha. I typically only cover the Brazilian markets, the Robotics Industry, and the Food Industry.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in YASKY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

|

|

Leave a Reply

You must be logged in to post a comment.